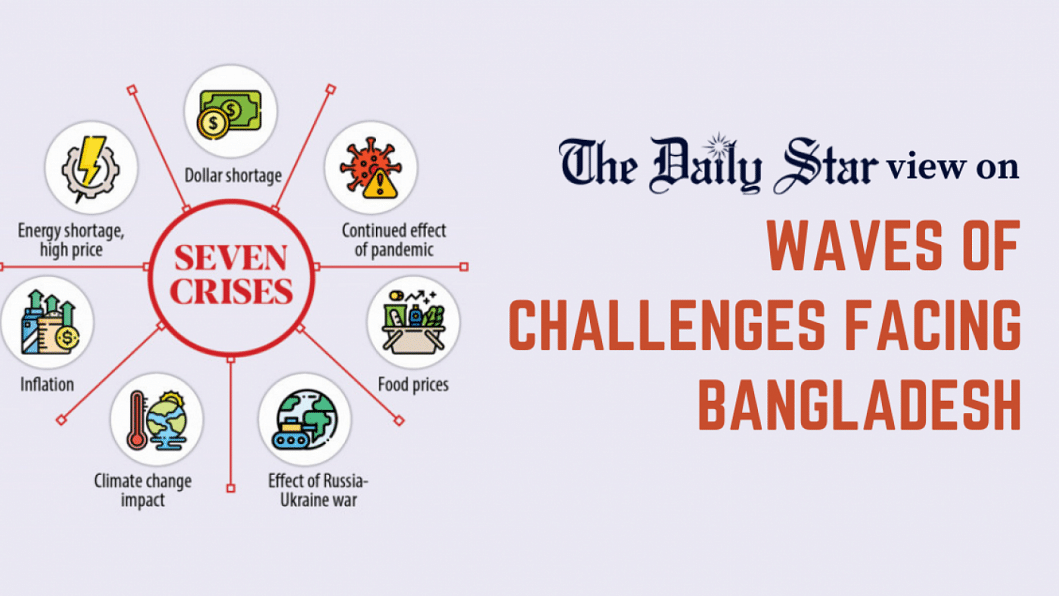

Seven crises, seven roadblocks to economic stability

We're hardly surprised by the Centre for Policy Dialogue's assessment that Bangladesh is facing at least seven major crises. These challenges – namely dollar shortage, high price and shortage of energy supplies, rising inflation, spiralling food prices, continued fallout of Covid-19, effects of Russia-Ukraine war, and climate change – have been with us for quite some time. Of late, Bangladesh has made regular headlines for its poor handling of the fusillade of economic disruptions that came on the heels of the pandemic, and later the war. What's new, however, is the alarming prediction that there will be no relief from them within the next year.

The CPD has made a number of observations and recommendations along with a few caveats, all worth taking seriously. The most important observation is that while the government took some steps to ride out these crises, those were "inadequate" and "short-term in nature". We cannot agree more. It's tempting – from the government's point of view – to shift the blame for most onto global factors like Covid/war instead of acknowledging pre-existing issues that exacerbated them.

In truth, this was a disaster waiting to happen, thanks to years of bad policies, financial irregularities and poor governance. All it needed to reach a boiling point was a push from outside. Had the government taken appropriate steps when the going was good, we would have more fiscal space now and could handle the situation better. As the CPD executive director said, all countries are facing the heat of the current global crisis, but those whose internal policies are strong will fare better.

Bangladesh, clearly, is not one of them. For example, its current gas and electricity crises, caused by dollar shortage and high fuel prices on the global market, could, in part, be attributed to its own energy policy that rewarded over Tk 26,000 crore in "capacity charges" to power companies in the last fiscal year alone. Consequently, many of those companies became richer while the government's fiscal space shrank.

The dollar crunch, which affected our buying capacity amid rising demands for imports, also should have been anticipated. In the absence of effective measures, forex reserves depleted to alarming levels – USD 36.3 billion as of October 12 – although it was USD 41.8 billion at the end of FY 2021-22. Meanwhile, food inflation reached almost 10 percent in August, the highest in 10 years, before dropping to 9 percent in September. The prices of food (and non-food) items have hit all-time highs, despite much-vaunted gains in food production. Households and businesses are suffering equally because of acute gas and electricity shortages.

With no sign of imminent global economic stability, and with quick fixes bringing no relief, the time now is for the long game. For that, the government must first address persistent internal problems like weak governance and corruption, and follow it up with long-term policies to reduce suffering and strengthen the foundation of our economy. To tackle these crises, experts have recommended forming a high-powered committee to monitor key economic indicators and come up with proper responses. The authorities should also control food prices, check further depletion of forex reserves, adopt production-friendly measures, increase minimum wages of workers, reduce fuel costs, take and properly utilise long-term loans, etc. They must do these urgently.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments