Profit declines for insurers

Most of the listed non-life insurance companies in Bangladesh posted lower profits in the first half of 2022 largely due to a decrease in premium incomes from their marine insurance segment as the country moved to curb imports.

A sharp fall in third-party insurance and lower earnings from the stock market investments were also responsible for the fall in profits.

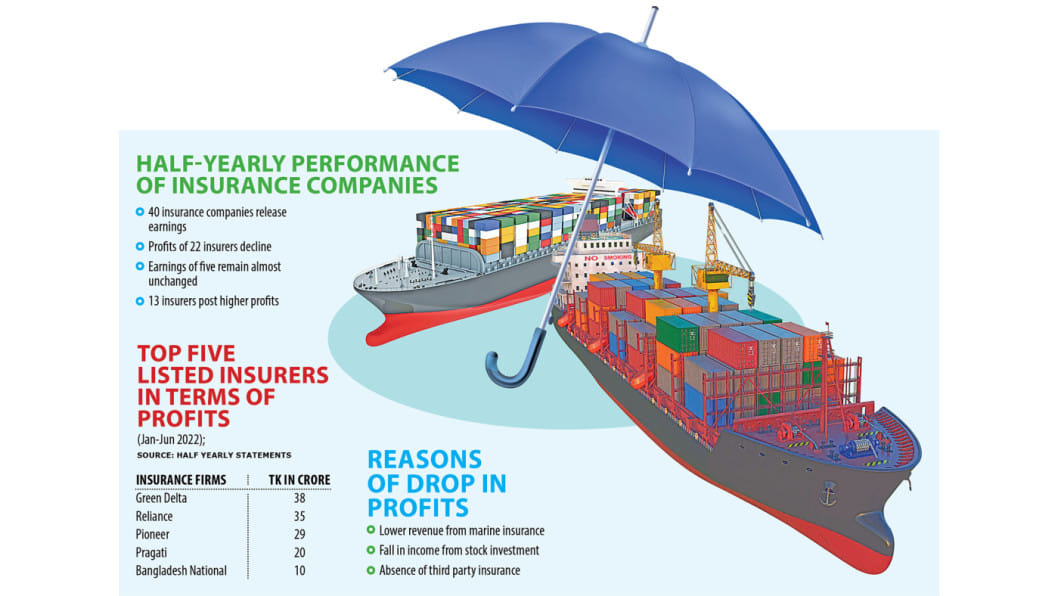

Of the 43 non-life insurance companies listed on the Dhaka Stock Exchange (DSE), 40 published their financial reports for the first half of 2022. Of them, 22 posted lower profits compared to a year ago.

The profits of five non-life insurance companies were almost flat while the rest made higher profits, according to their financial statements.

"The overall business activities of the country squeezed because of the coronavirus pandemic and this has impacted the insurance sector as well. The gross premium income declined for many insurers," said Sheikh Kabir Hossain, president of the Bangladesh Insurance Association.

In Bangladesh, non-life insurance companies do business mainly in three segments—fire, transport and marine.

The marine insurance business fell in the January-June period of 2022 as the opening of the letters of credit (LCs) has begun plummeting since March.

The insurers' profit was significantly impacted in the second quarter because of the outbreak of Russia's war in Ukraine as the conflict forced the government to curb imports to save US dollars and keep inflation in check.

"Due to the dollar shortages, the LC opening fell," said Hossain.

Half-yearly profits of Sonar Bangla Insurance, where Hossain is the chairman, dropped to Tk 6.7 crore from Tk 7.4 crore during the same period last year.

Industry people say a big blow came from a sharp fall in automobile insurance as third-party insurance has become largely non-existent in the country.

Third-party insurance is a policy purchased by the insured from the insurer for the protection against the claims of the third party. But in Bangladesh, none buys third-party insurance products since it is not mandatory.

As per Motor Vehicles Ordinance 1983, third-party insurance was compulsory. It is not mandatory under the existing Road Transport Act 2018.

"The income from the segment has fallen drastically after the withdrawal of the insurance requirement," Hossain added.

Green Delta Insurance registered the highest profit of Tk 38 crore among the listed non-life insurance companies followed by Reliance Insurance, which clocked a profit of Tk 35 crore in the January-June period.

SM Mahbubul Karim, chief executive officer of Nitol Insurance, says the Russia-Ukraine war hit the insurance business at a time when the economy of Bangladesh was on its way to recovering from the coronavirus pandemic fully.

Profits of Nitol Insurance went down to Tk 4 crore in January-June from Tk 5 crore, according to its financial reports.

Karim says export and import businesses have slowed and people are struggling to make a living as their expenses have surged owing to higher inflation.

"In line with the downward trend of all other businesses, our insurance business was hampered considerably in the first half of 2022."

Meanwhile, the re-insurance premium of fire insurance has gone up.

"This is because we can't assume the full burden of the risks related to such insurance products," said Ahmed Saifuddin Chowdhury, managing director of Bangladesh General Insurance Company.

Reinsurance is the practice where insurers transfer a portion of their risk portfolios to other parties with a view to reducing the likelihood of paying a large obligation resulting from an insurance claim.

Bangladesh General Insurance Company's profits slipped to Tk 6.8 crore in the first half of 2022. It was Tk 8.5 crore during the identical period in 2021.

The marine insurance business fell in recent months due to the lower LC opening, according to Chowdhury.

"This trend is common worldwide and Bangladesh is not an exception," he said.

Chowdhury says the investment income of the insurance companies was good except that from the stock market.

Insurers with significant exposure to the stock market were hit by the falling trend in the first half owing to the macroeconomic instability caused by higher imports, dollar shortages, and runaway inflation.

The DSEX, the benchmark index of the premier bourse in Bangladesh, tumbled 6.96 per cent in the first half, data from the DSE showed. The index had surged 9.46 per cent during the same period last year.

Zharna Parul, company secretary of Paramount Insurance, says the income from investment was lower this year due to the bearish run in the stock market.

She identified the fall in marine insurance income as the main factor for the decline in profits in the industry.

"Almost all companies faced the same situation as the overall LC opening dropped because of a costlier US dollar."

The US dollar was up at least 10 per cent against the taka in June as the country's foreign exchange market began facing a shortage of US dollars.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments