A holistic financial journey

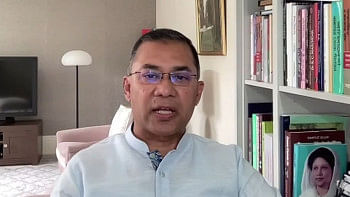

Syed Mahbubur Rahman

Managing Director & CEO,

Mutual Trust Bank

Over the years, Mutual Trust Bank (MTB) has evolved from being traditional service providers to becoming comprehensive financial advisors, adapting to the changing needs of customers and technological advancements. Initially focused on core banking services such as deposits, loans, and transactions, MTB and similar institutions have broadened their offerings to include wealth management, financial planning, and personalised advisory services. This transformation has been driven by increased competition, customer demand for holistic financial solutions, and advancements in digital technology.

Today, banks utilise data analytics, artificial intelligence, and digital platforms to provide tailored financial guidance, enabling customers to achieve long-term goals such as retirement planning, investment growth, and risk management. Additionally, MTB emphasises customer-centric strategies that align with global trends towards sustainable banking and fostering financial literacy. With over 25 years of banking excellence, we have established a reputation for trust and innovation. Our inclusive approach, supported by robust governance and a skilled workforce, allows us to cater to diverse customer needs, ensuring a holistic financial journey.

To support the financial growth and effective wealth management of our customers, MTB offers a comprehensive range of tailored products and services. These include retail banking, SME financing, and digital banking solutions. Our savings and deposit schemes, including fixed deposits, current accounts, and specialised savings plans, help customers grow their wealth securely. MTB also provides personalised investment advisory services, ensuring clients make informed decisions across diversified portfolios. For long-term financial goals, our asset management services encompass mutual funds, bonds, and other structured investment instruments.

Additionally, MTB's lending solutions, such as home loans, car loans, and SME financing, empower customers to achieve their life aspirations while maintaining financial balance. Through our digital banking platform, customers can access convenient and secure services, from wealth tracking to automated savings. With a focus on trust, transparency, and financial empowerment, MTB strives to be a reliable partner in every customer's financial success.

Mutual Trust Bank is leveraging technology and digital innovation to redefine service delivery, ensuring a seamless and customer-centric experience. By integrating advanced digital banking solutions, such as mobile banking apps, we enable customers to perform transactions, access account information, and receive real-time support anytime, anywhere. Our robust online banking platform incorporates state-of-the-art security features to protect sensitive data while offering intuitive navigation for enhanced user convenience.

Furthermore, we are investing in automation and blockchain technology to streamline processes, reduce turnaround times, and increase operational efficiency. By digitising back-end systems and adopting paperless workflows, we enhance speed and accuracy in service delivery while minimising environmental impact. Through continuous innovation, MTB ensures it remains at the forefront of the digital banking revolution, empowering customers with cutting-edge solutions.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments