New to Savings? Pick a plan that pays off

Choosing the right savings option is not just about interest rates—it is about matching your money habits with goals, lifestyle, and income pattern. What works for a student might not suit a new parent or a retiree. Whether you want to open a simple savings account, a disciplined Deposit Pension Scheme (DPS), or the dependable returns of a Fixed Deposit (FD), each option differs in terms of nature, flexibility and growth. Before you commit your hard-earned money, it is worth weighing a few key factors—ensuring your savings do not simply sit idle, but grow with purpose.

But, why trust a bank with your savings?

Your liquid assets deserve more than just a hiding spot—they should grow, stay secure, and be ready when you need them most. Banks offer a variety of secure, structured savings options designed to help your money achieve just that, tailored to your financial situations. Such savings serve as a crucial safety net during unexpected financial burdens like medical emergencies or job loss.

"Bangladesh does not have a strong savings culture, with many people spending their entire bonuses and relying on credit cards; shifting this mindset to treat a portion of earnings and bonuses as extra income for saving can significantly boost financial security," said Md. Rashed Akter, Head of Retail Distribution & Chief Bancassurance Officer, Midland Bank.

Whether it is building an emergency fund, planning for retirement, or working toward long-term goals, saving through a bank helps foster discipline and consistency. With the added benefits of security, interest earnings, and ease of access, banks provide a trusted environment not just for storing your money—but also for increasing it effectively.

"To grow your savings efficiently, both time and mindset matter. Starting early—like saving BDT 1,000 monthly from age 25 at 11% interest—can grow to over BDT 86 lakh in 40 years, thanks to compound interest. If that same person starts at 30, they miss out on the full potential of compound interest," added Akter from Midland Bank.

What to check before choosing a savings account?

A savings account is the most basic and accessible way to start saving money. Offered by almost all banks, it allows you to deposit and withdraw funds with ease while earning a modest interest on your balance. Ideal for day-to-day banking and emergency funds, these accounts usually come with low or no minimum balance requirements and user-friendly features.

There are a few key factors that customers should consider when selecting a savings account. Firstly, convenience is key, as modern customers value their time and prefer avoiding lengthy forms and in-branch visits.

Mohammad Ali, Managing Director and CEO of Pubali Bank highlighted this trend, saying, "Deposits coming through technological channels are showing a growth rate of nearly 30–40%, while the overall average remains around 20%."

"Look for a bank that allows fully digital account opening—where you can upload documents and complete the process from home," suggested Al Mamun Ansar, Head of Liability Business, Liability & Wealth Management at EBL advised

Next, evaluate the bank's mobile app. Can you perform essential transactions? Does it provide full services, or will you still need to visit a branch for most after-sales support? A good app should offer a seamless, end-to-end experience.

"Also consider the debit card: how widely accepted it is, how reliable the card network is, and does it work smoothly wherever you go, as long as there's money in the account? Ask peers about their experiences," added Ansar from EBL.

Finally, assess the availability and functionality of ATMs near your home or workplace. While the interest rates may not be as high as other savings options, the flexibility and liquidity of savings accounts make them reliable choices for short-term financial needs and building a habit of saving.

DPS vs FD—which is the smarter pick?

Both Deposit Pension Scheme (DPS) and Fixed Deposit (FD) fall under the broader category of savings schemes, which provide higher returns compared to regular savings accounts. DPS is a monthly savings plan where you deposit a fixed amount each month over a chosen period. In contrast, a FD requires a one-time lump sum investment for a set tenor, usually offering higher interest rates than DPS.

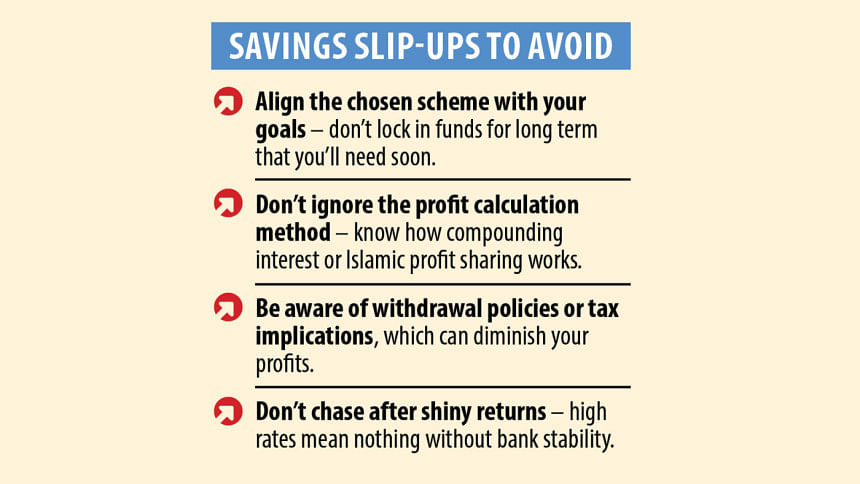

While opening such savings schemes, especially FD or schemes requiring a large amount of deposit, it is crucial to consider the bank's reputation and their liquidity situation before anything. "While interest rate is a key factor, higher returns often come with higher risk. It is wiser to choose a reputable bank. Many are drawn to cooperative banks offering 13–14% rate, but if the money isn't returned, the gain is meaningless," points out Arup Haider, DMD & Head of Retail Banking, City Bank.

Ansar from EBL also draws attention to this point, saying "Return on your deposit is not as important as return of your deposit–what's crucial is getting your money back when needed.

EBL has consistently maintained a strong reputation as one of the top three banks in the country, ensuring customers' funds are always accessible."

Moreover, customers should consider the quality of service and advancements in digital banking when choosing savings schemes with a certain bank. "A digitally advanced bank can save time and hassle; for instance, instead of visiting the branch for something as simple as a balance certificate, our customers can access it instantly through Citytouch," added the DMD of City Bank.

After you have made up your mind about a bank, here are a few things to consider if you are torn between DPS and FD:

Availability of funds

DPS is ideal if you want to save gradually over time with monthly contributions. FD is better if you have a lump sum amount ready to invest. While FDs suit those with immediate surplus funds, DPS works better for salaried individuals or those with regular income who prefer to save regularly in smaller amounts.

Required minimum deposit

Naturally, FDs require a large amount of initial deposit compared to DPS. However, be aware of the monthly installment requirements for DPS. Missed installments may result in penalty charges or reduced final maturity value. If several consecutive installments are missed (usually 3–6 months, depending on bank policy), the bank may choose to prematurely close the account.

In case of early closure or irregular payments, the interest rate might be recalculated at a lower "savings account" rate rather than the promised DPS rate. "Customers should choose a scheme with a monthly deposit amount they can consistently maintain—regardless of financial struggles, job insecurity, or unforeseen challenges," mentioned the Retail Distribution Head of Midland Bank.

Interest rate & flexibility

FDs usually offer higher interest rates than DPS schemes. Compare rates across banks and see which option yields better returns over your desired period. Moreover, consider that DPS requires consistent monthly deposits for a chosen period, while FDs require no ongoing commitment after the initial deposit.

Tenor & early encashment conditions

Consider how long you can afford to keep your money locked in. Both DPS and FD offer different tenor options; FDs often offer schemes with longer duration. In case of premature withdrawal before fulfilling designated tenor, FDs may allow you partial benefits.

For DPS, customers usually need to complete the full term and only get the self-deposited amount without any benefits in case of early encashment. Some banks may also charge for early encashment, check with your bank before opting for a savings scheme.

Additionally, many banks now offer goal-based savings options—such as schemes for education, motherhood, retirement, or home purchase—so you can choose one that aligns with your financial goals. Most banks also offer savings schemes in both traditional and Shariah-compliant formats—choose the one that aligns with your preferences and values. Finally, look into the tax implications of the interest earned, which can affect your net returns.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments