No clear roadmap for investment

The budget for FY26 has drawn strong criticism from business leaders who say it lacks a clear roadmap for improving the investment climate, bolstering industrial competitiveness, and implementing overdue reforms in the banking sector.

While the budget aims to stabilise the economy through increased revenue collection, industry leaders argue that this approach may backfire, especially as businesses continue to face high production and operational costs, elevated energy prices, rising interest rates, and the removal of export incentives.

"Revenue is being prioritised over recovery, and it's the private sector that will bear the cost," said Anwar-Ul-Alam Chowdhury (Parvez), president of the Bangladesh Chamber of Industries (BCI).

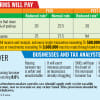

Sharp increases in VAT and import duties on essential raw materials, including construction inputs such as cement and rods, along with a proposed 2.5 percentage point hike in corporate tax for unlisted firms, have raised concern across sectors.

The proposed tax measures, Parvez warned, would further dampen industrial activity and job creation.

"This IMF-influenced budget lacks an investment-friendly outlook and undermines industrial growth. It does not address the survival needs of domestic industries, which will be forced to take a defensive stance," he said.

He also criticised the budget for increasing turnover tax and imposing higher duties on sectors that are still emerging. Parvez warned that rising costs in energy, transport, and finance are pushing many firms to the edge.

He questioned the government's inflation targets, pointing to rising market prices and declining private investment amid uncertainty over gas, electricity, law enforcement, and political stability.

Taskeen Ahmed, president of the Dhaka Chamber of Commerce and Industry (DCCI), acknowledged that the budget includes some positive steps, such as efforts to curb inflation, align minimum tax provisions, expand allowable deductions, and automate tax return systems.

However, he said the absence of specific policy directions for attracting investment and improving the ease of doing business may undercut the budget's long-term effectiveness.

"Despite encouraging moves in tax automation and compliance, higher turnover taxes and ambitious revenue targets could hurt small businesses and reduce liquidity," Ahmed said.

He also warned that higher taxes on import-substitute industries and essential inputs could lead to inflationary pressures and discourage local manufacturing.

Asif Ibrahim, vice chairman of Newage Group of Industries, said increasing advance tax for commercial importers from 5 percent to 7.5 percent would hurt small and medium enterprises, which often rely on these importers to source raw materials.

He also flagged the VAT hike on plastic manufacturing, from 7.5 percent to 15 percent, and on essential raw materials like cotton thread and man-made fibre used in the textile and RMG sectors.

"These measures contradict the goal of promoting domestic manufacturing and attracting investment," he said.

The pharmaceutical sector, however, welcomed one of the proposals. Md Zakir Hossain, secretary general of the Bangladesh Association of Pharmaceutical Industries (BAPI), praised the government's decision to extend VAT exemptions on Active Pharmaceutical Ingredients (API) until 2030.

"It's a timely and strategic move," he told The Daily Star. "Our industry is still developing capacity for API production. This gives us critical breathing space as we anticipate the entry of multinationals and patent laws while preparing for LDC graduation."

Rupali Chowdhury, managing director of Berger Paints Bangladesh, supported the proposed requirements for transparency, such as mandatory cashless sales and a 10 percent public share float.

She, however, cautioned that these measures may be difficult to implement in areas with weak digital infrastructure, and the listed firms unable to meet these requirements could see their tax rates rise from 22.5 percent to 27 percent — a measure she called "punitive."

Kamruzzaman Kamal, marketing director of Pran-RFL Group, said the proposed VAT and tax hikes would significantly increase production costs and discourage local industries. "It's a challenging budget for manufacturers," he said.

Syed Ershad Ahmed, president of the American Chamber of Commerce in Bangladesh, said the interim government's target of 5.5 percent GDP growth would require more than just a large Tk 7,90,000 crore budget. He stressed the need for immediate focus on inflation control and policy reforms.

He recommended prioritising crisis management, fiscal discipline, and key policy reforms to navigate current challenges effectively.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments