Cash dollar import unlikely

The import of cash dollars, necessitated by a surge in demand, is unlikely after the National Board of Revenue has refused to provide the 29 percent duty waiver on the purchase.

The country experienced a cash dollar crunch last month after the stock came down to $7 million from $17 million in March last year.

Subsequently, Bangladesh Bank directed Standard Chartered Bank to bring in $10 million in cash and asked the NBR last month to extend the tax waiver. Earlier in 2011, the BB imported $15 million through StanChart.

The revenue authority is unwilling to give the tax waiver as it says the law does not permit it.

Asked about the NBR's stance on the tax waiver, its Chairman Md Nojibur Rahman declined to comment.

The NBR is treating the cash dollar as a commodity and levying the duty on the monetary value of the currency rather than the weight of the product, making it an expensive venture for StanChart.

“We have applied to the NBR for the waiver and are awaiting their response,” said Bitopi Das Chowdhury, StanChart's head of corporate affairs.

If the NBR does not waive the tax, the bank will not be interested in importing the dollars as the cost will be high, said SK Sur Chowdhury, deputy governor of BB.

The revenue authority instead suggested the central bank import the cash dollars by itself as it is exempted from any duties.

Meanwhile, there has been a piecemeal improvement in the situation, with $11.7 million now available. Some businessmen who had cash dollars on them deposited the amount to banks soon after the BB's decision to import came to light, as it would have pushed the rate of dollar down.

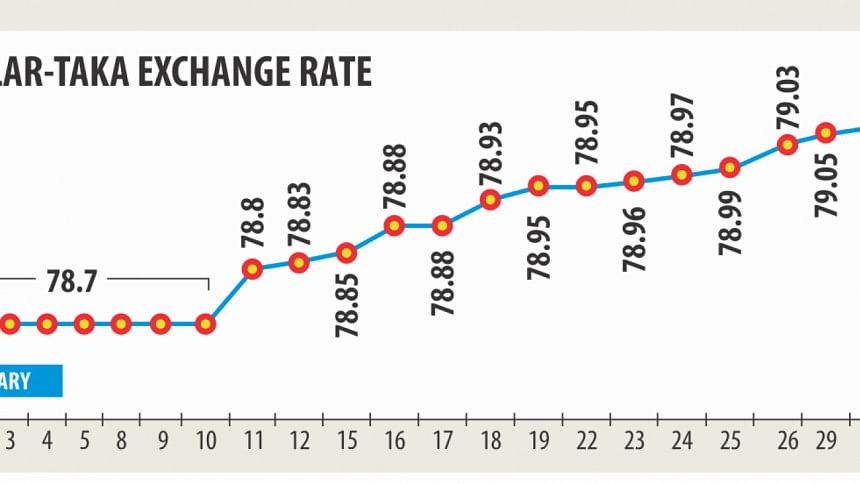

As of January 31, the gap in the dollar-taka exchange rate between the kerb market and the banks has come down to Tk 3 from more than Tk 4 a week earlier.

The interbank exchange rate stood at Tk 79.12 and in the kerb market it was Tk 82.

The gap is expected to narrow further as high-denomination notes are gradually becoming more widely available in India, a major tourist destination for Bangladeshi nationals.

Thousands of tourists and patients from Bangladesh visit India every year and they take cash dollars with them for convenience. Demand for the greenback goes high in winter, when hundreds of Bangladeshi tourists visit India.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments