Roadblocks ahead for commercial vehicles: surging demand vs challenges

The commercial vehicle market in Bangladesh has witnessed significant growth over the past decade, driven by improved road infrastructure and a thriving industry. However, the industry is currently facing challenges due to rising prices, reduced sales, and the need for regulatory reforms.

According to a report publish in The Daily Star on March 2022, the domestic market size of commercial vehicles has grown from Tk 2,000 crore in 2010 to approximately Tk 4,400 crore in 2021. This growth represents an average annual increase of 15%, attributed to the continuous improvement of road and infrastructure facilities.

Most of the demand for commercial vehicles comes from the country's garments industry. According to industry analysts, in 2021, the light commercial vehicles (LCVs) market size reached approximately Tk 1,200 crore, with an average annual sale of 11,000 units for the past three years. LCVs dominate 42% of the commercial vehicle market, but their market share increased to 45% in 2021 due to a 6% growth in sales.

According to industry insiders, as of 2023, the annual sale of brand-new trucks in the country reached 20,000 units, with 10,000 of them being LCVs. Among the various types of trucks, medium commercial vehicles (MCVs) weighing between 3 to 7 tonnes are popular on highways, but the LCV segment faces the highest demand and intense competition due to city limit laws.

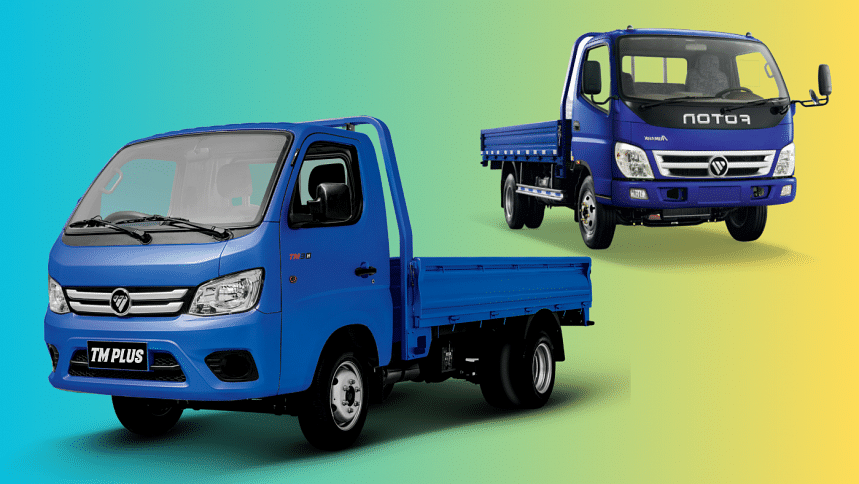

Fleet owners faced a lack of customised truck options, but Indian company Tata Motors provides a better variety. In fact, the Nitol-Niloy Group, the exclusive distributor of Tata Motors in Bangladesh, holds the largest market share in the commercial vehicle segment, accounting for 31%. The LCV market is mainly served by Indian automakers like Tata, Mahindra, Ashok Leyland, as well as Chinese brands such as JAC and Foton, covering 83% of the market. Notably, Foton trucks have achieved a 10% market share in just three years.

Despite the growth, the market has experienced turbulence over the past two years. Factors such as the increased dollar price, higher fuel costs, and lower imports have contributed to a nearly 22% decline in vehicle sales, particularly heavy-duty trucks, in 2022. According to Nitol Niloy Group, their heavy-duty vehicle sales have declined by 48%. According to the Bangladesh Road Transport Authority (BRTA), 4,528 units of trucks were registered in 2022, down from 5,789 units in the previous year.

Subrata Ranjan Das, Executive Director of ACI Motors Limited, highlighted the lack of discipline in the industry as a major challenge. He emphasised the need for adherence to traffic rules, proper training and salaries for drivers, and regulation of working hours. Establishing discipline and implementing measures to regulate movement and vehicle numbers can help alleviate the strain on the limited road infrastructure and improve overall road security.

Another significant issue is the inadequate bank loan facilities, which affects buyers' ability to make purchases. Furthermore, approximately 10% of vehicles get repossessed after owners fail to make loan payments, highlighting the need for better financing options for end users.

Additionally, there is currently no push for carbon emission reduction, and the tax structure does not favour commercial electric vehicles. Regarding old vehicles, according to BRTA, at least 38,123 trucks, lorries, and tankers are past their 25-year life.

Despite these challenges, industry insiders believe that the market has the potential for recovery. If everything stabilises, the market is expected to experience a growth rate of 15-20%. However, this recovery is dependent on both domestic and global factors.

While the commercial vehicle market in Bangladesh has experienced significant growth, it currently faces challenges that require the government's attention. By addressing these issues and promoting the sector as a respected career choice, Bangladesh can enhance employment opportunities and improve the quality of the commercial vehicle segment.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments