BB may hike policy rate again to curb inflation

The Bangladesh Bank may increase the policy rate for both local and foreign currencies in a bid to reduce inflation and increase international reserves.

Newly appointed central bank governor Ahsan H Mansur raised the issue on Wednesday during his first meeting with Salehuddin Ahmed, finance adviser to the interim government, a finance ministry official said.

The finance adviser was holding a meeting with officials concerned over the prices of essentials. The central bank governor, who was in attendance, took the opportunity to raise the issue of policy rates.

The policy rate, also known as repo rate, is the rate at which the central bank of a country lends money to commercial banks.

Recently, Salehuddin told The Daily Star that the central bank governor has told him they would revisit the policy rates. The governor will work to this end, Salehuddin said, adding that inward remittance may not increase to the expected level if it remains unaddressed.

Economists said the policy rate should be increased further to combat persistent inflation. Annual inflation in Bangladesh rose to 9.73 percent in FY24, the highest since FY12, according to the Bangladesh Bureau of Statistics.

In June, the International Monetary Fund (IMF) suggested that the central bank hike the policy rate by 50 basis points by this year since its monetary tightening is yet to rein in inflation.

Adding that inflation is still elevated, it said continued monetary policy tightening would be required until it consistently slows down to the central bank's medium-term target range of 5-6 percent.

"The policy rate may need to increase to a peak of 9 percent by the middle of FY25 to tame inflation to 7 percent by the end of the fiscal year and bring it close to 5.5 percent by the end of FY26," the IMF said.

The government assured the IMF that it would tighten the monetary policy further but, when the central bank announced its monetary policy for FY25 in July, it did not change the repo rate.

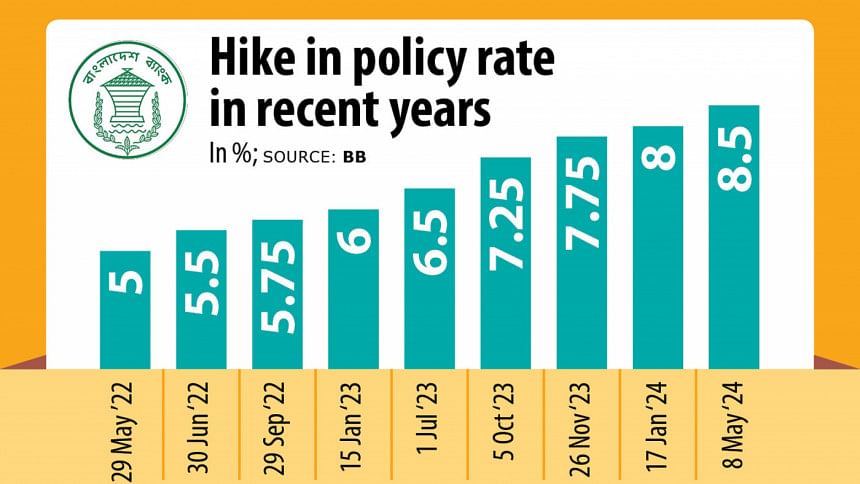

The central bank has been struggling to contain inflation despite making funds costlier by increasing the benchmark policy rate to unprecedented levels over the past two years.

The BB has raised the policy rate by more than 400 basis points in two years to 8.5 percent, but inflation has shown no signs of cooling.

The worsening economic crisis has spun off a price shock in terms of the Consumer Price Index (CPI), which includes food and non-food inflation.

The CPI surged to a 12-year high of 9.02 percent in the last financial year, far higher than the historical average.

The trend has continued into the ongoing financial year, with it staying above 9.5 percent, hurting the poor and low-income groups by significantly eroding their purchasing power.

The CPI rose 1.94 basis points to 11.66 percent in July compared to the month prior.

At the same time, Bangladesh has also been under pressure to increase its foreign currency reserves.

One of the main conditions set by the IMF for its $4.7 billion loan to the country is to maintain foreign currency reserves at a certain level. However, Bangladesh has repeatedly failed to keep the reserves in line with the conditions.

Forex reserves stood at $20.41 billion on July 31 this year, central bank data showed, down from $41.7 billion in August 2021.

The reserves had even declined to below $20 billion, but budget support from different development partners led to an increase.

On May 8, the central bank loosened its rigid grip on the taka to shore up foreign currency reserves. It now follows a flexible exchange rate system.

Under this new system, the government adopted the crawling peg, which allows for limited fluctuations within a predefined range.

The central bank set Tk 117 per dollar as the midpoint, but economists suggested it should be hiked further to increase inward remittance.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments