Agrani Bank’s health deteriorated fast in last five years

Once a reputable state-run commercial lender, Agrani Bank saw its financial health deteriorate fast over the past five years, mainly due to massive lending to politically backed businesses, mismanagement by the board and fallouts of Covid-19.

Excessive lending to a few large industrial groups, lacklustre recovery efforts from some old clients and frequent violations of the single borrower exposure limit have led the lender into a situation where all of its financial indicators are beeping red, according to industry insiders.

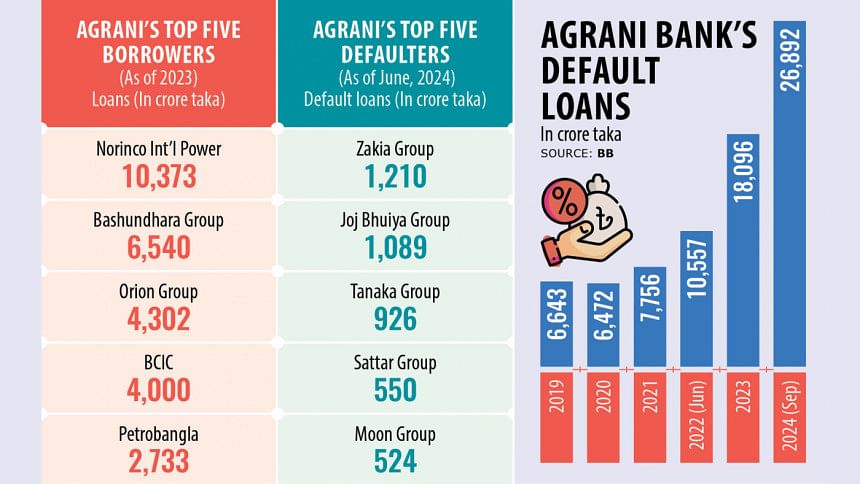

As of this September, Agrani Bank's bad loans stood at Tk 26,892 crore, which accounted for 39 percent of its total disbursed loans, showed data of the Bangladesh Bank.

A year earlier, the commercial lender's defaulted loans were Tk 16,874 crore. In 2019, bad loans were only Tk 6,643 crore, which was 14.26 percent of the bank's disbursed loans.

In 2019, the state-run lender had surplus capital and no provision shortfall. However, it now carries the burden of a Tk 7,591.40 crore provision shortfall. As of December last year, the bank faced a Tk 4,450 crore capital shortfall.

As of September this year, Agrani Bank's loans and advances stood at Tk 75,677 crore, up from Tk 46,583 crore in 2019.

As of December last year, Norinco International Power Ltd, Orion Group, BD Chemical Industries Corporation (BCIC), Petrobangla, Bangladesh-China Power Company Ltd (BCPCL), Thermax Group, Bangladesh Power Development Board (BPDB), Beximco Ltd, Beximco Pharmaceuticals Ltd, Bashundhara Group, Abul Khair Group, Zakia Group, Joj Bhuiya Group, Jamuna Group, BSRM Group, AA Knitspin Limited, Orion Pharma, Prime Group and Magpie Group were the top borrowers of the state-run lender.

In the last five years, funded and non-funded loan facilities have increased in several government institutions, power producers and private industrial groups, according to bank officials.

As of last year, Agrani Bank had 55 large borrowers, with loans to 20 of them crossing the single borrower exposure limits.

Besides, some old defaulters, several customers have defaulted in the past few years, including Saad Musa Group, Navana Group, Dhaka Hyde, Pacific Group and Samitex Group.

The top 20 defaulters of the bank hold 42 percent of its total defaulted loans, amounting to Tk 21,324 crore till June this year.

Of the 20 defaulters, Jakia Group's bad loans stand at Tk 1,210 crore; Joj Bhuiya Group at Tk 1,089 crore; Tanaka Group at Tk 926 crore; Sattar Group at Tk 550 crore; Moon Group at Tk 524 crore; Sonali Group at Tk 521 crore; Aerostock Group at Tk 462 crore; Dhaka Hyde at Tk 457 crore; Pacific Group at Tk 443 crore; and Saad Musa Group at Tk 410 crore, according to Agrani Bank data.

Wishing not to be named, a senior official of the bank told The Daily Star that the bank's defaulted loans are likely to increase in the coming days as loans of Awami League-affiliated business conglomerates may soon default due to non-payment.

From 2019 to mid-September 2024, Mohammad Shams-Ul Islam and Murshedul Kabir served as two managing directors of the bank.

Shams-Ul Islam joined the bank as managing director in 2016 and held the position until mid-2022. He was considered a pro-business managing director of state-run banks due to his lenient approach toward large business conglomerates.

During his tenure, loans to large businesses increased.

When contacted, Islam told The Daily Star that the loans disbursed during his tenure were not renewed later, leading to the sickness of these industries and their inability to facilitate subsequent repayments.

He added that all the customers he brought to the bank, such as Shanta Group, Akij and PHP, have left and the current defaulters were old customers.

"When I joined the bank, its bad loans were at 29 percent and they decreased to 12 percent when I left," he said, adding that defaulted loans have increased at the bank after his tenure.

Md Murshedul Kabir was appointed as managing director of the bank in August 2022.

However, after the formation of the interim government in August this year, the Ministry of Finance cancelled the contractual appointments of all state-run banks, including Kabir's, in September.

Kabir yesterday told the newspaper that most customers were unable to repay loans due to the post-Covid economic stress and Russia-Ukraine war.

He rejected Islam's allegation that lending facilities to businesses were not renewed.

For the past five years, economist Zaid Bakht was the chairman of the bank.

After the fall of the Awami League government, Syed Abu Naser Bukhtear Ahmed was appointed as the new chairman of Agrani Bank.

Ahmed told The Daily Star yesterday that he was working to restore the state-run bank to good health.

"Loan recovery is our first priority," he said, adding that the new board and management team are working to improve the bank's financial health.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments