BB to hike policy rate in two phases to fight inflation

The Bangladesh Bank will increase the policy rate twice and interest rate once by October to tame double-digit inflation, central bank Governor Ahsan H Mansur said at a press briefing yesterday.

Speaking to The Daily Star after the briefing, the governor hinted that the policy rate, at which commercial banks borrow from the central bank, is likely to be increased by 50 basis points to 9.50 percent this month.

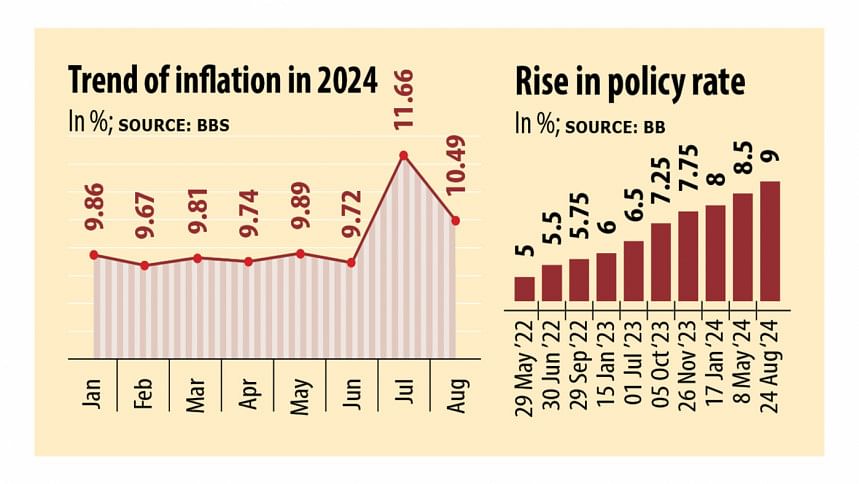

In the last week of August, the central bank hiked the policy rate by 50 basis points to 9 percent in a bid to rein in inflation, which has hovered above the 9 percent mark since March 2023.

Despite the tightening, inflation soared to above 10 percent in July and August.

"There is no doubt that the monetary policy is already quite tight," the governor said. "Yet, we will increase the policy rate by this week and will do it again next month."

Besides, the interest rate will also be increased again soon, he said at the media briefing at the central bank headquarters in Dhaka yesterday which was preceded by a meeting of the banking taskforce for the sector's reforms.

"My priority now is macroeconomic stabilisation. For this, I have finalised three tasks: to stabilise the balance of payments, to stabilise the exchange rate, and to bring the inflation rate down. So, I will tune the policy by increasing the interest rate," Mansur said.

He said the government's bank borrowing target would be reduced to Tk 80,000-85,000 crore from the previous estimation of Tk 137,500 crore in order to reduce the government's loans from the banking sector.

"If this happens, I am hopeful that it will support macroeconomic stabilisation. Through this, both the monetary policy as well as fiscal policy will be tightened," said the BB governor.

As a result of these policies, Mansur said the GDP growth would not reach the expected levels, saying he would be satisfied if it remains just above 5 percent. "I think it is acceptable."

Cashflow at crisis-hit banks improving

Mansur said cashflow at most of the crisis-hit banks was positive in the last two days, which means deposits were higher than withdrawals.

Islami Bank Bangladesh had a positive cashflow of around Tk 620 crore on Sunday, which was Tk 320 crore the day prior, according to the BB governor.

"This is a very encouraging sign. We do not need to pump liquidity into the bank if the cashflow is positive," he added.

About the merger of crisis-hit banks, the governor said it would be a "good decision" to merge small banks, but not right now.

"We don't want to do it at this stage. We have to see how far we can go," he said.

Speaking about liquidity support to crisis-hit banks, Mansur said they were simply guaranteeing that healthy banks would provide liquidity support to the troubled ones.

"We are giving you the guarantee. It is like water from this glass has gone to another glass. We are trying to get some water back in it."

Mansur said everything must be solved gradually, adding that if the deposit growth is sustained, it would help banks.

On banking reforms, he said they have formed three taskforces: one for banking sector reforms, another for strengthening the banks and the third for evaluating assets of banks.

Current account deficit of nine banks exceeds Tk 18,000cr

The deficit in the current accounts of nine private commercial banks maintained with the Bangladesh Bank has exceeded Tk 18,000 crore, according to the central bank.

National Bank has a current account deficit of over Tk 2,342 crore, First Security Islami Bank Tk 7,269 crore, Social Islami Bank Tk 3,394 crore, Union Bank Tk 2,209 crore, Commerce Bank Tk 380 crore, Global Islami Bank Tk 39 crore, Islami Bank Bangladesh Tk 2,201 crore, Padma Bank Tk 234 crore and ICB Islami Bank Tk 95 crore.

Of them, five commercial lenders have obtained a central bank guarantee to avail liquidity support from the inter-bank money market.

Following the installation of an interim government in August, all five commercial lenders saw their boards of directors reconstituted.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments