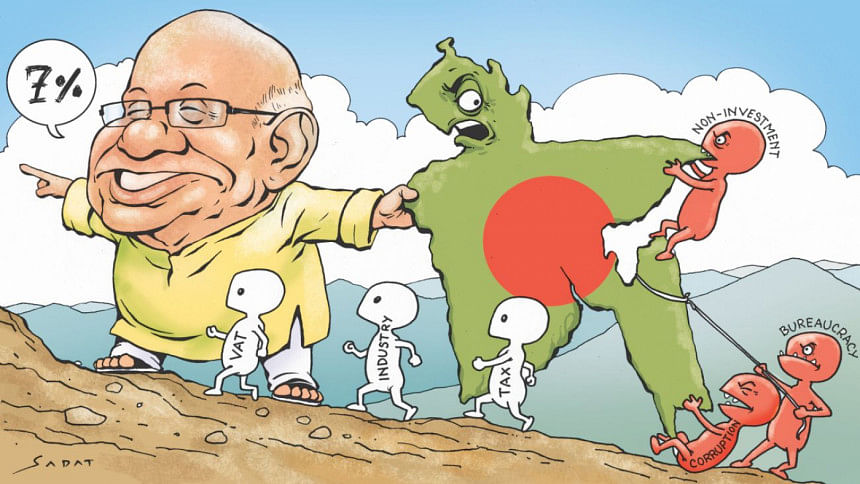

Big dream, grim reality

Finance Minister AMA Muhith has really dreamt of a big budget in every respect -- from expenditure to revenue generation. And he no longer wants to live in the 6 percent GDP class to push beyond 7 percent.

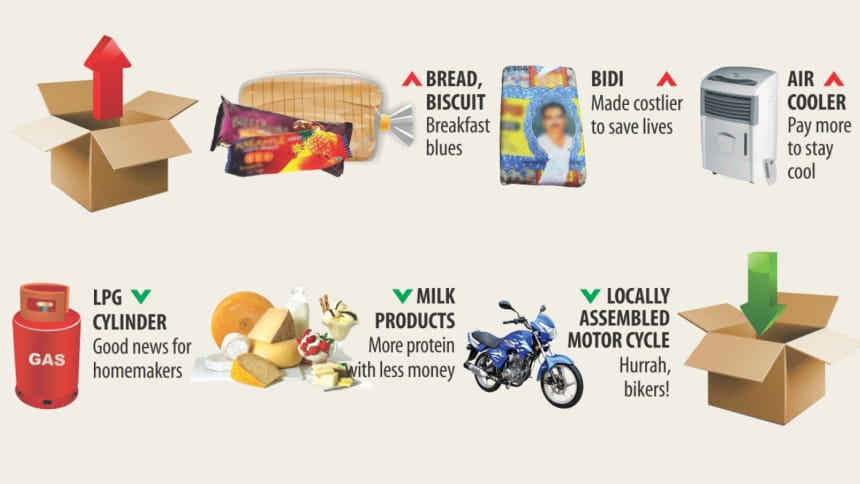

But his big dream promises to put extra pressure on people across the board, as he plans through his VAT and other tax proposals to extract that extra penny from every pocket.

Muhith has rightly said he needs more jobs through growth and so has thought of an industrial spark through various duty measures. He has proposed to substantially reduce tax rate on the garment industry, increase tax-exempted turnover limit for small and medium enterprises and also support the real estate sector.

Industries that need protection and support have got it from him either through new measures or through extension of prevailing benefits.

But his growth recipe still looks feeble and may therefore falter, making his 7 percent growth vision difficult to come true. He wants to create jobs through growth but he has not been able to show any real promise to improve governance and other bottlenecks that bring business competitiveness.

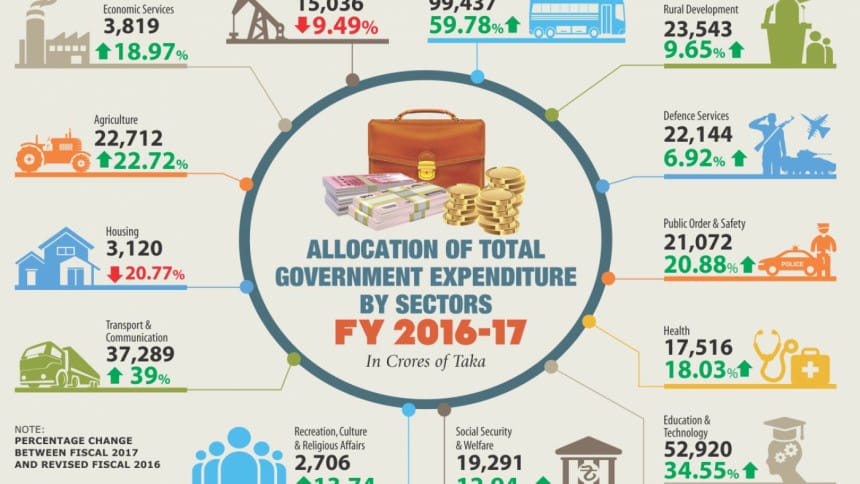

He has seen a higher ADP spending as key to growth, but other than the measure of having one director for one project, little reforms are offered to address the chronic implementation problem. It is not clear how the same persons with the same efficiency level can implement a 21.64 percent higher ADP when they could not implement a much smaller programme in this outgoing fiscal year.

He then pins hope on consumption, especially the salary-driven type. That is an easy solution because an every-taka increase in salary is directly translated into growth. But his thoughts on exports and remittances are debatable.

He knows he needs a big jump in private investment from the current 21-22 percent of the GDP to 27 percent to bring jobs and growth. But he offered little in terms of removing impediments to investment, like augmented energy and gas supply.

He has high hopes on coal-based power projects, which are moving very slowly. He has talked high about gas exploration for basic energy but the fact remains that Bapex is technologically hamstrung and has not been very successful in increasing gas supplies.

He has boasted about mega infrastructure projects but most of them are running behind the schedule with resultant cost overrun.

While going in full throttle on mega projects, Muhith seems aware of the danger looming and therefore he has thought of debt sustainability and proposed an analysis in this regard.

Corruption and red-tape -- two important factors to thwart private investment -- are left mostly untouched.

He also spoke of a growing domestic demand from increased agricultural production to drive up growth. And he has put high hopes on exports as well as remittances because more people are finding jobs abroad. But the fact is remittance is dwindling although a greater number of people are migrating. Middle East's economy promises no better pay. Nor does the global economy offer any demand for export growth.

Muhit wants a big leap in revenue receipts from this fiscal year's 10.3 percent to 12.4 percent of the GDP. This will prove a real challenge as no new reforms other than the ongoing ones have been proposed.

Only extensive VAT measures may well be his last hopes. Such a situation can lead to harassment and an additional pressure on people.

Similarly, his target for higher external financing to support spending looks tricky. He has eyed external financing at 1.9 percent of the GDP. But the fact is this year's figure may not cross 1.4 percent. So if the target fails, he will have to look for costlier domestic financing.

The finance minister's view on the state-owned banks does not inspire much hope about the future of these institutions. Reconstitution of bank boards is no guarantee that they would not be politically used. Nor will it prevent siphoning off of millions of taka.

In line with his government's sensitivity to the disadvantaged, Muhith has been extra sensitive. The budget looks sensitive to the vulnerable people with demographic change in mind. This is why he has thought of contributory social insurance schemes.

The demographic change the country is going through is also addressed through the proposed integrated government-run pension framework for self-employed and employees of private organisations.

All said and done, the finance minister will have to show a lot of energy and initiatives, and still he will have to keep his fingers crossed to see his big dreams come true.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments