Accessing China's trillion dollar market

China has sustained very high economic growth since the 1980s following the then President Deng Xiaoping's initiation of economic reforms. In fact, it is the only country that has sustained near double digit growth for three consecutive decades in the history of economic development. China's high growth has transformed its as well as global economy rapidly, making it the second largest economy in the word. It is the top trading nation, measured by the sum of exports and imports of goods, in the world. Ending United States' 110 years of dominance, China has become the world's top manufacturing nation. It has the highest reserves of foreign exchange worth about $3.8 trillion.

However, China now faces some structural problems. Per unit labour cost in the country is on the rise. Its labour productivity grew at 7 to13 per cent in the past two decades, leading to higher wage cost and losing its foothold as the world's lowest cost manufacturer of consumer goods. China's exchange-rate policy and global imbalances are also prompting Beijing concentrating on high-end manufacturing and services sectors, also known as vertical economy. Moreover, following the recent global financial crisis, there is a realisation among the top Chinese leaders that the country's current growth model that relies excessively on exports and investment needs to be rebalanced with a greater emphasis on household consumption which is about 36 percent of its GDP (Gross Domestic Product), compared to United State's 69 percent.

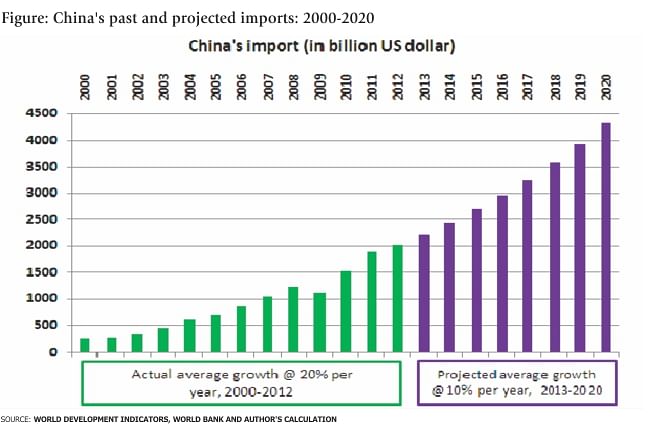

The rise of China's vertical economy: Opportunities for South Asia China's vertical economy could create much room for Bangladesh and other South Asian economies low-end labour-intensive manufacturing that had faced Chinese competition until recently. China is projected to buy about $20 trillion worth of goods and services in this decade. The country's average imports growth had been 20 percent per annum between 2000 and 2012. China's import volume stood $1.95 trillion in 2013. With higher base the country's annual imports could exceed 4 trillion by 2020, even if its imports growth averages 10 percent annually.

In fact, Beijing's shift towards a vertical economy is already felt in some parts of South Asia. Bangladesh, for instance, is set to become a hub for low value-added apparel products. It stands a chance to narrow its manufacturing catch-up gap by drawing low-end labour intensive industries that are hollowing out from the east cost of China. The world's second largest economy could become the next big export market for Bangladesh, particularly for apparel products. China's domestic RMG market is around $310 billion. Chinese importers sourced $100 million worth of clothing items in first 9 months of 2013 from Bangladesh, and their target is to reach $1 billion mark in 2014.

Bilateral trade between China and Bangladesh has been growing fast that reached $8 billion in 2012 and could exceed $10 billion by 2014. However, the trade imbalances favor Beijing heavily. China, nonetheless, has offered duty-free access to 4,721 Bangladeshi products to address the imbalance. Similarly, other South Asian countries are likely to benefit from China's rising consumer market. India and China have an extensive trade relations and the bilateral trade between the two countries could reach $100 billion in the next couple of years.

Coupled with China's own structural shift and South Asia's some unique advantages it is very likely that the latter could become a important source destination for the former's imports, as early as by this decade. There are several reasons behind this optimism.

First, China and most East Asian countries' demographic window closes at a time when South Asia stocks the highest number of working age population with a median age of about 25.

Thus, the region is in a position to produce a host of labour intensive manufacturing products, catering China's consumers, among others.

Second, Beijing is beefing up both bilateral and regional trade and investment relations with South Asia. It is developing key infrastructure, including deep sea ports, and planning to set up a number of industrial parks in its South Asian neighbourhood. This could be supplemented by the Asian Highway network, which is currently underway in many parts of Asia, including South Asia, to facilitate a seamless connectivity in the region.

Beijing is actively working with India, Bangladesh and Myanmar to develop an economic corridor under the aegis of BCIM. It is also planning to build up the China-Pakistan Economic Corridor, which is expected to include construction of an oil pipeline from Gwadar's port to northwestern China.

Manufacturing matters

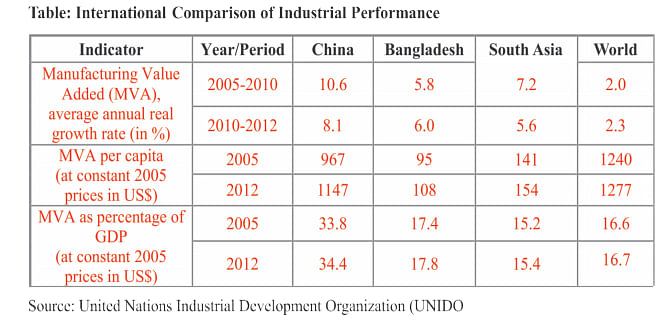

To seize upon export opportunities in China, Bangladesh and other South Asian countries should create room for higher manufacturing growth. The region lag behind East and Southeast Asia in term of manufacturing capabilities. Bangladesh's per capita manufacturing value-added, for instance, is $108, compared to China's 1147. In a recent report, Asian Development Bank (ADB) cautioned that Asian economies which bypass industrialization and leapfrog from agriculture to the services sector may fall into a 'middle income trap'. The ADB study identified the Philippines, India, Sri Lanka and Pakistan are among Asia's agriculture-driven economies that have bypassed industrialisation for the services sector.

It is estimated that an economy where the shares of manufacturing in total employment and output are at least 18 percent has a 42 percent probability of achieving high income levels, but the probability of an economy with a small manufacturing sector (in both output and employment) achieving high-income status is less than 5 percent. In the case of Bangladesh while manufacturing's share in GDP approaches to 20, the sector constitutes only 12 percent of total employment. It indicates that service sector is absorbing most of surplus labor released from agriculture. This is almost a South Asian phenomenon. During the last 4 decades, while Asia's economies have transformed structurally, the pace and extent have been very uneven.

According to ADB, desirable structural transformation has taken place only in five Asian economies: Japan; Hong Kong, China; the Republic of Korea; Singapore; and Taipei, China. China has experienced significant structural change, but agriculture is still the country's largest employer. Among other key economies, India lags well behind in the extent and pace of its transformation. Indonesia, Malaysia, Thailand, Vietnam and the Philippines have experienced transformation in terms of diversification, upgrading and deepening. The rest of the region lags far behind, including large economies such as Bangladesh and Pakistan.

That said, manufacturing matters for a number of reasons. It is the key driver of productivity growth, opens room for innovation, generates employment and foster trade. As Dany Rodrik of Harvard University observed, “For developing countries, expanding manufacturing industries enables not only improved resource allocation, but also dynamic gains over time. This is because most manufacturing industries are what might be called “escalator activities”: once an economy gets a toehold in an industry, productivity tends to rise rapidly towards that industry's technology frontier.”

Bangladesh's Manufacturing makeover

Bangladesh virtually needs a manufacturing makeover diversifying both export basket and destination. In doing so the country needs to get its manufacturing priorities right. Owing to the economy's structural problem it is hardly surprising that Bangladesh's export basket is very narrow. ADB has documented three levels of diversification of Asian economies' export baskets: economies that are well diversified and today have comparative advantage in over 700 products; economies that currently have comparative advantage in 100 to 350 products; and economies that today have comparative advantage in 80 products or fewer. Bangladesh falls in the last group that has advantages in producing only 50 products.

That said, global manufacturing industry is diverse and countries generally specialize based on their competitive or comparative advantages. Five broad groups of manufacturing are identified by McKinsey, a leading research and consulting outfit, with diverse characteristics and requirements. They are global innovation for local markets, regional processing, energy/resource-incentive commodities, global technologies and labor incentive tradables.

Currently, Bangladesh has advantages in manufacturing labor intensive tradables (that constitutes 7 percent of global manufacturing value added) and regional process (constitutes 28 per of global manufacturing value added) where labor intensity is relatively high. However, given the higher trade intensity, it enjoys comparative/competitive advantages in producing textile, apparel, leather, toys and other labor intensive products. It has also advantages in producing food and beverages, particularly for its large local market.

Going forward, Bangladesh needs both short and medium term strategies to boost its manufacturing output. In the short run, the country should exploit its existing comparative advantages fully in the area of RMG, leather, jute and other traditional exportables. It should draw some of the Chinese manufacturing units that are relocating to Indonesia, Vietnam and other Asian countries. The relocation of such manufacturing units bring technology, skills and capital, generate significant employment and create a market in China. In this connection, the Chinese government's proposal to develop an industrial park in Chittagong and the government's favourable response are some encouraging development. However, the success will depend on how fast the authorities allocate land and provide other supporting infrastructure for the project.

To become a competitive manufacturing location, diversifying its export basket, Bangladesh has to focus on a number of factors that affect export diversification in the medium to long run. They are natural resource rents (coastal space or minerals), population size, school enrollment and skill development and foreign direct investment, among others. It is observed that the most important variables in predicting long-term export diversification are the fraction of natural resource rents in GDP and the net primary enrollment rate. Population size and foreign direct investment play a secondary role.

As far as school enrollment and skill development are concerned, Bangladesh's education attainment lags far behind East and Southeast Asian countries even if the country's achievements are compared with these regions attainments in 1980s. Bangladesh is at least 40 years behind South Korea and 30 years of China as far as education attainment is concerned. There is a need for massive investment in education.

Concerning natural resource rents, Bangladesh has an unique advantage - the locational advantage of its coastal cities, notably Chittagong. The country's strategic advantage should be harnessed better by developing key infrastructure such as deep sea port and Chittagong-Myanmar-Bangladesh highway. Moreover, Bangladesh's settlement of the maritime boundary dispute with Myanmar that established the former's sovereign rights to a full 200 nautical mile exclusive economic zone in the Bay of Bengal and to a substantial share of the 'outer continental shelf' beyond 200 nautical miles have opened the opportunity to develop an ocean economy centering the Bay of Bengal. Dhaka is also likely to settle its maritime boundary dispute with India in the near future.

Some of the key components of its ocean economy should include energy security (oil and gas resources), fishery and fresh water resources preservation, port and logistics facilities development, ship building industry, trade route secure, tourism development, ecosystem protection, among others. This could change the economic geography of Bangladesh.

To sum-up, Bangladesh has to absorb nearly a million young population to its manufacturing sector annually to maintain stability in the labour market as well as to accelerate structural transformation. Otherwise, the new entrants to the job market will either be absorbed by low paid service sector or the country will continue to lose skills permanently, exporting the surplus labour overseas. This could force Bangladesh falling into a 'middle income trap' or making it a remittance economy jeopardizing the country's long term industrialization. As discussed, both short-term and long-term policies are required to transform Bangladesh a manufacturing powerhouse by this decade. This could also help availing emerging export opportunities in China, which could be as high as $20 trillion by 2020.

The writer is a Research Fellow at the Institute of Governance Studies (IGS), Brac University.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments