Committed to fostering msme sector growth

Sheikh Mohammad Maroof

Managing Director and CEO, Dhaka Bank

The Daily Star (TDS): How do you assess the current state of the MSME sector in Bangladesh, and what role do you think banks can play in accelerating its growth?

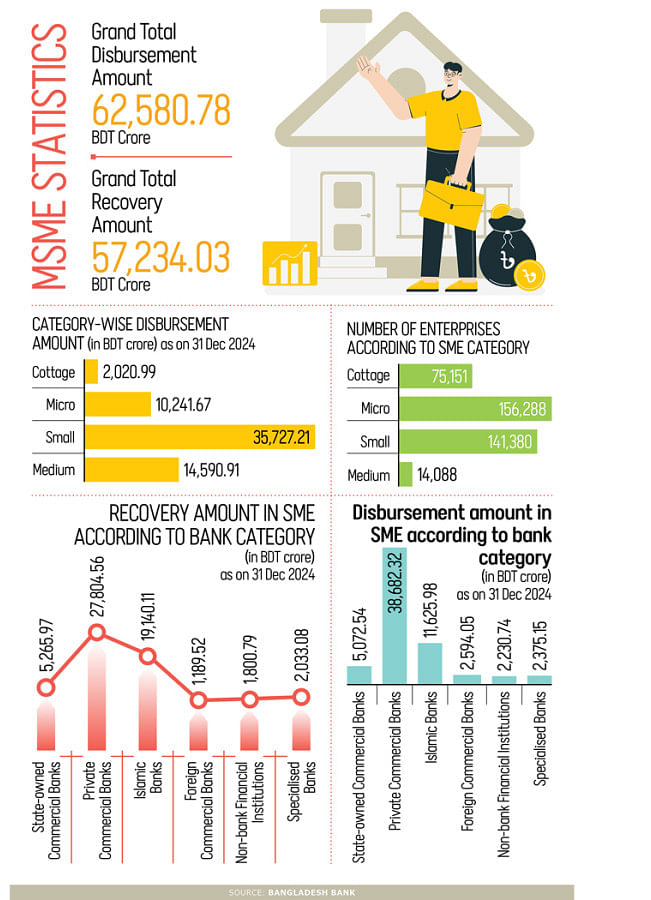

Sheikh Mohammad Maroof (SMM): The Micro, Small, and Medium Enterprise (MSME) sector is a vital pillar of Bangladesh's economy. It contributes over 25% to national GDP, generates more than 93% of industrial output, and employs around 32% of the labour force. MSMEs play a transformative role in fostering entrepreneurship, generating employment, reducing poverty, and driving inclusive economic growth.

Despite its significance, the sector faces a substantial financing gap—estimated at approximately USD 2.8 billion. Alarmingly, only about 36% of MSMEs currently have access to formal credit, well below the regional average.

Banks can play a catalytic role in bridging this gap. Through the design of customised financial products, participation in credit guarantee schemes, and effective utilisation of refinance facilities provided by Bangladesh Bank and other development agencies, banks can substantially improve access to affordable finance for MSMEs. In addition, banks can support the sector by offering capacity-building and advisory services.

TDS: What are the major challenges MSMEs face in accessing finance, and how is your bank addressing these issues—especially for micro and cottage industries?

SMM: MSMEs—particularly micro and cottage industries—face a range of structural and operational challenges in accessing formal finance. A key barrier is the requirement for collateral, which many small entrepreneurs are unable to provide. Limited financial literacy often prevents these businesses from navigating complex loan procedures, while relatively high interest rates further deter borrowing. Additionally, stringent documentation requirements delay loan processing, discouraging applications altogether. The absence of formal credit histories compounds the challenge, making risk assessments more difficult and impeding credit flow to the segment.

To address these barriers, Bangladesh's financial ecosystem must adopt more inclusive, simplified, and technology-driven solutions. At Dhaka Bank, we are pursuing this vision through multiple strategic initiatives. We have simplified our loan application process to minimise delays and documentation burdens. Moreover, we offer targeted training programmes to enhance the financial literacy and managerial capabilities of MSME clients. Our expanding branch network, complemented by our digital banking platforms, ensures greater outreach to underserved and remote communities, with a special focus on micro and cottage enterprises.

TDS: Does your bank have any dedicated products, financial literacy programmes, or credit guarantee schemes targeted at MSMEs?

SMM: Dhaka Bank is strongly committed to fostering the growth of MSMEs through a comprehensive suite of products, programmes, and partnerships.

We offer a wide array of tailored loan products for MSMEs, including Continuous Loans, Demand Loans, Term Loans, Supply Chain Financing, Distributor Finance, and various non-funded credit facilities. On the deposit side, we offer specialised solutions such as Shukti, SME Current Deposit Accounts, FD Plus (SME), and Mudaraba FD Plus (SME), which cater to the savings and investment needs of small businesses.

In partnership with Bangladesh Bank and the SME Foundation, we deliver financial literacy and entrepreneurship development programmes to enhance business acumen and credit readiness among MSMEs. Furthermore, we actively participate in credit guarantee schemes designed to mitigate lender risk and encourage broader access to credit.

TDS: How has your bank leveraged technology or digital banking solutions to improve outreach and services to MSMEs, particularly in semi-urban and rural areas?

SMM: Dhaka Bank has strategically leveraged technology to extend its reach and improve service delivery to MSMEs—particularly those located in semi-urban and rural areas. Key initiatives include:

• i-Samadhan: A dedicated digital platform that streamlines loan applications and service requests for SME clients, reducing turnaround time and enhancing user experience.

• Dhaka Bank GO: Our mobile banking app offers 24/7 access to a broad range of services, allowing MSMEs in remote areas to manage accounts, conduct transactions, and access credit facilities without visiting branches.

• ezybank: This digital onboarding platform enables MSMEs to open accounts from anywhere, eliminating geographic barriers and simplifying access to financial services.

• Digital Deposit Channels: Our digital transaction channels have already facilitated over BDT 1,000 crore in deposits.

TDS: What steps is your institution taking to support women-led MSMEs and promote financial inclusion among underrepresented segments?

SMM: Dhaka Bank is deeply committed to supporting women-led MSMEs. Our Oditiya Loan is an EMI-based product tailored specifically to help women-led businesses acquire assets and expand operations sustainably. We are also an active participant in the Bangladesh Bank Women Entrepreneur Refinance Scheme, which offers preferential financing to women-owned enterprises.

Beyond credit, we invest in financial literacy and entrepreneurship development programmes—often in collaboration with Bangladesh Bank and the SME Foundation—focused on building managerial, planning, and digital capabilities. These programmes are particularly targeted at women entrepreneurs in rural and semi-urban areas to foster inclusive participation in the formal economy.

TDS: Looking ahead, what policy reforms or collaborative efforts between banks and the government would you recommend to ensure sustainable development of Bangladesh's MSME ecosystem?

SMM: For the sustainable development of Bangladesh's MSME ecosystem, a coordinated effort across policy, regulatory, and institutional levels is essential. This includes expanding credit guarantee schemes and refinance windows to reduce lending risk, simplifying collateral requirements, and introducing alternative credit scoring models using behavioural data. Streamlining tax and licensing procedures through one-stop centres, investing in rural digital infrastructure, and supporting women-led and marginalised enterprises can also promote inclusive and resilient regional growth.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments