Agent banking accounts keep growing

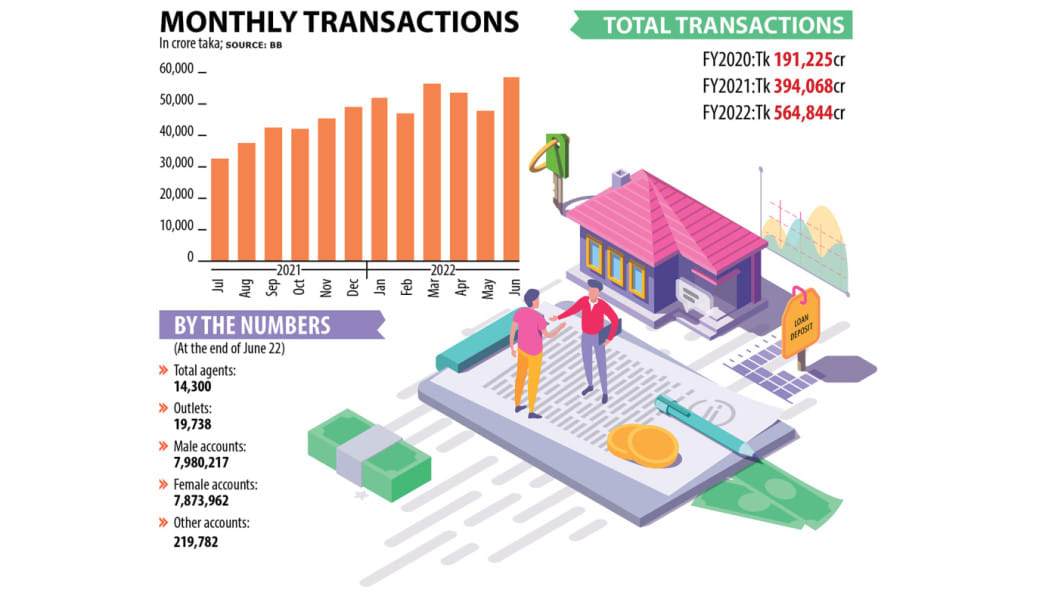

Transactions through agent banking accounts rose 43 per cent year-on-year to Tk 5,64,844 crore in fiscal year 2021-22 as a growing number of people are now using the new banking window, showed Bangladesh Bank data.

In fiscal year 2020-21, the amount passing through these accounts, opened through agent banking services, stood at Tk 3,94,068 crore.

However, the growth of the transaction amount from what was in fiscal year 2019-20 to that in fiscal year 2020-21 was 106 per cent.

Agent banking was introduced in Bangladesh in 2013, with the central bank awarding 28 agent banking licences with an aim to provide a secure alternative delivery channel of banking services to the underprivileged and under-served population who live in remote locations.

Following the central bank's guideline, Bank Asia introduced the country's first agent banking services in January 2014.

Apart from the sharp growth in transactions, the number of agent banking accounts, meaning accounts opened by agents, has also increased year-on-year

The number of agents across the country stood at 14,300 as of June 2022, which was 12,930 in the same month of the previous year. The number of agent banking outlets rose to 19,738 from 17,147 during the period.

Apart from the sharp growth in transactions, the number of agent banking accounts, meaning accounts opened by agents, has also increased year-on-year.

The total number of agent banking accounts stood at 1.6 crore in June 2022, up by about 31 per cent from that in the same month a year back. However, there was a 54 per cent growth in the number of accounts in June 2021 from that in the same month of the previous year.

According to Bangladesh Bank data, 79.80 lakh males had opened agent banking accounts as of June 2022, a year-on-year of about 20 per cent.

In case of females, it was an increase of 52 per cent year-on-year to 78.73 lakh as of June this year.

The agent banking sector saw a rapid growth as an alternative to the branch-based banking model in Bangladesh, especially in rural areas, where setting up full-fledged offices is not commercially viable because of their low business volume.

As of June 2022, out of total of 19,738 agent banking outlets, 17,005 were in rural areas while the rest in urban areas while 12,115 agents out of total 14,300 were in the rural areas, showed data from the central bank.

In case of the number of transactions, more than Tk 1.85 crore out of total 2.25 crore transactions took place in rural areas.

Usually, basic banking services such as cash deposits, cash withdrawals, and receipt of remittances are provided through agent banking. Apart from that, banks have also started disbursing loans through their agents.

As per the BB data, the deposit balance was Tk 27,754 crore as of June 2022, up from Tk 20,218 crore in the same month of 2021.

Banks disbursed Tk 671 crore in loans through the agent banking system until June this year, up from Tk 456 crore in the same period last year.

Until June 2022, Tk 155 crore was paid as utility bills through agent banking services which was Tk 108 crore in the same month last year.

However, the inflow of remittance through the agent banking channel has declined year-on-year.

As of June 2022, Tk 2,272 crore was channelled to the beneficiaries, down from Tk 2,855 crore in the same period of the previous year.

At least 24 banks have rolled out the agent banking service. Of them, five opened 90.20 per cent of the agent banking accounts as of March.

Bank Asia has opened the highest, 5,154,261 accounts, comprising of 33.92 per cent of the total accounts, the central bank data shows.

In deposit collection, Islami Bank topped the list with 38.63 per cent (Tk 9,722 crore) of the total deposits followed by Dutch-Bangla Bank with 14.71 per cent.

In case of lending, five banks account for 98.49 per cent of the total lending as of March 2022.

Brac Bank topped the list with Tk 4,061 crore, which is 63.24 per cent of the total amount lent through agent banking.

"The agent banking brings a new area in our palm which was not in our territory earlier," said Nazmur Rahim, head of alternative banking channels of Brac Bank.

Instead of using SME units, the bank can reach new customers through agent banking. New customers and SME entrepreneurs also do not hesitate to utilise banking channels due to the presence of the agents.

"So, we can realise which areas deserve a sub branch to promote SME lending," he said.

About the surge in growth of transaction in FY 21, Rahim said people prefer to go to the agents for their banking needs instead of going to the branches amidst the coronavirus pandemic.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments