Govt to rely more on local banks than foreign funds

The government will rely more on domestic bank borrowing than foreign financing in the next fiscal year, intensifying pressure on the economy.

In the revised budget for the current fiscal year of 2023-24, the net foreign financing was cut by 25 percent due to the increasing debt servicing cost and low utilisation of foreign funds.

Net foreign financing is calculated after excluding the expenditure on debt servicing.

The net foreign financing is likely to be reduced by 12 percent in 2024-25. In the current fiscal year, Tk 1,02,490 crore was allocated as net foreign financing, which was later reduced to Tk 76,293 crore.

The amount will be Tk 90,700 crore in FY25.

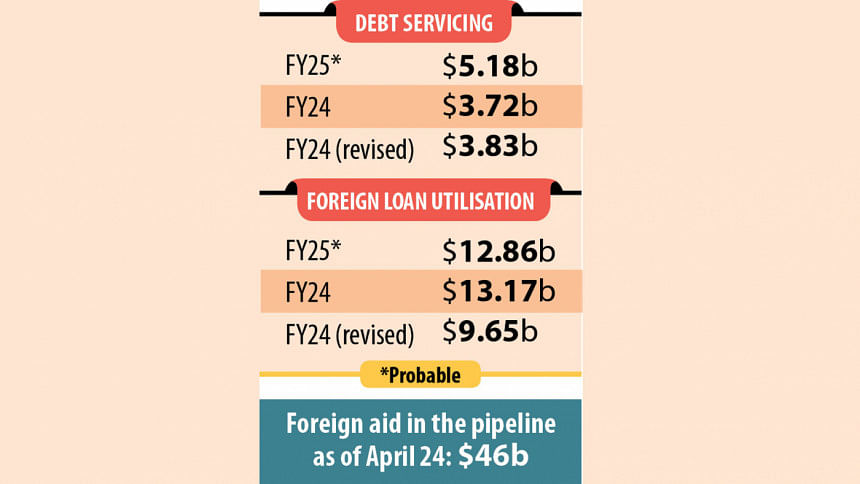

In the revised budget, the allocation for debt servicing has increased by 2.7 percent to $3.82 billion, including principal amount and interest payments. The expenditure climbed 13.8 percent due to the depreciation of the taka and stood at Tk 42,200 crore.

When the budget was placed last year, an exchange rate of Tk 99.46 per dollar was used. An exchange rate of Tk 110 per dollar has been taken into consideration in the case of the revised budget of FY24 and the proposed budget for FY25.

On May 8, the central bank, however, fixed Tk 117 as the mid-rate as it looks to allow the market to set the exchange rate.

How much money Bangladesh would have to pay will ultimately depend on the exchange rate at the time of payment.

In the proposed budget to be placed today, the debt servicing cost is likely to be $5.18 billion or Tk 57,000 crore, a 35 percent increase compared to the revised budget.

The debt servicing cost is increasing, and foreign funds are not being utilised fully. As a result, the net foreign financing has reduced.

The government had set aside $13.17 billion as foreign financing in the budget for this year, but it was later revised to $9.65 billion. Of the amount, $2.92 billion was earmarked as budgetary support in the original budget, and it was revised to $1.35 billion.

The new budget is likely to allocate $12.86 billion as foreign financing and $3 billion of it could be kept as budget support.

A top finance ministry official said the government had, in most years, failed to utilise the allocated foreign funds. The low use is another reason behind the decreasing foreign financing, according to the officials.

As of April, at least $46 billion in unused foreign financing was in the pipeline.

During the National Economic Council meeting last month, Prime Minister Sheikh Hasina asked all ministries and divisions to quickly finish foreign-funded projects.

While foreign fund utilisation is decreasing, the amount of bank borrowing is increasing significantly.

The highest borrowing will be from banks, Tk 1,37,500 crore. In the revised budget, the bank borrowing increased by 17.78 percent to Tk 1,55,935 crore.

Zahid Hussain, a former lead economist at the World Bank's Dhaka office, said if the government increases bank borrowing, it leaves fewer chances for the private sector to get loans.

"This affects inflation and puts pressure on foreign currency reserves."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments