Businesses worried over double-digit bank interest rate

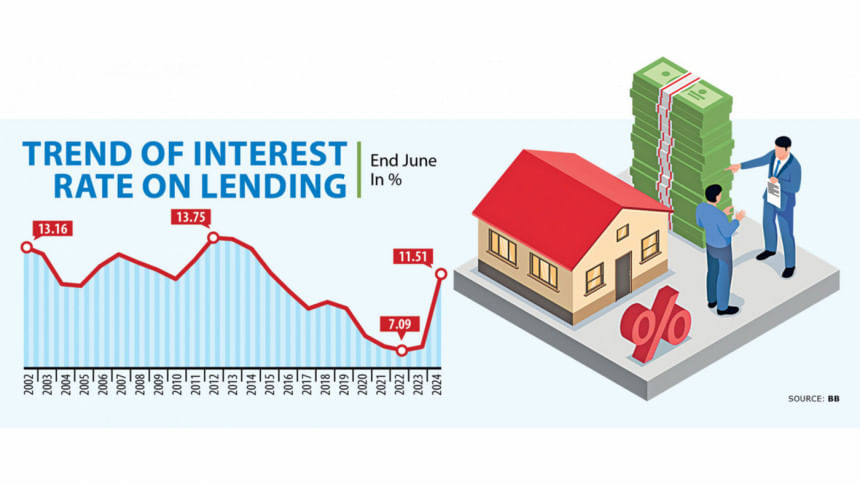

Businesses are worried over the interest rate of bank loans reaching double digits as it will increase the cost of doing business and subsequently affect profitability, the country's business leaders stated yesterday.

"There is no country where businesspeople can make a profit with a double-digit bank interest rate. Now the rate of interest is 14 percent," said Syed Nasim Manzur, a former president of the Metropolitan Chamber of Commerce and Industry, Dhaka.

He was delivering a speech at a seminar styled "Current State of the Economy and Outlook of Bangladesh" organised by the Dhaka Chamber of Commerce & Industry (DCCI) on its premises.

Regarding malpractices in business, Manzur, also president of the Leathergoods and Footwear Manufacturers and Exporters Association of Bangladesh, alleged that the whole business community gets blamed for the misdeeds of a few.

Foreign direct investment (FDI), a very important factor for enhancing product value, image and engagement with the global value chain, will not come about at the moment as the country is going through a transition, he said.

With state administrations partially functional, investors are uninterested in providing fresh funds and are opting to wait it out, which has halted employment generation, he said.

No country can run solely with the financial assistance of donors, rather businesses need to stay active while investments need to be made for the economy to develop, he said.

Manzur urged the interim government to prevent violence at industrial zones and ensure law and order by focusing on the strategic deployment of industrial police.

The interim government has not yet been able to build up confidence among businesspeople, said Mir Nasir Hossain, a former president of the Federation of Bangladesh Chambers of Commerce and Industry.

The government needs to engage in dialogues with the business community and hear about their problems, he said, adding that no businessperson had been able to speak their mind to the National Board of Revenue in the past 10 years.

Regarding bank loans, he said the actual interest rate was more than 14 percent.

He further said loans from the International Monetary Fund end up having a detrimental effect on the country and do not benefit businesses.

Hossain also urged the government to bring unscrupulous businesspeople to justice.

Mohammad Hatem, president of the Bangladesh Knitwear Manufacturers and Exporters Association, said he was now engaged in building up the confidence of buyers to continue running business with them.

Echoing Manzur, he said it was becoming tough to do business due to the high interest rates of bank loans.

Regarding the recent labour unrest in industrial zones, he alleged that it was provoked by "outsiders".

Employment generation is a moral responsibility of businesspeople, said Ahsan Khan Chowdhury, chairman and chief executive officer of Pran-RFL Group.

Law and order must be ensured in order for industries to flourish, Chowdhury emphasised.

Proper decisions were not taken at the appropriate time during the previous government's tenure, which affected the country's macroeconomic situation, said M Masrur Reaz, chairman and chief executive officer of Policy Exchange Bangladesh.

If law and order is ensured in industrial zones, it will have a positive impact on the economy, he said.

The interim government has given a lot of attention to the banking sector but it has yet to similarly focus on other sectors, Reaz said.

Businesses still feel that law and order in the country is yet to reach an acceptable level, said Ashraf Ahmed, president of the DCCI.

"Businesses face many challenges at present. Some issues can be addressed locally, but others require national-level solutions with government intervention," he said.

Ahmed also said the possibility of arson, vandalism, and looting at factories and business establishments remain major concerns for the business community.

Law enforcement agencies are present but they are not active enough to respond quickly to emergencies, he said.

"The industrial police have not fully recovered psychologically or regained the confidence they once had, hence their response is delayed," Ahmed added.

He also pointed out that some industries were struggling to pay workers, largely because banks were unable to disburse necessary funds.

Syed Mohammad Kamal, country manager of Mastercard Bangladesh, Shams Mahmud, a former president of the DCCI, and Ambreen Reza, co-founder, chairman and CEO of Foodpanda, also addressed the seminar.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments