Krishi Bank incurring losses for 30 years

Bangladesh Krishi Bank (BKB) has been incurring losses for at least 30 years due mainly to structural weaknesses as the state-run lender has to lend at lower interest rates, pay more for deposits and is sitting on higher non-performing loans.

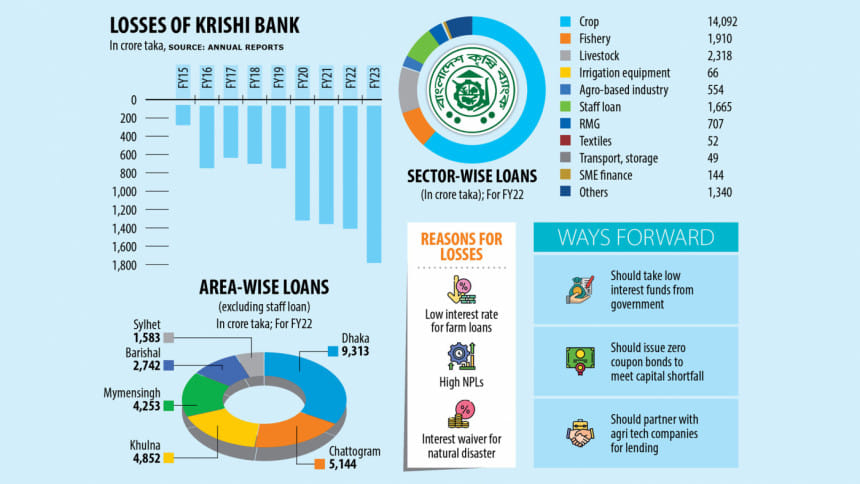

The loss aggravated in the last six years, almost tripling to Tk 1,700 crore in the fiscal year of 2022-23 from Tk 625 crore in 2017-18.

The specialised bank was established under a presidential order in 1973 in order to support the agriculture sector of the war-torn country.

BKB officials say the bank has been incurring losses from its inception except for several years.

Figures show the bank suffered a loss of Tk 165 crore in 1994-95. It has been in the red since then except for 2000-01 when it logged a profit of Tk 2.91 crore.

"The main reason for the loss is the bank lends at a rate that is lower than the cost of funds," said Ali Hossain Prodhania, a former managing director of BKB.

The bank mainly lends to the agriculture sector where the interest rate is administered and it is at least 3 to 4 percentage points lower than the commercial lending rate. However, the cost of funds is similar to the commercial banks, he explained.

"It is tough to bring commercial viability to the bank if the basic structure remains unchanged."

Additionally, the bank had to give waivers to farm loans following the government order in the mid-1980s. However, it did not receive the principal amount as a subsidy, which widened the loss.

BKB also provides some services free of cost. It has 35 lakh borrowers, so monitoring and managing such a borrower base is costly, said Prodhania.

BKB's NPLs stood at Tk 3,188 crore at the end of FY23, which represented 10.55 percent of its disbursed loans, central bank statistics showed.

In most cases, small farmers did not default on their repayments. Rather some large loans disbursed in the readymade garment sector turned sour, Prodhania said.

BKB has kept logging the highest capital shortfall in the banking sector: the deficit stood at Tk 15,540 crore in June.

Md Shawkat Ali Khan, managing director of BKB, blamed the higher NPLs and the negative net interest income for the persisting loss.

Low investment income is another factor for the loss, he said.

"In the past, the bank waived a huge amount of interest income and principal amounts but it did not receive any subsidy from the government. Therefore, the bank is facing a huge capital shortfall."

Around 65 percent loans of BKB go to the agriculture sector. In order to meet the lending target, the bank has to collect deposits at higher rates.

The government can set aside low-cost funds to boost the agriculture sector and accelerate its modernisation, Khan said.

Since agriculture is a disaster-prone sector, BKB is instructed to give interest waivers to borrowers for logical reasons, he said.

"The contribution of the bank to the agriculture sector is high."

BKB's lending portfolio is concentrated in the Dhaka and Chattogram divisions. Of the Tk 29,555 crore loan book in FY22, a third or Tk 9,313 crore was disbursed in the two regions.

Asked, Khan said the bank provided a huge number of loans to the industrial sector too, so the credit concentration in the divisions was high.

BKB plans to recover bad loans with a view to cutting losses and reaching small and medium enterprises (SMEs).

"The new management is trying to get back the bad loans even by giving interest rate waivers," Khan said.

He said management has set its sights on both profit and service and plans to lend Tk 8,000 crore in the SME sector.

"We are working on credit guarantee schemes and catering to women entrepreneurs. The bank is also focusing on bringing more remittance."

To make the bank commercially viable, Prodhania recommends the government pay subsidies equal to the negative net interest income.

"Otherwise, the bank will not be sustainable."

He said the government has prioritised lending to the agriculture sector at a lower interest rate and this has been a good initiative. At the same time, the government needs to support the bank so that it can continue its operations.

To meet capital shortfall, BKB can issue redeemable zero-coupon bond, he added.

AB Mirza Azizul Islam, a former finance adviser to a caretaker government, said BKB should be careful in giving out loans and extend funds to genuine borrowers.

"If a loan turns NPL, the bank should equally be strict to realise it."

Islam backs the idea of giving subsidies to the bank so that it can adjust the loss.

"The government is providing subsidies in many sectors. It can give some subsidies to Krishi Bank considering its contribution to the agriculture sector."

BKB is also paying the price of loan irregularities, said a former top official of the bank.

"Sometimes, officials of the bank would borrow funds under the name of farmers. But later, it was found that the farmers didn't know anything about the loans. Many of these loans became NPLs."

It is true that disbursing loans in the agriculture sector is relatively costlier, said Mustafizur Rahman, a distinguished fellow of the Centre for Policy Dialogue.

"But Krishi Bank still could make a turnaround if it can enhance its efficiency. Then the volume of bad loans will go down and it will benefit the farmers."

Atiur Rahman, a former governor of the central bank, thinks BKB needs to go through major reforms to make itself relevant and efficient.

"It should be allowed to concentrate only on agriculture and agri-processing industries without overburdening it with many other non-agricultural funding activities."

He said the bank would have to be heavily recapitalised once and for all and allowed to operate freely like an independent commercial enterprise.

"If the government wants to give low-cost funds to the agriculture sector, the rate of interest must be subsidised from the budget through the central bank. The bank can't give low-cost funds from its own sources."

The noted economist said the bank may be encouraged to go for partnerships with mobile financial services and digital banking windows to collect repayment instalments more cost-effectively.

"The bank can also go for more linkage programmes with microfinance institutions to reach real borrowers like other better-run private commercial banks."

He said the board of BKB should be made more robust with a chairperson from among the independent directors drawn from academia and entrepreneurs.

"The human resources development needs major restructuring with more focused skilling and re-skilling programmes to make its business operations smarter and more efficient."

He urged the central bank to increase its monitoring and supervision of the bank to improve its ethical standards.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments