Financing Sustainability: Shaping Bangladesh’s Economic Future

In a country like Bangladesh, where limited resources and high population density pose significant challenges, driving national economic growth requires innovative approaches. Among these, sustainable finance has emerged as a pivotal strategy, offering a promising path to financial stability and a brighter future for the nation.

The financial sector in Bangladesh is uniquely positioned to lead in environmental stewardship and sustainable investment. The central bank's initiative in sustainable finance represents a significant advance towards green growth, demonstrating a strong commitment to the principles of People, Planet, and Profit.

"Sustainable finance addresses national, economic, and human resource challenges, ensuring that future generations can benefit," explains Imran Khan, Deputy General Manager and Head of the Sustainable Finance Department at IPDC Finance Limited.

Both banks and non-bank financial institutions (NBFIs) have made significant strides in this area. The Bangladesh Bank's Sustainability Rating 2023 acknowledges and supports this progress, with ten banks and three NBFIs being recognized, underscoring the sector's growing importance.

"When a bank receives a sustainable rating, it is seen as a mark of quality, and recognition from the central bank enhances this perception. As a result, banks are increasingly committed to sustainable finance," adds Fakhrul Abedin Milon, Head of CRM & SFU at Dhaka Bank.

In December 2020, Bangladesh Bank introduced the Sustainable Finance Policy to guide this process and set targets. Consequently, all scheduled banks and NBFIs have now established their own sustainable finance units.

The central bank's sustainable banking initiatives are broadly categorized into key areas: policy formulation, monitoring the sustainable finance activities of banks and NBFIs, providing refinance support for various green products and sectors, and implementing its own environmental management practices.

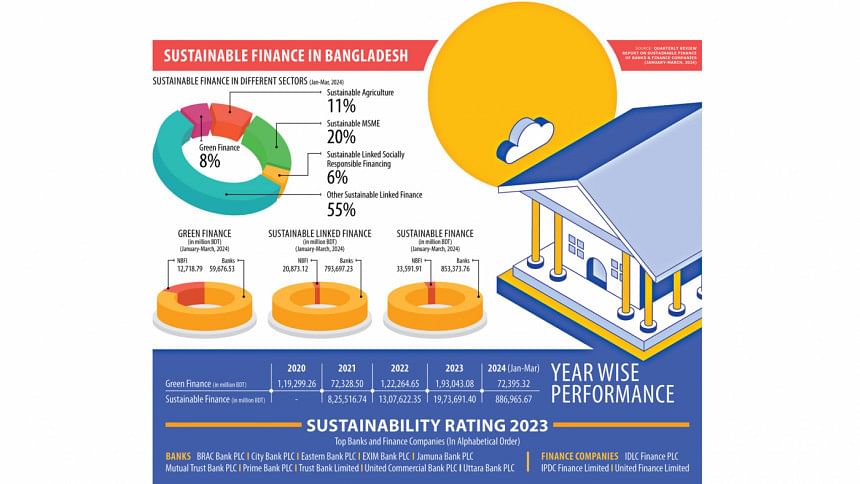

According to Bangladesh Bank's Quarterly Review Report on Sustainable Finance of January-March 2024, total sustainable finance amounts to BDT 886,965.67 million, with banks holding BDT 853,373.76 million and NBFIs holding BDT 33,591.91 million. The total Sustainable Linked Finance stands at BDT 814,570.35 million, comprising BDT 793,697.23 million from banks and BDT 20,873.12 million from NBFIs. Notably, Sustainable Finance as a percentage of total loan disbursement is 31.85%, with banks contributing 32.22% and NBFIs 24.60%. Additionally, during the period of January-March 2024, the total recovery was BDT 654,478.55 million, and BDT 13,669.90 million was rescheduled.

Sector-wise, sustainable finance is divided into Sustainable Linked Finance and Green Finance. Sustainable Linked Finance, a broad category, includes Sustainable Agriculture (BDT 73,118.03 million), Sustainable MSME (BDT 164,318.06 million), Sustainable Linked Socially Responsible Finance (BDT 59,732.49 million), and other Sustainable Linked Finance (BDT 517,401.77 million). Green Finance accounts for BDT 72,395.32 million.

The total number of borrowers in sustainable finance is 1,316,763, with banks serving 1,310,901 borrowers and NBFIs serving 5,862. Gender-wise, banks have 653,831 male and 657,070 female borrowers, while NBFIs have 4,265 male and 1,597 female borrowers. Notably, the proportion of male and female borrowers is almost equal, with 658,096 males and 658,667 females in total.

In the rural-urban distribution of borrowers, banks serve 940,630 rural borrowers and 370,271 urban borrowers, while NBFIs cater to 1,812 rural borrowers and 4,050 urban borrowers. This indicates that banks predominantly serve rural areas, whereas NBFIs are more focused on urban regions, reflecting their urban-centric nature. Notably, banks account for the vast majority of borrowers, with 1,310,901, while NBFIs serve only 5,862.

The year-wise performance of sustainable finance has shown significant growth. Total sustainable finance amounted to BDT 825,516.74 million in 2021, BDT 1,307,622.35 million in 2022, BDT 1,973,691.40 million in 2023, and BDT 886,965.67 million in the first quarter of 2024. The percentage of sustainable finance relative to total loan disbursement has also risen sharply, from 8.04% in 2021 to 31.85% in the first quarter of 2024, indicating a strong upward trend.

In the January-March 2024 quarter, 26 banks and 10 NBFIs successfully met their target of allocating 20% of total loan disbursement to sustainable finance, as reported by the central bank.

Sustainable agriculture, closely tied to sustainable finance, involves funding critical areas such as crops, storage, irrigation, and poverty alleviation, all essential to the economy. Industry insiders reveal that banks and financial institutions tend to invest in sustainable agriculture with careful attention to gender equity, ensuring that loans are equally accessible to both men and women—a commitment reflected in central bank reports. Today, there is a growing belief among banks and NBFIs that ethical financing in sustainable sectors is more important than the traditional focus on profit.

"In 2023, we financed BDT 5,256 crore through a sustainable finance scheme, serving 98,420 account holders. By June 2024, we have disbursed approximately BDT 2,475 crore in sustainable finance. Individuals who seek sustainable finance tend to be conscientious, prioritizing people, society, and the environment. Although making green investments can be costly, it results in a lower NPL rate. We are morally committed to sustainable finance, recognizing the crucial role agriculture plays in our country," shares Mynul Hossain, FVP, CRM at Bank Asia.

"We finance sectors like solar power, which not only avoid harming nature but actively contribute to a cleaner environment. We also support sustainable agriculture by financing projects such as dairy farms, enabling farmers to expand their businesses and positively impacting the entire agricultural cycle," explains Imran Khan, Deputy General Manager and Head of the Sustainable Finance Department at IPDC Finance Limited.

"We are financing sustainable agriculture in North Bengal, char regions, and other hard-to-reach areas. Our investments include solar panels, widely used by farmers for irrigation, and deep tube wells, where a significant number of participants are women. We organize clusters of 10-12 stakeholders in each area to manage these deep tube wells. We evaluate each proposal to ensure it aligns with sustainable finance and agriculture, focusing on societal and environmental benefits," explains Fakhrul Abedin Milon, Head of CRM & SFU at Dhaka Bank.

"Around 70% of our total portfolio is currently in sustainable finance. This number is on an upward trend, not just because of regulatory relaxation but also due to our efforts to increase sustainable finance. As a values-based bank and the only member of the Global Alliance for Banking on Values (GABV) in Bangladesh, we always prioritize values in our decision-making, which is a core component of sustainability. We also consider the three P's—people, planet, and prosperity—in all our activities," says Md. Sabbir Hossain, Deputy Managing Director & Chief Sustainability Officer, BRAC Bank PLC.

Sustainable finance has become a benchmark for financial inclusion, particularly in terms of gender equity, with a strong track record of low non-performing loans (NPLs), giving lending institutions the confidence to invest.

"Sustainable finance creates a win-win situation; under the guidance of Bangladesh Bank, the NPL rate in this sector is significantly lower compared to other loan segments, as borrowers tend to be more selective and responsible. We consider this a form of responsible lending, carefully assessing each proposal to ensure there are no negative impacts on the environment or society. Additionally, repayment performance has been strong, as borrowers are now more informed and technologically adept," states Syed Mahbubur Rahman, Managing Director & CEO, Mutual Trust Bank.

The SME sector is considered the lifeline of the national economy, and banks and NBFIs are increasingly investing in this vital component of sustainable finance.

"As an SME-focused bank, even before this sustainable finance policy, we were already involved in socially responsible financing, along with agriculture and SME financing. The NPL rate for sustainable finance (2.5%) is lower than our overall NPL rate (3%)," adds Md. Sabbir Hossain, Deputy Managing Director & Chief Sustainability Officer, BRAC Bank PLC.

"We are focused on sustainable and sustainability-linked sectors with geographic specificity. Our teams are raising awareness about sustainable business practices. We promote and provide loans for initiatives such as plastic recycling, waste management, organic farming, agro-machinery, and jute. We also prioritize carbon reduction, alternative environmental products, and energy efficiency. Our operations are not confined to Dhaka; we have extended financing across all 64 districts. Currently, more than 40 percent of our total loan disbursement portfolio is dedicated to SMEs, far surpassing the 25 percent target," explains Sudip Saha, Head of SME, United Finance Limited.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments