Transactions via SWIFT rise 32.7pc

Bangladesh last year registered 32.7 percent year-on-year growth in foreign exchange transactions through SWIFT owing to an increase in trade finance payment.

Around eight million foreign currency transactions in and out of Bangladesh were completed through the SWIFT network last year, according to Alain Raes, chief executive of SWIFT's Asia-Pacific region.

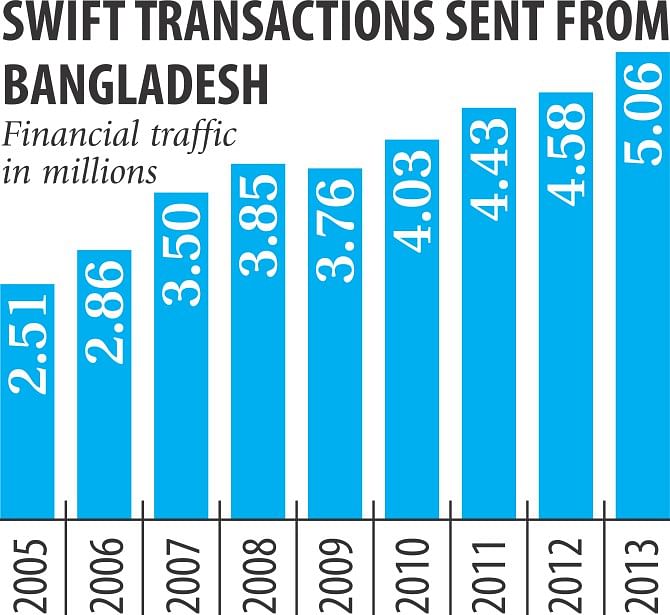

Trade accounts for 56.1 percent of financial traffic sent by Bangladesh, which is 5.06 million a year.

“Bangladesh has registered significant growth in trade finance as it is gradually becoming a manufacturing hub,” he told The Daily Star in an interview yesterday.

Bangladesh's import payment rose 9.77 percent year-on-year to $33.18 billion between July and May, according to data from BB. Inward remittance was $14.22 billion in fiscal 2013-14, while Bangladesh exported $30.17 billion of goods in the same year.

Raes was in Dhaka to mark SWIFT's 20 years of operation in Bangladesh. A programme was organised at the capital's Westin hotel, which was attended by top officials of financial institutions and Bangladesh Bank Governor Atiur Rahman.

The country ranks 16th in the Asia-Pacific region for total sent traffic and 14th for received traffic, he said.

SWIFT, short for the Society for World-wide International Financial Telecommunication, is the member-owned cooperative that provides the communications platform, products and services to connect 10,500 banking organisations, securities institutions and corporate customers in 216 countries and territories.

Its presence was extended to the US in 1979 and to Asia in 1980. Today, it handles more than four billion messages a year between financial institutions, market infrastructures and corporation.

The network was introduced to Bangladesh in 1994 by AB Bank Ltd and a few other ambitious commercial banks.

Later in 2002, more commercial banks including the central bank started using SWIFT for their day-to-day payment and settlement activities. At present, 56 commercial banks are members of SWIFT.

As a modern payment system, SWIFT is playing a crucial role for economic development of any country, Rahman said at the event, adding that the network has made secure, hassle-free foreign transactions possible for the country.

The BB governor said the central bank has taken an initiative to introduce real-time gross systems (RTGS), a specialist fund transfer system where transfer of money or securities takes place from one bank to another on a “real time” and on “gross” basis, in Bangladesh and would like to partner with SWIFT in this new venture.

“We look forward to having SWIFT play a vital role in the recent initiatives of RTGS in Bangladesh payment system. SWIFT may also consider exploring the inter-bank settlement system,” Atiur said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments