11 banks facing a capital shortfall of Tk 33,575cr

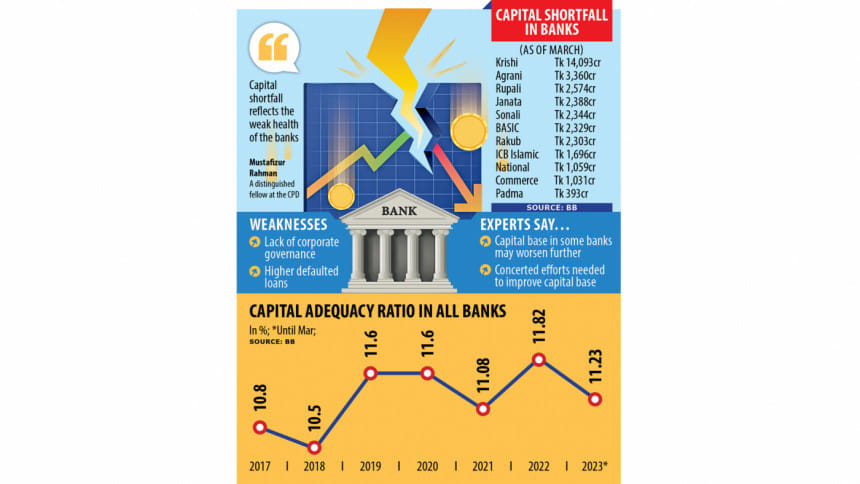

Eleven banks in Bangladesh faced a collective capital shortfall of Tk 33,575 crore in March, up 9.3 per cent from a quarter ago, in a reflection of their worsening financial health caused by persisting irregularities and lack of governance, central bank data showed.

The fund deficit of the banks -- Bangladesh Krishi Bank, Agrani Bank, Rupali, Janata, Sonali, BASIC Bank, Rajshahi Krishi Unnayan Bank, ICB Islamic Bank, National Bank, Bangladesh Commerce Bank, and Padma Bank -- was Tk 30,697 crore in December.

Experts hold corruption and a lack of corporate governance perpetrated at the banks responsible for the large capital shortfall.

As of March, Bangladesh Krishi Bank had the highest amount of capital shortfall of Tk 14,093 crore among the 11 lenders.

State-run Agrani's deficit stood at Tk 3,360 crore. It was Tk 2,574 crore for state-run Rupali and Tk 2,388 crore for Janata Bank, another government-owned bank.

"The worrying situation is that the financial health of the banks that have higher capital shortfall is deteriorating," said Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh.

The high ratio of defaulted loans has deepened the capital shortfall in the banks.

Default loans increased by Tk 10,964 crore in the first three months of 2023 to Tk 131,621 crore. The non-performing loans (NPLs) in the banking sector increased by 9 per cent from three months ago and 16 per cent from a year earlier.

The ratio of NPLs stood at 8.8 per cent of the outstanding loans as of March, up from 8.16 per cent in December and 8.53 per cent in the same month last year.

Banks have to set aside a large amount of provisioning against the defaulted loans, which ultimately hit their capital base.

"Both the government and the central bank should take concerted efforts to lower the capital shortfall," said Mansur, also a former official of the International Monetary Fund.

The government should inject capital into the state-run banks since it is the owner of them, he said.

"But such an injection has a negative impact as funds will come from the pockets of the common people. So, the central bank should sit with the private banks facing the capital shortfall to formulate a strategy to improve their situation."

"But no formula will work unless corporate governance is strengthened."

The banks weighed down by the capital shortfall have played a major role in deteriorating the capital base in the entire banking sector.

The capital base eroded in March compared to December, so the capital adequacy ratio (CAR) shrank to 11.23 per cent in contrast to 11.82 per cent.

The CAR, also known as the capital-to-risk-weighted assets ratio, measures a bank's financial strength by using its capital and assets. It is used to protect depositors and promote the stability and efficiency of financial systems.

The capital base of the banking industry in Bangladesh is also weaker than its peers in South Asia, according to the Bangladesh Bank's Financial Stability Report.

In 2021, banks in Pakistan maintained a capital adequacy ratio of 18.7 per cent, while it was 16.5 per cent in Sri Lanka, and 16.6 per cent in India.

"If a bank faces a capital shortfall, its capacity to absorb shocks erodes," Mansur said.

Mustafizur Rahman, a distinguished fellow at the Centre for Policy Dialogue, says the capital shortfall reflects the weak health of the banks.

"The central bank should specify the banks whose financial health has deteriorated despite the injection of funds."

He thinks there is a strong correlation between higher default loans and capital shortfall.

"So, ensuring corporate governance is important to improve the capital base."

Md Mehmood Husain, managing director of National Bank, said the private commercial lender had already taken a number of measures to reduce the capital shortfall.

The capital shortfall at National Bank stood at Tk 1,059 crore in March.

"We have already taken permission from the central bank and the Bangladesh Securities and Exchange Commission to issue bonds to strengthen our capital base," said Husain.

"We are also working to find out foreign investors to sell shares so that the capital base is strengthened."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments