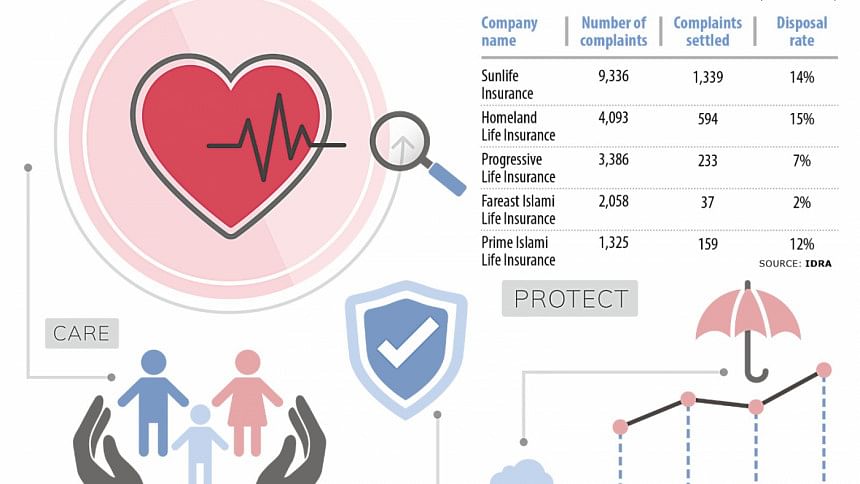

24,605 complaints filed against 14 insurers in 10 months

More than a dozen life insurance companies settled only 14.09 percent of the 24,605 complaints they received in the first 10 months this year, creating uncertainty about whether policyholders will get back their money, official figures showed.

Of them, 95 percent are related to non-settlement of claims despite policies reaching maturity, said an official of the Insurance Development and Regulatory Authority (Idra).

The remaining complaints are linked to management issues, violation of rules in appointing top officials and bad investments, among others.

Policyholders filed the complaints against 14 life insurance companies, which settled 3,467 claims between January and October.

The insurers are Sunlife Insurance, Homeland Life Insurance, Progressive Life Insurance, Fareast Islami Life, Prime Islami Life Insurance, Golden Life Insurance, Baira Life Insurance, Padma Islami Life Insurance, Sunflower Life Insurance, Popular Life Insurance, National Life Insurance, Swadesh Islami Life Insurance, and MetLife Bangladesh.

There are 35 life insurance and 46 non-life insurance companies in Bangladesh.

On October 12, the Idra directed the chief executive officers of the 14 companies to resolve the complaints by December this year.

The piling up of complaints come as several life insurance companies are struggling to settle claims due to a lack of liquidity resulting from bad investments and fund embezzlement.

Of the insurers, the highest number of complaints, at 9,336, was filed against Sunlife. In contrast, the lowest number of claims, just one, was lodged against Trust Islami Life, according to the data of the Idra.

Sunlife settled 14 percent of the complaints.

Mohammad Nurul Islam, CEO of Sunlife Insurance, said due to the Covid-19 crisis, the revenue stream was reduced at one point. As a result, the claim settlement decreased.

"The claims could not be settled due to a huge cash crunch. As per Idra instructions, we have decided to resolve the complaints by December."

Green Delta Insurance Company is going to purchase a 43 percent stake in Sunlife.

The second-highest number of complaints was filed against Homeland Life Insurance. It settled 15 percent of the 4,093 complaints made.

Faridul Alam, chief executive officer (current charge) of Homeland, said after the meeting at the Idra on October 12, some 20 percent more claims were paid as of October 27. The rest will be cleared in a gradual manner.

He also blamed the lack of liquidity for the lower settlement ratio.

Recently, the insurance regulator gave Homeland Life Insurance the approval to withdraw Tk 10 crore from its fixed deposits.

"Money is being withdrawn and insurance claims are being settled step by step," Alam said.

Progressive Life Insurance, which attracted the third-highest number of complaints, resolved 7 percent of the 3,386 complaints filed.

Shajahan Azadi, managing director of Progressive Life Insurance, could not be reached for comments.

The fourth-highest number of complaints, at 2,058, were filed against Fareast Islami Life, which settled 2 percent of them.

Sheikh Kabir Hossain, chairman of Fareast, recently described the company as "sick" as it owes a lot of money while its owners are in jail for alleged funds embezzlement.

"So, it is not possible to pay back debts at the required rate."

According to an audit report, Tk 2,367 crore has been embezzled from the company. Apart from this, accounting irregularities amounting to Tk 432 crore were also detected.

Nazrul Islam and MA Khaleque, former chairmen of Fareast Islami, Hemayet Ullah, former CEO, and former directors and senior officials were found involved in the embezzlement.

The government has appointed a new board, comprising independent directors, to run Fareast.

Prime Islami Life Insurance received 1,325 complaints, the fifth highest. Of them, 12 percent were sorted out between January and October.

Zahangir Alam, spokesperson of the Idra, told The Daily Star that more than half of the country's life insurance companies are financially weak.

"They don't have enough liquidity, so they can't settle the claims."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments