Rate hike further dampens investment mood

In an effort to curb stubbornly high inflation, the central bank's latest interest rate hike has sparked concerns among the business community as they argue that the increased cost of borrowing will strain their existing ventures and dampen future expansion plans.

The Bangladesh Bank yesterday raised the policy rate by 50 basis points to 10 percent, marking the fifth increase this year and the third under Governor Ahsan H Mansur.

This hike places the repo rate, the interest rate at which commercial banks borrow money from the central bank, above the inflation rate for the first time in many years.

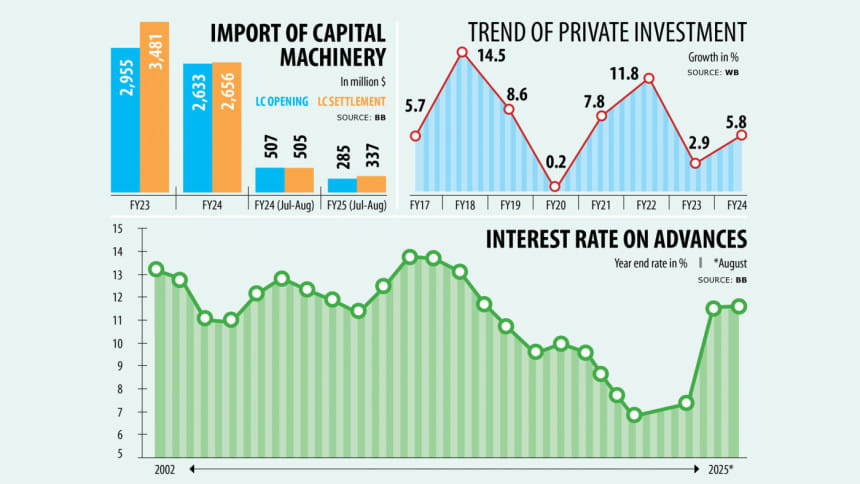

The new policy rate, which will take effect on October 27, comes amid a decline in letter of credit (LC) opening for capital machinery imports and a slump in private investment -- key indicators of investor sentiment.

According to official data, LC opening for capital machinery imports dropped 44 percent year-over-year to $285.56 million during July-August.

"I don't believe the new interest rate will reduce inflation," said Mohammad Hatem, president of the Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA). "Instead, it will cause sufferings to the industry and force investors to default on their bank loans."

Hatem said the latest hike has increased the cost of industrial loans by nearly 17 percent year-over-year. "How can entrepreneurs survive with such high financing costs?" he questioned.

The business leader's concerns are not unfounded.

According to the World Bank's recent Bangladesh Development Update, a cocktail of inflationary pressures, tight financing conditions, and economic and political uncertainties is expected to slow the growth of private consumption, investment and exports.

Anwar-Ul-Alam Chowdhury Parvez, president of the Bangladesh Chamber of Industry (BCI), said that while the central bank's policy tightening is meant for reducing inflationary pressures, it may ultimately lead to "suicidal results" in terms of investment and employment generation.

According to Parvez, three factors can largely slow private investment: deteriorating law and order, inconsistent energy supply and excessively high interest rates.

All of these factors are currently present, he said, adding that there is no guarantee that the business environment will improve in the near future. In such circumstances, businesses tend to cut costs and avoid financial losses.

"I believe investors will not take on new investment risks at this time," he commented.

The BCI president anticipated that rising interest rates would severely hurt small and medium-sized entrepreneurs and that the purchasing power of the general population would decline rather than inflation cooling down.

He argued that the theory of policy tightening is more effective in import-based economies like the United States and Canada, but less so in developing countries like Bangladesh.

International development partners and multilateral lenders like the International Monetary Fund (IMF) have been advocating for policy tightening in Bangladesh to help alleviate inflationary pressures.

Since assuming office in August, the new governor of the Bangladesh Bank Ahsan H Mansur, a former IMF economist, has continued to increase interest rates in an effort to combat inflation.

However, Humayun Rashid, president of the International Business Forum of Bangladesh (IBFB), said blindly following the "IMF prescription" would not solve all problems.

He said the new interest rate will further erode public trust as commodity prices are likely to continue to rise in the coming days.

The increase in interest rates will discourage investors from making new investments, as there is currently a lack of investment interest among businessmen. Both domestic and foreign direct investment will be deterred, said Rashid.

He said if there is no new investment, economic growth and job creation will be in jeopardy. "The new decision will increase the cost of doing business and beyond a certain threshold, traders will be reluctant to take on new investments."

Ashraf Ahmed, president of the Dhaka Chamber of Commerce and Industry, said the new interest rate increase is expected to result in higher borrowing costs for businesses and tighter liquidity in the banking sector, which will reduce credit flow to the private sector.

He believes that this will create reactionary pressures on investment and job creation.

"While the interest rate hike may help reduce inflation in the short term," said Ahmed, "it could lead to a slowdown in growth and increased bad debts if not reversed in time."

He pointed out that the reduction in banking system liquidity between June and September is a precursor to the current trend, which will likely be exacerbated by the interest rate increase.

Higher interest rates and reduced availability of bank lines may constrain the supply side, pushing up prices for imported food and other commodities, the Dhaka chamber president commented.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments