Banks gearing up for the digital wave

Banks are no longer a place where depositors just go to stash their money and borrowers go to borrow funds during the usual banking hour and pick products from a set of offers.

Rather, technology is transforming the retail banking landscape very fast, changing the way people and companies connect with their banks and demand services and products from anywhere, anytime.

Customers, used to convenience and personalisation from retail and e-commerce, now seek the same multi-channel ease of use from their banks.

Banks are also responding by embracing technology to meet customers' demand in an increasingly competitive market.

“Technological adoption in Bangladesh's financial industry is gathering pace,” said Naser Ezaz Bijoy, chief executive officer of Standard Chartered Bangladesh, the pioneer in the field.

Almost all the major banks in Bangladesh now offer online or mobile app-based banking solutions.

Customers too are taking to the digital platform like a duck to water.

In 2018, Standard Chartered Bangladesh saw an increase of 36 percent in retail online transactions and a 27 percent increase in active internet banking users.

Digital transformation is taking placing on many fronts in the country's banking sector, said Syed Mahbubur Rahman, chairman of the Association of Bankers, Bangladesh, a platform of private banks' chief executives.

Almost all banks' cards are now EMV-compliant. The number of ATMs (automated teller machines) and PoS (points of sales) machines has gone up, while some banks have introduced cash recycling machines.

Internet banking is growing, with many banks now posts such as head of digital banking -- a position that was not there even a few years ago, according to Rahman, also the managing director of Dhaka Bank.

“Digital transformation offers immense huge economic benefit to banks,” he added.

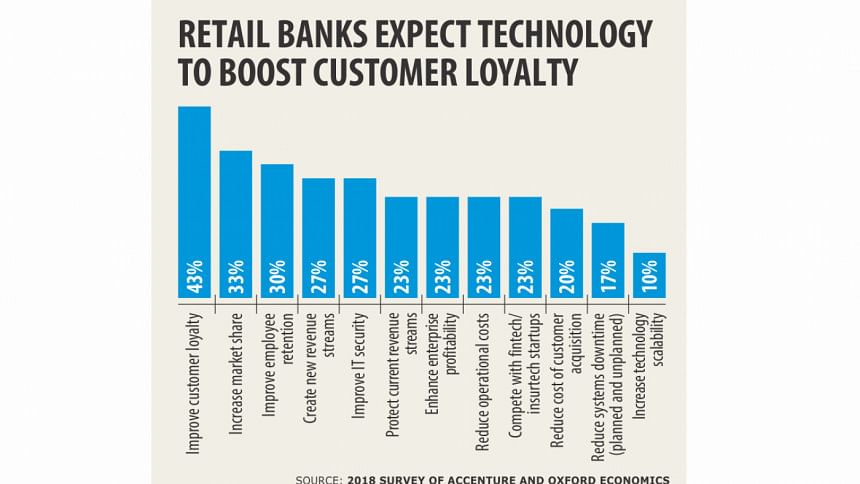

Globally, the financial services industry has moved beyond viewing technology as primarily a means to cut costs, according to a 2018 survey of Accenture and Oxford Economics on North America, the Asia-Pacific, and Europe.

Survey data suggests retail bank executives expect technology to accelerate their company's growth.

Among the key findings: 43 percent of retail bank executives expect their technology investments to improve customer loyalty, which is critical in an industry that's all about asset-gathering.

A third of the banks think technology will boost their market share and more than a quarter (27 percent) expects it to create new revenue streams.

Two-thirds of the survey respondents say that within five years consumers will do most of their saving, investing, and borrowing online.

Digital transformation is paying off as well.

“Economic benefits are increasing for traditional retail banks that have implemented the most effective digital strategies,” said the Global Retail Banking 2018 report of the Boston Consulting Group (BCG).

Across six major geographic regions -- North America, the Asia-Pacific, Western Europe, Latin America, Eastern Europe, and the Middle East/Africa -- most institutions are about midway into their digital transformations.

To make further progress in this area, banks must address two emerging imperatives: personalisation and continuous delivery, BCG said.

The rise of financial technologies -- fintech, for short -- has forced banks to accelerate their adoption of digital technology, said Capgemini, a global leader in consulting, technology services and digital transformation, in a report last year.

Fintechs are bringing a new wave of technologies that help combine digital with data analytics to set new industry standards.

Encumbered by archaic legacy systems and unable to swiftly digitise and innovate, many traditional retail banks are at a disadvantage when it comes to catering to loud-and-clear customer demands for better experience.

In Bangladesh, mobile financial services have given a major boost to retail banking services.

Technological convergence is increasingly making possible a digital lifestyle, enabled by digital services and multi-channel payment systems, Bijoy said.

“From buying and consumption, processing payments, managing individual finances and growing their wealth for the future, clients will more and more turn to the convenience of digital solutions,” he added.

With digital transformation the importance of security would be magnified, said Bari of Al-Arafah Islami Bank, while calling for a policy guideline from the government to safeguard customers from cyber crimes and digital fraud.

Investments in block-chain, cloud infrastructure, bionic workforce, big data and artificial intelligence are critical but not enough, according to Bijoy.

“Bankers will need to change the mindset and should be willing to invest in emerging technologies, which will enable banks to offer hyper-personalisation to offer tailor-made solutions based on individual preferences and behaviour,” he added.

Speaking about the future, Rahman said the country's banking sector will see wholesale digital transformation in five to 10 years' time.

The 4G and 5G connectivity, the young population that likes to do many things online, the countrywide mobile network, and the government-run union digital centres would all help the banking sector a lot.

“If an electronic Know Your Customer (e-kyc) is put in place, a lot of problems will go and the banking sector will take a giant leap forward,” he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments