Small Businesses Drowning In Debt: Deprived of help for no documentation

Basudeb, who hails from a remote village in Patuakhali, thought he had carved out a comfortable life for himself and his family in Dhaka.

The hair salon he ran in the capital's Bhashan Tek area was a community hub. On March 24 last year, his buzzing salon went quiet as the government announced a fortnight-long countrywide general shutdown to flatten the curve on coronavirus.

While the government had announced a stimulus package of Tk 23,000 crore for micro-entrepreneurs like Basudeb to tide them over the pandemic fallout, lack of proper documentation meant the benefits of the initiative never reached those who truly needed it.

To save his salon, he took a loan at a high-interest rate -- a step that has now left him on the run from the loan shark's henchmen.

They threatened to pick up his wife and children to work in the lender's brickfield as slave labourers if he did not pay back about Tk 2.5 lakh.

"What else could I do?" a tearful Basudeb told The Daily Star over the phone from his home in Baufol upazila.

Stories like Basudeb's can be found in many places in Dhaka.

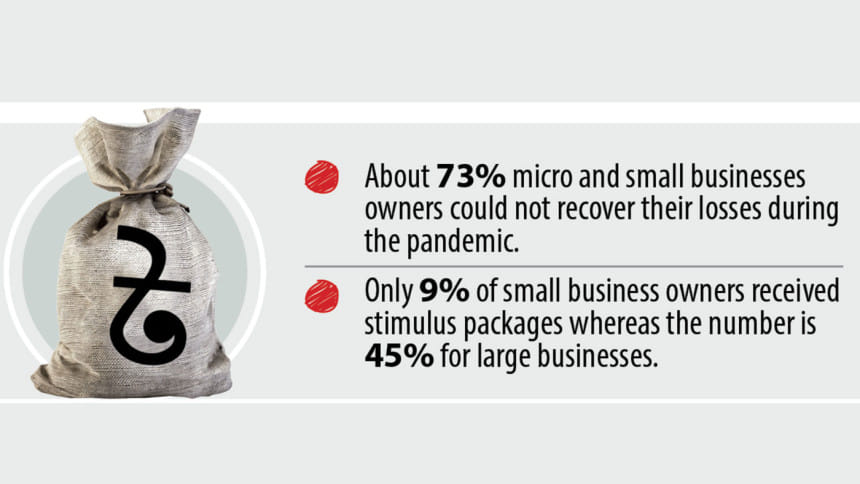

According to a survey conducted by the South Asian Network on Economic Modelling (SANEM) conducted in July, 73 percent of the micro and small businesses owners could not recover their losses during the pandemic.

Meanwhile, only 9 percent of micro and small business owners said that they received stimulus packages.

"These incentives are not for us," said Md Amjad Hossain, a merchant of bed sheets and pillows in Dhaka's Gausul Azam market.

Shorn of stimulus and riddled with debt, he had to close down his shop and sell off all his assets to survive. He is now getting by by peddling kitchen tools in bus terminals.

"It was destined that the micro and small businesses stimulus package would not get the stimulus package -- these entrepreneurs do not have proper documentation to apply for the funding," said Selim Raihan, executive director of SANEM.

The Daily Star spoke with a host of financial institutions that lend to the cottage, micro, small and medium enterprises and all spoke of a common factor that has deprived those businesses of not just stimulus funds but also formal financing.

"While disbursing loans we found that many micro and small entrepreneurs do not have necessary documents such as trade license, TIN certificate, income tax return etc -- they have to get these documents from different authorities," said Md Saifuddowla Shamim, head of SME, IDLC Finance, one of the big SME lenders.

The government should have a central repository system for such entrepreneurs from where they can avail all the necessary documentation, Shamim added.

When asked what the government is doing to reach out to struggling micro and small entrepreneurs, Abdul Latif Bakshi, senior information officer of the ministry of commerce, said: "The central bank issued regulations for sanctioning loans to all banks. Those who want to get the benefit of the stimulus packages must comply with those regulations. For further queries, you should talk to Bangladesh Bank spokesperson."

Contacted, Serajul Islam, executive director and spokesperson of the BB, acknowledged that the bulk of the CMSME stimulus funds went to the medium-sized enterprises.

To get the stimulus funds, the business owners must have some minimum documentation, which the majority of them do not have.

"We are working with the SME Foundation to sensitise small and micro business owners about the necessity and process of having proper documentation," Islam added.

The SME Foundation has arranged eight regional fares for micro and small entrepreneurs where they learned about the processes of getting proper documentation and banking services, said its Chairperson Masudur Rahman.

Raihan recommends providing cash incentives to the small and micro business owners to rescue them from their current despairs.

"In our five round of surveys, we did not see any improvement on the indicators that act as barriers for small entrepreneurs to access the stimulus package," Raihan said, while urging the government to eliminate the barriers for small and micro-entrepreneurs to accessing the rescue funds.

Rahman also called for increasing the share of small businesses in the stimulus package.

In the last two phases of disbursing stimulus package, the SME Foundation could provide funds only to 100,000 SMEs whereas the number of total SMEs according to 2013 statistics is more than 7.8 million.

"Besides, we have to rely on banks to disburse the funds, which requires lengthy and complicated procedures for the small and micro-level business owners," he added.

Fahmida Khatun, executive director of the Centre for Policy Dialogue, recommended engaging the non-governmental organisations in disbursing stimulus packages to ensure transparency.

The NGOs that are working on microcredit can reach families living in the remotest part of the country, so they would be able to successfully disburse the package to small and micro-entrepreneurs, she said.

Whatever the government decides to do, it must act now or else more than 20 lakh small businesses are staring at a similar fate like Basudeb, according to Helal Uddin, president of Bangladesh Shop Owners' Association.

At least 40 lakh small businesses are saddled with debt, which they incurred by taking loans out of desperation from local usurers who set high-interest rates.

"Stimulus package from the government did not reach most of these small businessmen, and banks were not interested in grant them loans."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments