What are the likely tax and duty measures in FY26?

The interim government is set to introduce a series of tax and duty measures in the upcoming fiscal year to support Bangladesh's smooth transition from Least Developed Country (LDC) status and to stimulate economic growth.

Finance Adviser Salehuddin Ahmed is expected to unveil the proposed measures on June 2 as part of the FY2025-26 national budget. These include steps to reduce the cost of doing business and align tax policies with the requirements of LDC graduation.

Key proposals include the withdrawal or reduction of supplementary duties on 622 products and a cut in customs duty on 100 others, aiming to boost market access and trade competitiveness. Items likely to benefit include cold storage machinery, paper products, buses, newsprint, cancer treatment equipment, and raw materials for pharmaceuticals and eco-friendly goods.

The government also plans to grant duty exemptions on liquefied natural gas (LNG) imports and pharmaceutical inputs. Penalties for import-related misdeclarations are expected to be reduced to 200 percent from the current 400 percent to ease business operations.

Officials at the finance ministry said these measures are critical for enhancing Bangladesh's global competitiveness after LDC graduation.

US tariff response

To counter potential trade challenges, particularly with the United States, the National Board of Revenue (NBR) is set to propose zero import duties on an additional 100 products. The move is intended to mitigate the impact of a proposed 37 percent tariff on Bangladeshi exports by the US, following policy changes introduced by the Trump administration.

The list includes raw materials for the textile sector, military equipment, and industrial machinery. The government aims to expand duty-free imports to offset the impact of new tariffs and safeguard market access.

Pharmaceutical industry support

To strengthen the pharmaceutical sector and reduce healthcare costs, the budget is expected to expand duty exemptions on raw materials and medical equipment. An additional 79 items may be added to the duty-free list, particularly benefiting manufacturers of drugs for cancer, kidney, and vascular diseases. The move is expected to lower treatment costs and improve healthcare access.

Support for cold storage, toy and cricket bat makers

The government plans to exempt duty on cold storage machinery, including compressors, to stabilise agricultural prices and reduce post-harvest losses.

Duty cuts are also likely for raw materials used in toy and cricket bat production. As part of this plan, the tariff value of imported finished toys may be set at $4 per kg, while duty on willow wood,used for making cricket bats,may be reduced from 37 percent to 26 percent.

Duty cuts on public transport and microbuses

In an effort to ease traffic congestion in cities like Dhaka, the import duty on buses with 16-40 seats is expected to be reduced from 10 percent to 5 percent. Similarly, the supplementary duty on microbuses (10-15 seats) may be slashed from 20 percent to 10 percent, making these vehicles more affordable for transport operators.

Sugar import duty reduction

The government is also likely to reduce the specific duty on refined sugar imports from Tk 4,500 to Tk 4,000 per tonne, aiming to keep domestic prices stable and enhance revenue collection.

Boost for software export

To promote the export of domestically developed software, the government may reduce import duty on development tools, operating systems, databases, and security software from 10 percent to 5 percent.

Higher duties on luxury items

While easing duties for essential sectors, the government also plans to raise customs valuation for certain luxury goods. For example, the minimum tariff value for lipsticks and face wash may be doubled to $40 per kg. A similar increase is expected for chocolates, which would raise their retail prices.

Helicopter import duty hike

The duty on imported helicopters is expected to increase from 1 percent to 10 percent. The measure is likely to raise costs for businesses and services that rely on helicopters for transport and emergencies.

VAT exemption on LNG imports

The budget is also expected to exempt LNG imports from the existing 15 percent Value Added Tax (VAT), which would help reduce energy costs for power generation and industrial operations.

Corporate and income tax changes

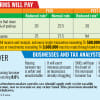

To increase revenue, the government is likely to introduce several income tax adjustments, including the reintroduction of a 30 percent tax rate for high-income earners.

A progressive tax structure may be introduced, with rates adjusted across different income slabs.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments