2022: a year of revival, struggle and resilience

Bangladesh welcomed 2022 on a strong footing and was about to recover from the coronavirus pandemic in full swing and fire on all cylinders. In fact, economic activities were almost back to the pre-Covid level.

But the outbreak of the Russia-Ukraine war upended the recovery. The impacts of the conflict were so deep that Bangladesh soon found itself confronting one of the most difficult periods in recent memory or perhaps in its history.

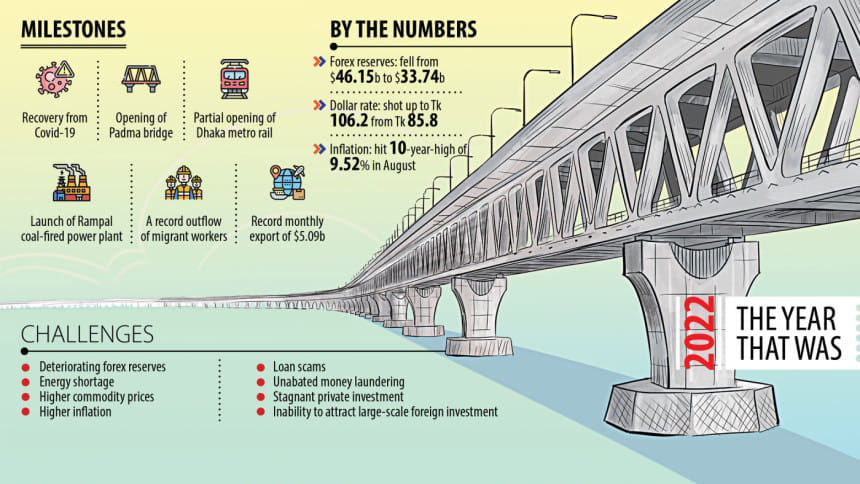

The foreign currency reserves slid amid a surge in import bills as commodity prices rocketed in the global markets. The exchange rate went past Tk 100 per US dollar and even hit as high as Tk 110 as the shortage of the American greenback deepened.

Inflation climbed to a decade high in August, hurting households.

A shortage of gas spelt out a power crisis in a year the country brought 100 per cent of the population under electricity coverage. The escalated tension in domestic politics even stoked concerns that economic activities would be disrupted.

One silver lining was that the economy has not faced Sri Lanka like situation. The Island nation had plunged into a crisis due to economic mismanagement and drying up of forex reserves.

"The decade-long achievement in macroeconomic stability helped the country withstand any macroeconomic disastrous situation amid the current crisis," said Selim Raihan, executive director of the South Asian Network on Economic Modeling.

Overall, the economy was under pressure due to a number of factors, including the continuous decline of the foreign currency reserves, the unprecedented hike in the US dollar rate, supply disruptions, deteriorating governance in the banking sector, the lower tax-to-GDP ratio, the skyrocketing of the prices of daily essentials, and the failure to control money laundering.

"Bangladesh was able to save the economy from the downward trend and handle the situation although it was not managed entirely in the way many had hoped to. It was a big achievement for the economy," said Salehuddin Ahmed, a former governor of the Bangladesh Bank.

"The opening of Padma bridge has brought joy to the economy."

Export growth remained in positive territory despite record inflation and the energy crisis in the western economies, and the forex shortage and the higher cost of production because of the increase in gas and oil prices, all driven by the war-induced global crisis, at home.

Ahmed identified the failure to restore discipline in the banking sector and manage the forex reserves properly as two major disappointments in 2022.

Reserves have fallen by a quarter in the year amid higher import payments and lower-than-expected remittance receipts and moderate export earnings.

Another challenge for the country was the unabated money laundering, said Ahmed.

"This is a matter of frustration for the nation. It will continue if the government can't deal with it strongly."

Muinul Islam, a former president of the Bangladesh Economic Association, described the opening of the Padma bridge and 100 per cent population coming under electricity coverage as the major highlights of the outgoing year.

"Despite the war-induced crisis, the economy did not collapse. Even the government was able to secure foreign funds to tackle the crisis," he said.

Prof Islam thinks the government was not able to mobilise revenue as expected. "Money laundering and the inability to manage the exchange rate were major concerns."

Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh, said the economy had rebounded from the Covid-19 crisis and the export reached the pre-pandemic level before the war broke out.

"The government saved the economy from falling into a crippling situation. Export performance and remittance inflows have provided the breathing space."

According to the former official of the International Monetary Fund, the vulnerability in the banking sector and rising non-performing loans were major risks.

"The central bank has completely failed to establish governance in the banking sector and control inflation. Despite a number of initiatives, the government has not been able to rein in the prices of essentials."

He also pointed out the inefficiency of the National Board of Revenue to increase the tax-to-GDP ratio.

Fahmida Khatun, executive director of the Centre for Policy Dialogue, said amidst various challenges, exports and remittance inflows were positive and these can be considered major achievements in 2022.

She said the crisis in the banking sector has remained unresolved and the list of failures in the sector is rather longer than in any other sector.

"The problem in the banking industry has continued for a long time."

Fahmida said the opening of the Padma bridge would bring a long-term positive impact on the economy.

"Connectivity is always positive for an economy."

Selim Raihan highlighted insufficient and ineffective management of the exchange rate.

The cap on the lending rate has restricted the major monetary policy tool to act properly amid inflationary pressure, he said.

The central bank has maintained a 9 per cent ceiling on the interest rate on loans since April 2020.

"The ineffective measures against domestic market imperfections and market anomalies further exacerbated inflationary pressure," said Raihan.

"The huge reliance on the imports of liquefied natural gas and fossil fuel for power generation and a lack of progress in renewable energy were among the failures."

The professor of the economics department of the University of Dhaka said some steps have been taken by the government to maintain macroeconomic stability in terms of releasing pressure on the balance of payments.

The developments that exposed the weaknesses of the economy included the scams in the financial sector, stagnant private sector investment, inability to attract large-scale foreign direct investment, the cost-overrun and time-overrun of projects, and rampant corruption, he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments