Nvidia faces record $279 bln market cap loss in one day

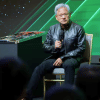

Nvidia, a leading player in artificial intelligence, experienced a steep 9.5% drop in its shares on Tuesday, marking the largest single-day loss in market value for a US company. As a result, the company lost $279 billion in market capitalisation.

Nvidia's recent losses are triggered by lukewarm economic data and a dampened investor enthusiasm for AI—a sector that has been a significant driver of this year's stock market gains. The PHLX chip index plummeted 7.75%, its biggest one-day drop since 2020.

The latest jitters about AI come after Nvidia last Wednesday gave a quarterly forecast that failed to meet the lofty expectations of investors who have driven a dizzying rally in its stock.

"Such a massive amount of money has gone to tech and semiconductors in the last 12 months that the trade is completely skewed," said Todd Sohn, an ETF strategist at Strategas Securities.

Intel dropped nearly 9% after Reuters reported CEO Pat Gelsinger and key executives are expected to present a plan to the company's board of directors to slice off unnecessary businesses and revamp capital spending at the struggling chipmaker.

Worries about slow payoffs from hefty AI investments have dogged Wall Street's most valuable companies in recent weeks, with shares of Microsoft and Alphabet trading lower following their quarterly reports in July.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments