Brac Bank offers agent banking

Brac Bank has decided to go big with agent banking in a bid to get business by providing financial services to the unbanked.

"Time will come when there will be no villages in the country out of the range of agent banking," Sir Fazle Hasan Abed, chairman of the bank, said at the launch of its agent banking services at the lender's head office in Dhaka yesterday.

As part of the move, the SME-focused bank plans to recruit 5,000 agents in the next five years.

Abed, also founder and chairperson of microfinance institution Brac, inaugurated the new banking window simultaneously at all eight divisions through a video conference.

The bank has initially started the service recruiting 10 agents and will increase the number to 50 within the next three months, he said.

Abed said Latin American countries introduced the model 20-25 years ago but the Bangladesh Bank commenced the service just five to six years earlier.

The MFI had placed a proposal at the central bank to allow it to run agent banking through its branches just three months after the service was introduced in the country. But the offer was rejected, he said.

The BB had feared that Brac will sprint ahead leaving others behind if it managed to get the permission to operate the service, he said.

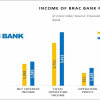

Under the existing agent banking services, both banks and agents are not gaining the desirable profit. But the model of Brac Bank will offer good profits for agents by sharing its income, he said.

The customers living in remote areas will be able to access many services at the agent banking outlets of the bank.

They will be able to open accounts, deposit and withdraw cash, avail deposit premium scheme and fixed deposit receipt, transfer funds, receive foreign remittance, pay utility bills and insurance premiums and get disbursed loans.

Selim RF Hussain, managing director of Brac Bank, said the bank's new window, which includes biometric verification and digital capabilities, would bring convenience to people, providing them round-the-clock banking services.

The bank will leverage its expertise in SME banking to make agent banking a widely expansive distribution channel, he said.

The agent banking service will create new jobs and contribute significantly to uplift the rural economy, Hussain said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments