Who can and how to take out home loan

Everyone dreams of a house of their own to dwell in peace and happiness with their families. But dreams get shattered for those whose earnings are limited to their salaries when they see skyrocketing prices of flats in the capital, home to around two crore people.

In such circumstances, low-cost bank loans become their saviours. To meet the growing demand, developers and lenders offer different loan schemes, especially for middle and low-income groups.

Home loan interest rates, which came down to as low as 8 percent three years ago, soared to 13 percent at the beginning of 2018, thanks to a sudden cash crunch in the banking sector.

In August, the rates started cooling down, riding on the availability of cash and banks' rising lending capacity. Some banks are also coming up with new home loan products.

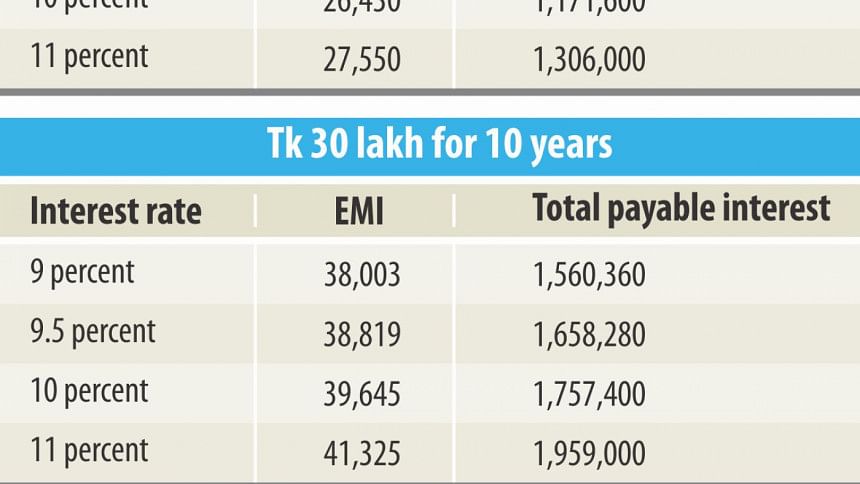

Amounts starting from Tk 5 lakh to a maximum of Tk 1.2 crore or 70 percent of the property's value, whichever is lower, are usually available as bank loans. Up to 2 percent of the loan is charged as loan processing fee, varying from bank to bank.

All that a borrower now needs to do is to gather necessary documents and provide it to the lender.

WHO CAN TAKE HOME LOAN

- With a minimum of three years' experience

- Any salaried executive

- Self employed doctors, architects, engineers, chartered accountants, certified consultants and IT professionals

- Businesspersons

- Landlords

- Age limit: Minimum 25 years and maximum 65 years

- Minimum monthly gross income: for salaried executives Tk 20,000 to Tk 30,000, for self employed/professionals Tk 40,000 and for businesspeople Tk 50,000

In case of joint applicants:

- The applicants should be spouse or immediate family members

Combined gross income should be a minimum of Tk 40,000 a month

DOCUMENTS REQUIRED

- Two copies of photo,

- National identity or a copy of passport,

- TIN certificate,

- Copy of a utility bill,

- Bank statement of last six months,

- Salary certificate and pay slip,

- Office ID

- Title deed,

- Updated land tax,

- Mutation,

- Updated holding tax,

- CS, SA, RS, B/S Khatian, City Jorip Khatian (if there is any),

- Approved plan,

- Project photo,

- Price quotation

- Details of a reference (address, contact number)

- Sanction letter and last one year's repayment history (if there is any existing loan)

WHAT THE GUARANTOR NEEDS TO SUBMIT

- Two copies of photo

- NID/ passport clear copy

- Personal information (address, contact number)

FIXED RATE

A personal loan at a fixed rate means the interest rate will remain the same for the life of the loan. The repayment instalments stay the same even if the interest rate of the bank increases.

VARIABLE/FLOATING INTEREST RATE

Some loans offer variable interest rates, where the repayment amounts may rise or decrease with a change in the market's interest rate. The borrower gets benefitted only if the rate falls.

WHY APPLICATIONS GET REJECTED

- Insufficient income

- Bad credit history

- Incorrect information

- Bad reputation of the company the applicant works for

- Pending EMIs of previous loan

- Too many loans

- Unstable employments

- Dubious loan purpose

LOAN TAKEOVER

The takeover facility allows a borrower to approach a new bank and seek a new loan which is equivalent to the outstanding amount of the loan with the existing bank.

TOP-UP LOAN

Top-up loan enables a customer to increase the amount of his/her existing loan.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments