Banking stocks battered

Banking stocks took a punch yesterday as investors reacted violently with the government move to fix the interest rates for lending and savings at 9 percent and 6 percent respectively, effectively clipping the lenders’ ability to log in profits.

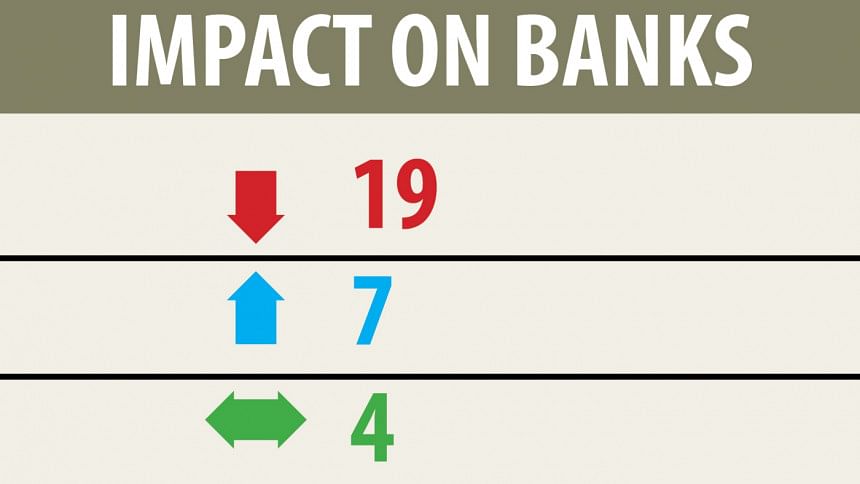

Of the 30 listed lenders, 19 declined and 4 remained unchanged after trading resumed yesterday after a recess the previous day for bank holiday.

Banks will have to implement the new interest rates from April 1 next year as per Prime Minister Sheikh Hasina’s instruction -- a move taken to spur private investment, industrialisation and job creation.

The step though can go on to theoretically break down the market mechanism for funds. Banks’ profits may contract by Tk 4,000-4,500 crore, so its impact was seen in the banking stocks, said Khairul Bashar Abu Taher Mohammed, chief executive officer of MTB Capital.

“If banks’ profit decline their stock price will come down,” he said, adding that this expectation has impacted their current stock prices.

A 3 percent spread, which is the difference between interest rates of deposits and loans, cannot make banks profitable.

“However, it is still not confirmed that banks profits will surely shrivel.”

Because, if the government keeps its deposits with private banks too then their turnover may rise and it may compensate for this blow, said Bashar, who is a former secretary general of the Bangladesh Merchant Bankers’ Association.

Banks will have to count losses to some degree as they will have to continue their existing fixed deposit receipts and deposit pension schemes while giving out loans at 9 percent, said a managing director of a private bank requesting anonymity due to the sensitivity of the matter.

“If the government actually keeps its fund in private banks it will tide us over.”

The government has deposited Tk 200,002 crore in the banking sector, but the majority of the sum is with state-run banks, he added.

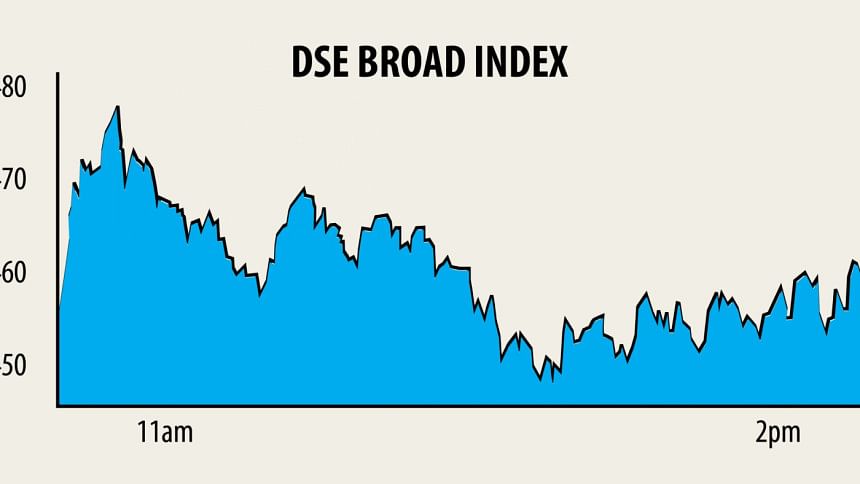

Yesterday, Brac Bank, National Bank, Dutch-Bangla Bank, City Bank, and South East Bank was among the top ten negative contributor to the index that rose 0.35 points to close at 4,453.29.

However, it was Grameenphone that caused the biggest dent to the index: it alone snatched 9.41 points from DSEX, the benchmark index of the Dhaka Stock Exchange, according to amarstock.com, a stock market data analyst.

Subsequently, market capitalisation of the telecommunication sector dropped 1.53 percent, banking 1.45 percent and life insurance 0.92 percent. The other sectors headed upwards, according to data from LankaBangla Securities.

As many as 63 percent stocks rose yesterday. Turnover, another important indicator of the DSE, dropped 7.11 percent to Tk 296.30 crore. Of the traded issues, 221 advanced, 86 declined and 46 closed unchanged on the premier bourse.

Khulna Power Company dominated the turnover chart with its transactions worth Tk 17.47 crore, followed by LafargeHolcim Bangladesh, Standard Ceramic, Beacon Pharmaceuticals and Standard Insurance.

Delta Spinners was the day’s best performer with a 10 percent gain, whereas Appollo Ispat was the worst loser that shed 7.69 percent.

CSCX, the benchmark index of the Chittagong Stock Exchange, also advanced: it went up 7.23 points, or 0.08 percent, to finish the day at 8,195.14. Gainers beat losers as 139 advanced, 65 declined and 24 finished unchanged on the port city bourse.

The port city bourse traded shares and mutual fund units worth Tk 9.54 crore.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments