Banking sector now an orphan: CPD

The banking sector, which is currently going through choppy waters thanks to rising loan irregularities and deteriorating corporate governance, is being enabled by those who were supposed to keep it in check, said the Centre for Policy Dialogue.

“Now I think the banking sector has turned into an orphan and its protectors are abusing it,” said CPD Distinguished Fellow Debapriya Bhattacharya at a press conference yesterday.

The independent think-tank organised the meet at the Cirdap auditorium to share its recommendations for fiscal 2018-19's national budget.

Bhattacharya's comments come as the finance ministry, under pressure from directors of private bank, in a flurry of moves earlier this month undid the tight monetary stance announced in January for the second half of fiscal 2017-18.

“This has seriously undermined the independence of the central bank and has dented its credibility,” the CPD said.

The banks' cash reserve requirement, which is a specified minimum fraction of the total deposits that banks must hold as reserves either in cash or as deposits with the central bank, was cut by one percentage point and set at 5.5 percent.

The repo rate, which is the rate at which banks take loans from the central bank, was lowered to 6 percent from 6.75 percent.

From this month, the private banks can keep 50 percent of the government funds. Previously, they could hold 20 percent of the funds for annual development programme and 25 percent from the revenue budget.

The CPD said the decision to slash the CRR is likely to encourage the poorly performing private banks to continue with their business-as-usual practices.

The CRR cut may also encourage banks to lend more aggressively and indiscriminately, which would also raise the risk of an increase in classified loans, it added.

At the end of December last year, the overall non-performing loan ratio in the banking sector stood at 10.70 percent, up from 10.10 percent six months earlier.

“The attempt on the part of the finance ministry to rescue the private banks through CRR reduction was in fact similar to government's recapitalisation support for the state-run banks.”

The civil society body said the central bank should investigate whether the recent liquidity crunch was brought about by loan defaulters who chose to repay their loans from state banks by borrowing from private ones.

Typically, a liquidity crisis is a symptom of a disease, Bhattacharya said. “But this is not a disease. The disease is that you have created a challenged banking system.” He also warned of capital flight given the stagnancy in private investment, private sector credit growth and surging imports. “If private sector investment remains stagnant, where has all the private sector credit gone?”

Private sector credit grew 18 percent in February, according to data from the Bangladesh Bank.

Both the state and private banks are giving credit to the private sector. “Yet, private investment is not picking up. How is it possible?”

Private investment is estimated to increase 0.2 percentage points to 23.3 percent this fiscal year.

On the other hand, import is rising fast. In the first eight months of the fiscal year, import grew 26 percent year-on-year to $35,820 million, according to data from the BB.

Historically, trade misinvoicing and capital flight are found to be more extensive during the election year, the CPD said.

It is important to see whether capital is being siphoned off in the name of capital machinery imports, Bhattacharya said.

Subsequently, he suggested coordinated efforts by policy agencies including the BB and the National Board of Revenue to curb illicit financial flows and making effective the revenue authority's Transfer Pricing Cell.

The CPD also warned about the bullish trend in stock market ahead. “It raises concerns of outflow of capital,” Bhattacharya said.

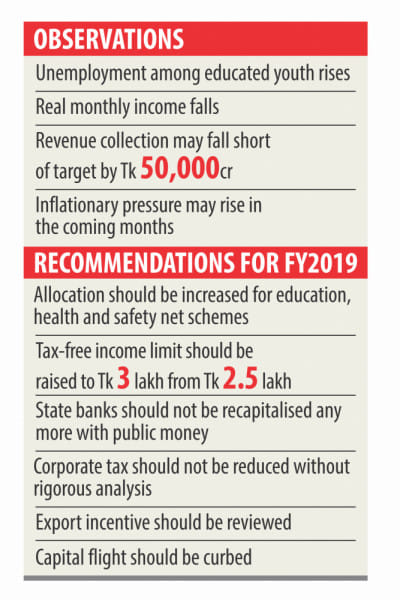

In its analysis, the CPD also questioned this year's 7.65 percent economic growth estimate put forward by the Bangladesh Bureau of Statistics, following in the lead of the World Bank and the Asian Development Bank.

It also cautioned on rising import payments and pressure on the balance of payments, volatility in foreign exchange market and depreciation of taka against the US dollar as well as increase in inflation.

The think-tank recommended the BB pursue a cautious monetary policy to curb inflation and ease the pressure on BoP.

It also recommended restraining the influence of vested interest groups while formulating national economic policies, vigilance over the role of commercial banks and an end to recapitalisation of state banks with taxpayers' money.

Between fiscal 2009-10 and fiscal 2016-17, the government allocated Tk 15,705 crore for the purpose of recapitalising the state lenders.

“Such support has not improved the performance of these banks,” said CPD Research Fellow Towfiqul Islam Khan, who presented the analysis on the state of economy and recommendations for budget for fiscal 2018-19.

Rather, the amount of the non-performing loans had piled up on a continuous basis over the past years.

“The practice of bailing out the losing banks with public money is economically unjustified and morally incorrect,” he said.

As alternative avenues, the CPD proposed using revenue to increase capital, exploring private investors to buy bank shares or merging with other banks.

The number of banks is very high given the size of the economy, said CPD Executive Director Fahmida Khatun.

“So no new bank is needed. If any bank sinks, let it sink. If any bank wants to merge it can. We support reducing the number of banks to enhance efficiency in the banking sector.”

GROWTH AND JOB CREATION

Despite the high GDP growth, not enough number of jobs was created in the industrial sector; most of the employment was created in service sector, the CPD said.

Besides, disparities exist among regions in terms of employment generation, it said, adding that the number of jobs increased only in Dhaka, Chittagong and Rangpur divisions. Employment fell in the south and southwest, north and northeast divisions, it added.

Unemployment rate among the relatively more educated labour force, particularly with secondary and higher secondary and tertiary education, had risen, said the CPD referring to the Labour Force Survey data published recently by the BBS.

The major concern is joblessness among educated youth.

The higher the education the higher the rate of unemployment, Islam said.

Unemployment among the educated youth rose in fiscal 2016-17 from a year earlier. In addition, the average real monthly income fell in fiscal 2016-17 from the previous year. Bhattacharya termed the trend as income-less jobs.

Real income of females has declined at higher rate than the males. Income in rural areas has dropped higher than in urban areas, he said.

“You have so far heard about jobless growth. Today, we say income-less employment. Whatever the rate of economic growth, its results are important,” Bhattacharya added.

It is important to look into the quality of growth, said CPD Distinguished Fellow Mustafizur Rahman.

“The real income of working class persons has declined. So, it is time to hold a debate on how far the growth could benefit people,” he added.

CPD Research Director Khondaker Golam Moazzem also spoke at the briefing.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments