An uninspiring budget proposal

Despite having a few positive features, the proposed budget from FY2024-25 fails to recognise the immediate needs and medium-term challenges facing the economy. There are three key problems that the budget somewhat correctly identifies: runaway inflation, dwindling foreign exchange reserves, and increasing debt burden. However, the strategies for curbing inflation and providing relief to the poor and fixed-income groups are grossly insufficient. For starters, duties have been reduced on only a few essential items, and the government's poor track record does not give a lot of hope as to whether this will ultimately result in lower prices for consumers. Moreover, the government's target to reduce inflation to 6.5 percent appears overly ambitious in light of the fact that average inflation has remained above 9 percent for two consecutive years. Most importantly, the budget does not provide any detailed roadmap on how to change that.

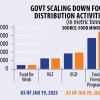

The government has correctly decided to slow down on expenditure, and the budget deficit has been set at 4.6 percent, the lowest in 10 years—indicative of a contractionary fiscal policy supplementing the contractionary monetary policy of the central bank. But it has failed to recognise where to prioritise its spending. Allocation for the social safety net programmes, for example, saw a small increase from Tk 1,26,272 crore in FY2023-24 to Tk 1,36,026 crore. Not only is this amount insufficient, but it's also misleading as the proportion of the social safety net programmes as a percentage of the GDP actually dipped from the outgoing fiscal year's 2.55 percent to 2.43 percent proposed in the new budget. And if government employee pensions and interest payment for savings certificates are discounted, the share further drops to 1.62 percent of the GDP. Similarly, allocations for education and health also remain grossly below what's needed to develop our human capital.

Keeping the tax-free income threshold unchanged when prices have skyrocketed is disappointing. The government should have sought to acquire more revenue through tax reforms instead, and by bringing tax evaders under the tax net. Instead, it has focused on increasing revenue collection via indirect taxes, which will disproportionately affect lower-income groups, increasing inequality. The government's immoral decision to allow corrupt individuals a scope to whiten black money by paying a low flat rate of 15 percent is another point of contention. Add to that the absence of any mention of how it plans to bring down the non-performing loans, and it seems that the Awami League government has performed a complete U-turn on its so-called policy of "zero tolerance" against corruption.

In fact, the overall budget speech delivered by the finance minister was disappointing on the structural reform front in light of the expectations from this being the first post-election budget. The government, it seems, has again opted not to rattle any cages by undertaking politically challenging initiatives that are critical to strengthening our economic pillars. So, the mantra seems to be to recognise the challenges, promise changes, but commit very little to actually achieve them.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments