Govt seeks solution to stubborn inflation

Three advisers to the interim government of Bangladesh will meet today to discuss solutions for taming inflation, which remains high even though several initiatives have been implemented to this end.

The three advisers are Finance and Commerce Adviser Salehuddin Ahmed, Planning and Education Adviser Wahiduddin Mahmud, and Power, Energy and Mineral Resources Adviser Muhammad Fouzul Kabir Khan.

Finance Secretary Khairuzzaman Mozumder, Bangladesh Bank Governor Ahsan H Mansur, National Board of Revenue (NBR) Chairman Abdur Rahman Khan, and some other high officials will also be present at the meeting at the finance ministry.

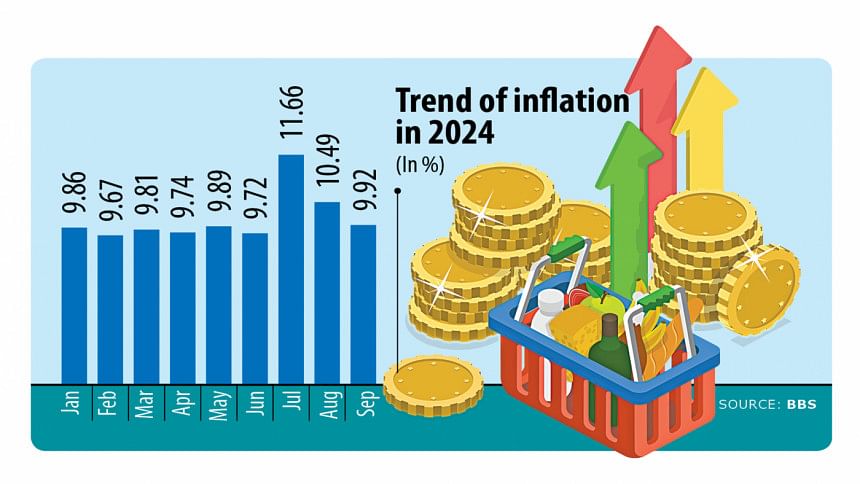

The inflation rate has been hovering at above 9 percent for more than two years, affecting low income and fixed-income people in the country.

Last July, the inflation rate stood at 11.66 percent before reducing slightly to 10.49 percent in August and to 9.92 percent in September, according to the Bangladesh Bureau of Statistics.

The data for October has not been published yet.

Although the inflation rate is declining, it remains above 9 percent despite several steps by the government to reduce it.

Economists blamed incorrect policy measures for enabling inflation to remain high even at a time when it is dropping worldwide.

After the Awami League government was ousted on August 5, Bangladesh Bank raised the policy rate for a third time to 10 percent in order to reduce the money supply.

Besides, the central bank extended the band on the exchange rate to Tk 120, after which the exchange rate became slightly stable.

Meanwhile, the NBR reduced the duty on importing essential items several times.

"It will take time to see the impact of the government's recent policy steps," said Zahid Hussain, the former lead economist of the World Bank's Dhaka office.

"The high inflation in the country also stems from supply problems as market management is not being done properly," he added.

Hussain also said certain political parties remain active in extortion, as law enforcers and bureaucrats were not yet fully functional.

There is a pressure from entrepreneurs to ease the money supply. On the other hand, it is not clear whether the market can supply enough US dollars for the import of essential items, he said.

To reduce the inflation rate, the government needs to take steps in the supply side, he said.

Besides, the market monitoring system should be more competitive, he added.

"Also, new businessmen should get the chance to import and do business beside the old and big players in order to ensure more competition," Hussain added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments