Three difficult choices to heal economy

Bangladesh yesterday made three major decisions to cushion the economy against critical risks such as stubborn inflation and depletion of foreign currency reserves.

In a rare move, the central bank devalued the local currency by Tk 7 to Tk 117, the steepest slide in a day against the mighty dollar. What is more, it loosened its age-old grip on the taka as it will now follow the crawling peg, a flexible exchange rate system.

Bangladesh Bank has also made lending rates fully market-based, abandoning a treasury bill-linked formula for banks. This marks a major shift from the command-and-control mechanism imposed on banks four years ago.

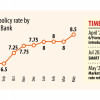

The monetary authority also raised the overnight repurchase agreement rate, a form of short-term borrowing cost for banks, by 50 basis points to 8.5 percent, the second straight hike this year.

The three decisions coincided with the International Monetary Fund's pledge to give Bangladesh $1.15 billion in loans. The steps reflect the authorities' struggle to bring the economy back on track.

According to the monetary policy committee of the BB, the economy faced two critical challenges -- persistently high inflation and depleting foreign exchange reserves.

Although the BB and the government have taken various measures to curb inflation, stabilise the exchange rate and protect the erosion of foreign exchange reserves, inflation remains stubbornly high and the foreign exchange reserve situation is not improving to the desired level, the central bank said.

Inflation has stayed above 9 percent since March last year, and the local currency weakened by 35 percent against the US dollar in the past two years. The country's reserves have more than halved, bringing about one of the worst economic crises for the low-middle-income nation. It has been struggling to raise enough taxes to meet its growing expenses.

The central bank's decisions came as an IMF team, led by Chris Papageorgiou, wrapped up its 15-day visit to Bangladesh yesterday. During the visit, it discussed economic and financial policies in the context of the second review of the loan programme.

In a statement, Chris Papageorgiou described the BB's actions as bold, which are aimed at realigning the exchange rate and simultaneously adopting a crawling peg regime.

Talking to The Daily Star, Syed Mahbubur Rahman, managing director of Mutual Trust Bank, welcomed the scrapping of the SMART formula. "Now, the interest rate will be market-driven," he said.

Since the policy rate has been revised upwards and the reference lending rate, known as SMART, has also been scrapped, the interest rate may rise. This will make funds costlier, which may help the central bank contain the demand but deal a blow to borrowers.

Similarly, the spike in the exchange rate may come as a boon for exporters and remitters because they will get a better US dollar rate whereas importers will have to pay more to buy goods and inputs from the global market.

"The flexible exchange rate was necessary for us as the cost of doing business has risen significantly due to increasing gas and power tariffs. The government also reduced the cash incentive on export receipts," said SM Mannan Kochi, president of the Bangladesh Garment Manufacturers and Exporters Association.

Ashraf Ahmed, president of Dhaka Chamber of Commerce and Industry, said the move towards a market-based exchange rate was a step in the right direction.

Subir Kumar Ghose, chief executive officer of Partex Petro Ltd, predicts that the interest rate in the banking sector may soar up to 20 percent.

The average lending rate was less than 14 percent yesterday.

Humayun Rashid, managing director of Energypac Power Generation, said the rate of interest will go up immediately as banks are collecting deposits at higher rates.

Selim RF Hussain, chairman of the Association of Bankers Bangladesh, thinks the flexible interest rate and the exchange rate would help reduce capital flights from Bangladesh.

Ahsan H Mansur, executive director of the Policy Research Institute, said the spike in interest rates may slow the economy further. "But it is necessary to overcome the challenges."

He said the introduction of the crawling peg would stabilise the taka-dollar exchange rate and improve foreign exchange reserves.

"The taka may depreciate further," he said, urging the government to discontinue the subsidy on remittances.

Asked whether the measures will bring back stability to the economy, the former economist of the IMF, said, "These are necessary steps, but not sufficient. However, without these steps, it will not be possible to help the economy overcome the crisis."

Zahid Hussain, a former lead economist at the World Bank's Dhaka office, said that of the three BB steps, the abolition of the SMART system was the most significant.

"The market-based interest rate is nothing new for us. Bangladesh has been following it since the economic liberalisation in the 1990s. Therefore, there is nothing to be worried about, and banks and other financial institutions are well-experienced in running operations under such a system."

The former WB official thinks the spike in the policy rate is appropriate, and it has to be kept at an elevated level until inflation comes down.

Hussain, however, said he was confused about the crawling peg system.

He said the central bank has narrowed the gap between the official exchange rate and the prevailing market rate by setting the dollar rate at Tk 117.

"With this, we have just moved from one exchange rate to another.

"Importers were already paying around Tk 120 per dollar before the crawling peg was introduced. So, the latest move might not be helpful. Rather, it might backfire," he added.

Speaking at a media briefing at the finance ministry, Chris Papageorgiou said the reserves have been declining for a real confluence of external shocks such as the Ukraine war, hike in interest rates globally and higher commodity prices.

The higher prices have trickled down to the economy more quickly than other economies, raising inflation to a decade-high, he said.

The authorities took a bold action -- a package of real reforms to deal with the current situation, he noted.

Papageorgiou said the introduction of a new flexible exchange rate and the elimination of SMART could help create more flexibility.

The IMF official mentioned that for many decades, the country has had a tax-to-GDP ratio of about 10 percent, one of the lowest in the world. "We think that there is room for improvement."

The IMF said it is imperative to prioritise sustainable revenue generation to bolster investments in social welfare and development initiatives.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments