Now is not the right time to raise fuel prices

Currently, the world is going through a major energy crisis. In the last couple of months, natural gas, coal, crude oil, and electricity prices increased manyfold, jeopardising the post-Covid economic recovery across the continents. While the developing countries are hit hard, even the developed countries are facing unprecedented situations as well.

Insufficient coal supply has created such a power generation shortage that two-thirds of Chinese provinces experienced rolling blackouts. Similar power curtails took place in many Indian states. Electricity prices in Germany and Spain, where coal and gas still produce substantial amounts of electricity, soared to a record high. China forced all its energy-intensive industries (steel, aluminium, and cement) to cut down production, which in turn triggered supply chain worries all over the world. Natural gas prices in Europe and Asia increased 10 times from the same time last year. The coal price is almost five times higher now compared to November 2020. Crude oil price is heading towards the highest in several years. Many countries are helping the affected consumers.

This unusual situation was not caused by any single event. This was not due to the worldwide energy transition trends towards renewable and sustainable energy. Several factors created the current situation. In the early stage of Covid last year, the energy demand went down so drastically that oil, gas, and coal prices bottomed to historically low prices. At one point, the WTI (Western Texas Intermediate) crude oil price went to a negative value. As a result, new investment in fossil energy completely dried up, which was already on the decline since 2015. At the same time, many active fossil fuel production operations were closed down. With the introduction of vaccines in early 2021, the world economy started turning around. With the improved Covid situation, the world economic recovery got into full gear, posting the highest post-recession recovery rate in the last 80 years, driving the energy demand to exceed that of pre-Covid times. The traditional energy sector could not ramp up production at the same pace. As a result, a major supply deficiency has hit the market. At the same time, an early, colder winter is also creating more demand for energy, which could not be supplied by renewable or any other source. Wind in Europe is producing much less power than average. New environmental regulations in China and India also hampered local production. Fire, maintenance, hurricanes, feed gas issues, shutdown of US shale oil production, and tight control by OPEC Plus countries have created less than expected energy supply scenarios on all fronts. The max out of LPG production will keep all the energy prices at an elevated level for an extended period.

Bangladesh is increasingly getting dependent on imported energy. Dwindling local gas supply that went down to 2,250 million cubic feet per day (mmcfd) from a peak of 2,750 mmcfd within one year has forced increased LNG imports. Out of a total of 7.2 million tonnes of yearly regasified liquefied natural gas (RLNG) capacity, Bangladesh imports four million tonnes RLNG through long-term contracts indexed with Brent oil price. The rest of the capacity was kept for spot purchase that has soared to more than USD 34 per mcf from only USD 3.5 per mcf a year back in the Asian spot market. The country brings in its entire crude and petroleum products via import, which may top 6.5 million tonnes a year. We also import roughly five million tonnes of coal. All these imports put the energy sector at high risk of supply and price variation.

The increasing dependence on imported oil and gas for power generation has amplified the production cost of electricity. System inefficiency, pilferage and overcapacity have added to that cost. As a result, the government paid Tk 11,300 crore in subsidies to the power sector alone last year. Due to a severe domestic gas supply shortage, the government did not have any other choice but to import LNG from the spot market at almost 10 times more value than last year's low. The current average gas selling price by Bangladesh Oil, Gas and Mineral Corporation (Petrobangla) since 2019 is Tk 9.8 per cubic metre. While the average cost of gas was about Tk 12.2 per cubic metre before the current crisis, it has shot up to Tk 23 now, needing a subsidy of about Tk 14 per cubic metre. The government has been paying subsidies to the power sector for a long time, especially after increasing oil-based generation capacity to 35 percent. The gas subsidy is a recent phenomenon that started with the import of LNG in 2018. How and why we arrived at this state requires a detailed analysis that is beyond the current scope of discussion.

Typically, oil prices lead to energy crises and generally have much more impact on the economy. The current oil price of USD 84 per barrel (bbl) is high, but not considered threatening yet. Rather, "it is the tail that is being wagged" by other fuels. The oil price has remained rather stable for a very long time—since the advent of shale oil in the US and the beginning of the energy transition towards renewable energy that took off in 2014-15. Bangladesh set its current oil price in 2014, when the oil price was hovering around USD 90/bbl. When the price crashed to as low as USD 27/bbl in February 2016 and remained low, the government reduced the diesel price by a token Tk 3 per litre—from Tk 68 to Tk 65. The average oil price between 2015 and 2020 has been about USD 56/bbl. Despite thousands of crores of taka given to Bangladesh Petroleum Corporation (BPC) in subsidies in the past, the sheltered corporation has never been upfront in its accountability and transparency, and it has been making money in the last seven years to the tune of over Tk 40,000 crore. The BPC declared that it had lost Tk 1,100 crore in the last five months.

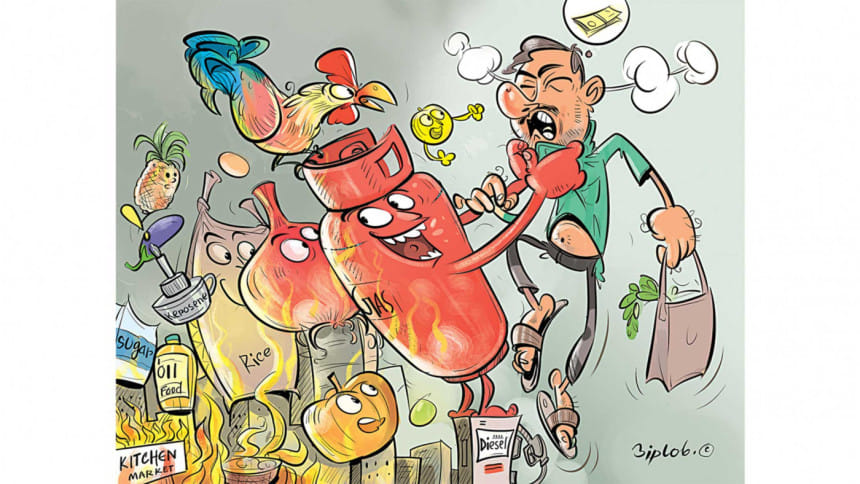

Bangladesh, like many other countries, is on a sharp path of post-Covid economic recovery. If the oil price remains at the current level, the maximum subsidy in the next six months would be Tk 1,500 crore. Bangladesh is heavily dependent on its internal economy. We saw its benefit during the high Covid period, when we did relatively well against the worldwide steep economic downtrend. Even before the current diesel price increase, the food price-driven inflationary movement was creating economic hardship for the average citizens. Covid has bankrupted many small and medium businesses, created double-digit job losses, and wiped out the personal savings of average citizens. People were just getting back on their feet; the sudden increase in diesel price has cut the ground from under their feet. The internal economy will suffer a big blow as the disproportionate price increase in passenger and goods transport will increase all sorts of food prices in the kitchen market, which is already evident.

If the fuel cost of a Tk 100 ticket is even Tk 50, a 23 percent increase of fuel price will increase the overall ticket price to Tk 111.5, an 11.5 percent increase—provided all other costs (bank loan, salary, maintenance, etc) remain the same. The bus and launch owners have "successfully" negotiated 28 percent to 43 percent hikes. This shows the helplessness of the government and the suffering public.

This is a well-known routine. The fuel price increase to save just Tk 1,500 crore in the next six months is ill-timed, and will have a devastating effect on the economy, increasing the hardships of the majority. The government should reconsider this decision for the country's sake. The state-controlled oil price must be regulated by the Bangladesh Energy Regulatory Commission (BERC), where consumer representation will be ensured—which is absent now. This will also ensure transparency and expose all hidden costs, profit, inefficiencies, etc.

Dr M Tamim is professor at the Department of Petroleum and Mineral Resources Engineering in Bangladesh University of Engineering and Technology (Buet).

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments