Corporate tax for apparel cut to 20pc

The corporate tax rate for the garment sector has been slashed 15 percentage points to 20 percent in the forthcoming fiscal year, in what is a middle ground between the demand of apparel manufacturers and the government.

At present, the corporate tax rate for the sector is 35 percent, which the garment exporters demanded be brought down to 10 percent -- a rate they enjoyed until 2014 -- to reduce their costs of production and attract investment.

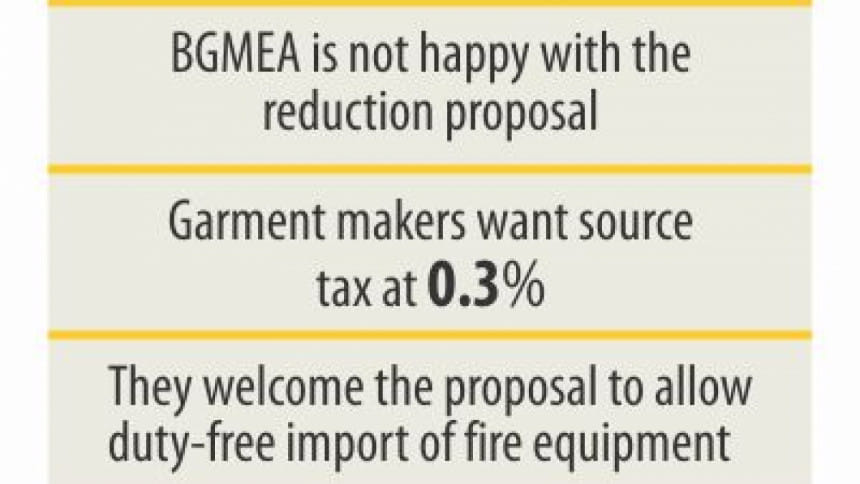

“We are not happy with the reduction proposal,” said Siddiqur Rahman, president of Bangladesh Garment Manufacturers and Exporters Association, in his reaction to Finance Minister AMA Muhith's budget speech.

He said the 20 percent corporate tax rate is still too high for the sector, which is in the midst of massive and expensive reforms as a result of 2013's Rana Plaza collapse, one of the worst industrial disasters in the world.

“For attracting higher investment and further expansion of factory capacity we need policy support from the government.”

The garment makers also want the government to cut the source tax to 0.3 percent from 0.6 percent, but in the proposed budget for fiscal 2016-17 there is no clear indication on the matter, Rahman said.

But, the minister proposed to increase the source tax to 1.5 percent. Any increase in source tax would only hurt the garment sector as the profitability from the apparel export has been declining, he said.

However, the BGMEA chief welcomed the government's proposal to allow duty-free import of fire equipment and inputs for pre-fabricated buildings in the upcoming fiscal year as well.

“We also welcome the duty reduction on some chemicals used in the textile sector as such a move will help reduce the cost of production for the primary textile sector.”

The government proposed reducing the duty on stripping chemical to 15 percent from existing 25 percent.

However, the spinners and weavers are not happy with the proposed budget.

The Bangladesh Textile Mills Association demanded zero-duty on import of capital machinery, but Muhith did not yield to it.

Instead, Muhith proposed continuation of duty concession on import of capital machinery. Currently, importers have to pay 1 percent regulatory duty for bringing in capital machinery from abroad.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments