Banks see rising deposits for higher interest rates

Bank deposits grew in the third quarter of 2024 as many people were encouraged by rising interest rates to park their money at commercial lenders.

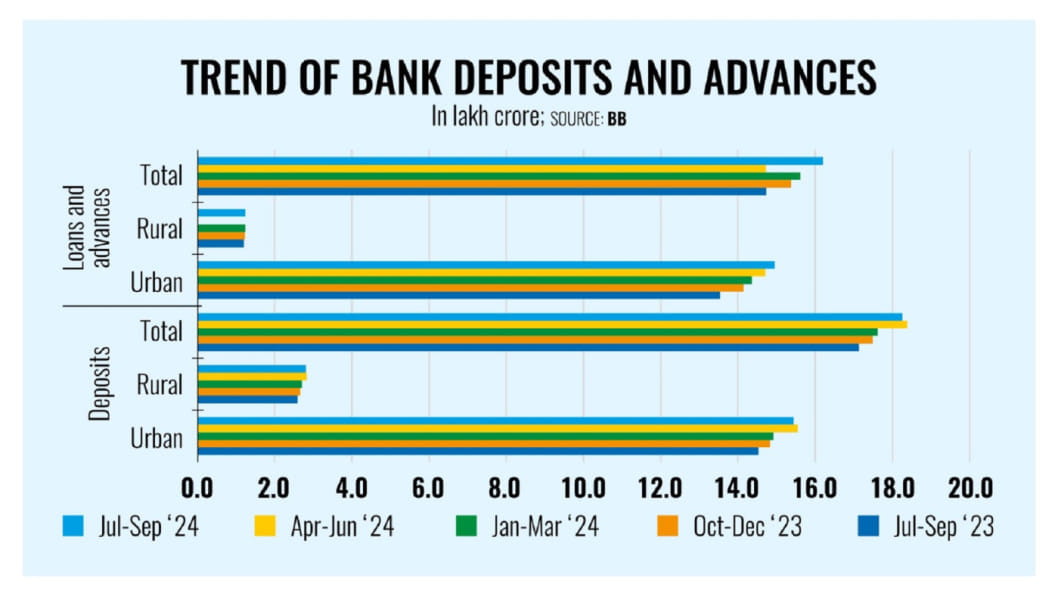

In the July-September period of the previous calendar year, bank deposits rose 7 percent year-on-year to Tk 18.25 lakh crore, with bank branches in rural areas registering higher deposit growth compared to their urban counterparts.

The significant hike in interest rates was a key driver behind the growth in bank deposits, said Syed Mahbubur Rahman, managing director and chief executive of Mutual Trust Bank PLC.

Besides, banks have carried out a lot of campaigns to attract depositors, he added while informing that they expect the uptrend of deposits to continue.

The weighted average interest rates on deposits rose to 5.88 percent in the July-September quarter last year from 4.55 percent during the same period of the previous year, according to data of the Bangladesh Bank.

But when comparing the April-June quarter, bank deposits declined by 0.73 percent year-on-year due to widespread unrest centring a mass movement that ousted the Awami League government on August 5.

Overall bank deposits stood at Tk 18.38 lakh crore by the end of last June.

Private commercial banks, including Islamic banks, constitute 68 percent of the total deposits at present.

However, the central bank data shows their deposits shrank 0.33 percent to Tk 12.58 lakh crore by the end of last September from Tk 12.62 lakh crore three months prior.

The crisis ridden Islamic banks recorded the steepest decline in deposits during the July-September period. Meanwhile, state banks closely followed even though both public and private banks saw deposit growth for about one year since the end of September 2023

On the other hand, loans and advances maintained an uptick for four quarters ending with the July-September period of 2024.

Loans and advances increased by 10 percent year-on-year to Tk 16.19 lakh crore by the end of September last year.

Between June and September of 2024, loans and advances to bank borrowers grew by 1.43 percent mainly in urban areas.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments