Early Savings, Lasting Gains: Why School Banking Matters

When a 10-year-old Faiha spent all her hard-earned allowance on a colourful doll, the cashier's question—"Won't you save some for next time?"—made her pause. Puzzled, she looked at her nearly empty wallet and realised she had not thought beyond this purchase. As she returned home with an empty wallet, her parents sat her down and introduced the concept of budgeting and savings—a lesson that would stay with her far longer than the doll.

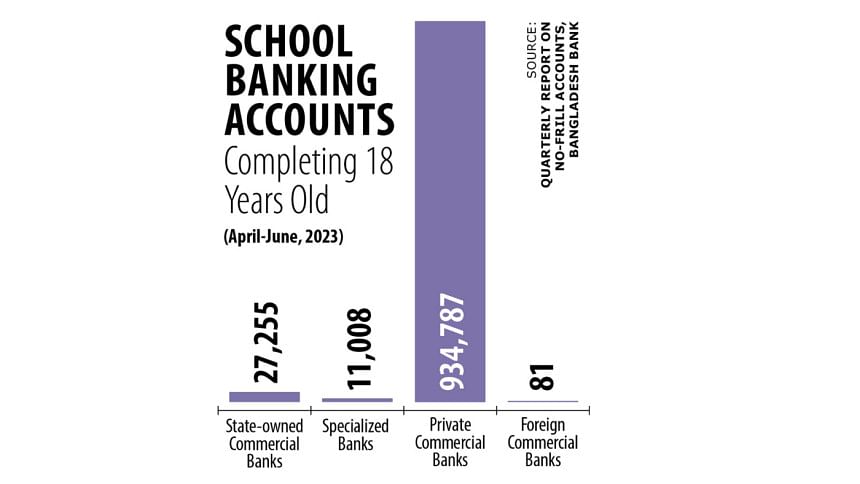

Financial literacy is a skill best nurtured early. Yet, in a world where financial decisions shape our lives, many young people grow up without the knowledge to manage money wisely. School banking can serve as a critical tool for children to internalise key concepts of savings, financial planning and responsible spending. It refers to the banking facility available for school students, according to Bangladesh Bank's guideline initially issued in 2010. It not only promotes financial literacy but also brings individuals from diverse socio-economic backgrounds into the formal banking sector, while simultaneously cultivating saving habits in students that boost national savings and investments, fueling long-term economic growth.

Build habits today for a secure tomorrow

School banking offers students hands-on experience with banking operations and teaches them basics of money management, savings, and budgeting, enhancing their financial literacy at a formative age. Financially literate individuals are better equipped to make informed decisions, avoid debt traps, and contribute to the economy. In this regard, Ali Reza Iftekhar, Managing Director and CEO of Eastern Bank mentioned, "Managing their own bank accounts teaches students to set goals, delay gratification, and handle financial transactions responsibly."

Banks frequently run interactive campaigns and workshops in schools which familiarise students with school banking and encourages saving habits. "School banking instills financial discipline and encourages saving habits from an early age. Cultivating this mindset during school years equips individuals to manage finances effectively as entrepreneurs or professionals in the future," noted Md. Rashed Akter, Head of Retail Distribution, Midland Bank. Moreover, introducing financial literacy through these programmes addresses gaps in traditional education systems, which often overlook essential life skills like money management.

Unlock the perks of school banking accounts

Competitive interest rates

School banking accounts generally offer a higher interest rate than general savings accounts, encouraging young minds to start saving. Nighat Mumtaz, Head of Sustainable Banking, NCC Bank said, "We offer a fixed deposit scheme under school banking, where the interest rate is 0.25% higher than conventional Fixed Deposit Receipts (FDRs)." Similarly, Md. Arifur Rahman, In-charge, Student Banking, Mutual Trust Bank mentioned, "MTB Children Education Deposit Scheme offers an attractive 9.75% interest rate with early encashment facility, where customers can deposit any amount of money per month with 4 years of maturity."

Low minimum initial deposit

These accounts can be opened with a low initial deposit, which makes the service accessible to a wide range of customers coming from different economic classes. On this note, Tahsin Taher, Head of Retail Segment, Mutual Trust Bank mentioned, "Like many other banks, MTB requires only BDT 100 for opening school banking accounts, which makes parents eager to open accounts when we introduce the schemes during our campaigns in different schools throughout the country."

No maintenance fee

School banking accounts come with zero maintenance fees, ensuring accessibility for students and families without added financial burdens. This feature encourages young savers to manage their money without worrying about hidden costs. Sk Asadul Hoque, SAVP & Head of FID, Al Arafah Islami Bank commented, "School banking accounts fall under no-frill accounts, which do not require any maintenance fee as per Bangladesh Bank's Guideline."

Complimentary debit card

Students receive a free debit card, empowering them to make secure transactions and withdrawals. It is a practical way to teach financial independence while giving them hands-on experience with modern banking tools. "Providing a free debit card with school accounts enables students to deal with money first-hand. This early exposure prepares them to confidently navigate the increasingly cashless economy of the future," added H M Mostafizur Rahaman, SEVP & Head of Retail Business of Dhaka Bank.

Balance financial freedom and parental guidance

School banking accounts strike an ideal balance between granting financial freedom to students and providing parental oversight. These accounts allow students to experience financial independence by managing their own money, making transactions, and learning the importance of budgeting. At the same time, these accounts ensure parents remain involved in guiding their children's spending habits through built-in monitoring tools.

"Parents can track account activity and ensure that withdrawals align with approved spending categories, such as education materials, restaurants, or shopping. This feature helps prevent impulsive or unnecessary expenditures while reinforcing responsible spending habits," noted Ahsan Zaman Chowdhury, Managing Director of Trust Bank. Additionally, parents have the option to set limits on withdrawals, ensuring students adhere to their financial plans and focus on essentials.

By combining freedom with supervision, school banking accounts foster a partnership between parents and children in financial management. This not only prepares students for independent financial decisions in adulthood but also strengthens family communication about money matters, building a foundation for long-term financial success.

Be the catalyst for economic progress and SDG achievement

School banking accounts are more than just financial tools; they are key drivers of economic progress and contributors to achieving the Sustainable Development Goals (SDGs). Due to the minimal initial deposit required for school banking accounts, students from various social classes can be brought under financial inclusion from an early age. This inclusion is especially impactful in semi-urban and rural areas, where access to traditional banking services may be limited.

"School banking serves as a crucial tool for financial inclusion. Through school banking, people from different socioeconomic backgrounds can be connected to the formal banking activities and financial transactions, which in turn expedite economic growth," commented Sk Asadul Hoque of Al Arafah Islami Bank.

Through school banking, students and their families become part of the formal economy, contributing to higher national savings rates. These savings fuel investments in infrastructure, education, and other key sectors, driving sustained economic growth. As a customer of such initiatives, individuals play a direct role in supporting these broader objectives. By engaging with school banking programmes, they not only secure their financial future but also become catalysts for economic progress and drivers of a more inclusive and sustainable society.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments