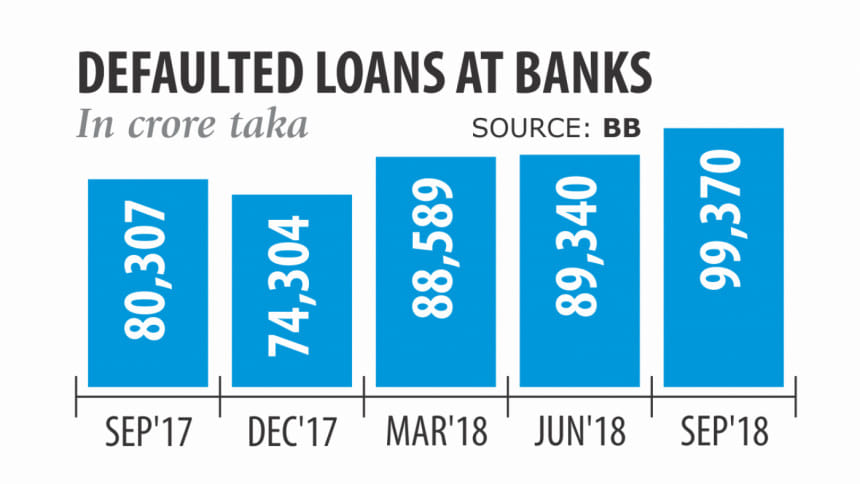

Default loans at all-time high

Banks' non-performing loans hit nearly Tk 1 lakh crore at the end of September -- the largest yet in Bangladesh's 48-year-history.

“If the trend continues there will be dire consequences for the economy,” said Ahsan H Mansur, executive director of the Policy Research Institute.

The amount of toxic loans increased 11.23 percent to Tk 99,370 crore at the end of the third quarter, compared to the previous quarter, according to data from the central bank. The amount is up 24 percent from a year earlier.

The NPLs now account for 11.45 percent of the banking sector's total loans, up from 10.41 percent in June.

The vast amount of default loans reflects the failure of the government to run the financial sector effectively in the last 10 years, Mansur said.

“Argentina, Pakistan and Sri Lanka have been beset by economic woes in the recent past because of lack of corporate governance in their respective financial sectors. And the ongoing trend of our defaulted loans has hinted that we are going to face the same consequences.”

The high non-performing loan ratio indicates that money is now being laundered abroad frequently, which has already left an adverse impact on the balance of payment (BoP), said Mansur, also a former economist of the International Monetary Fund.

“Some unscrupulous persons have been laundering money in the name of import, which has already created a large deficit in the current account.

The government has highly depended on the non-concessional foreign loans on the back of a waning situation of the BoP, which will sink the country into a debt trap. “Defaulted loans, money laundering and the latest crisis of the BoP are closely inter-related but the government has been overlooking the issues.” He apprehends the data on default loans provided by Bangladesh Bank does not reveal the full picture: many banks tend to conceal their NPLs to show net profit.

Nearly 50 percent of the loans belong to half a dozen state-owned banks, showed the BB data. The six state-banks' total default loans stood at Tk 48,080 crore as of September, up 12.20 percent from three months earlier.

In contrast, the 40 private banks' default loans stood at Tk 43,666 crore, up 12 percent from that at the end of June three months ago. No exemplary punishment had been handed down on scamsters who leveraged their close connections with government higher ups to plunder money from banks, said AB Mirza Azizul Islam, a former finance advisor to a caretaker government.

“Political intervention has worsened the corporate governance in the banking sector. The government should promptly take action to restore discipline in the financial sector.” Legal complexities are one of the impediments to recovering the NPLs from habitual defaulters, said a managing director of a private bank.

“We strongly wished to recover handsome amounts of money from defaulters who intend to contest in the upcoming parliamentary election. But, they filed writ petitions with the courts against their default loans to avail the non-defaulter status.” It takes 7-8 years to settle a particular case with the money loan court to realise money from a defaulter, he said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments