Bangladesh 2nd in South Asia in bad loan ratio

Bangladesh's banking sector has the second-highest ratio of non-performing loans (NPL) among the countries in South Asia as lenders continue to face multiple challenges emanating from scams, a lack of corporate governance and borrowers' growing reluctance to make instalments regularly.

Only Sri Lanka is ahead of Bangladesh.

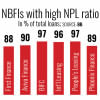

And in the case of non-bank financial institutions (NBFIs), the ratio of NPL is the highest in Bangladesh, with Sri Lanka coming second, according to a World Bank report, which was released recently.

The report styled "Expanding Opportunities: Toward Inclusive Growth" said the latest NPL ratios remain below the 2021 levels and the 10 per cent threshold commonly used to indicate systemic stress in most South Asian countries.

Exceptions are Bangladesh and Sri Lanka, where the NPL ratio reached above the 2021 level: it was 9.4 per cent in Bangladesh and 10.9 per cent in Sri Lanka in September 2022.

"Asset quality has deteriorated in Bangladesh and Sri Lanka," said the report.

The report comes at a time when defaulted loans resulting from factors, namely scams and a lack of corporate governance, continue to be a drag on the banking sector.

As of December 2022, the default loans at banks of Bangladesh increased 16.8 per cent year-on-year to Tk 120,656 crore as habitual defaulters showed reluctance to repay the funds.

The ratio accounted for 8.16 per cent of the outstanding loans given out by banks as of December, up from 7.93 per cent a year ago, according to data from the Bangladesh Bank.

The WB said: "In Bangladesh, the NPL ratio has risen due to higher import costs, poor payment discipline of borrowers, and weak regulatory enforcement. The resumption of lax loan rescheduling and asset classification in mid-2022 has delayed the full recognition of distressed assets."

The NPL ratios among NBFIs are even higher than in the banking sector, reaching over 23 per cent in Bangladesh in June 2022 and 17 per cent in Sri Lanka in September 2022, according to the report.

Bhutan has the third-highest NPL ratio in South Asia, followed by Pakistan, the Maldives and India. Nepal has the lowest amount of NPL.

The WB said countries in South Asia with latent non-performing loans following forbearance measures during the Covid-19 pandemic are more vulnerable to spillovers from volatile global financial markets.

"Loan moratorium programmes during the pandemic have delayed the recognition of distressed assets."

According to the report, distressed loans are concentrated in the sectors that have recovered more slowly or were hit by adverse shocks.

In India, while most of the pandemic-era loan moratoria have expired, some are still active and are being gradually phased out. As a result, distressed loans that were previously in the moratorium programmes are just starting to be recognised.

For example, the report said, around 16 per cent of the total number of loans under India's Emergency Credit Guarantee Scheme, which provided full credit guarantees to micro, small and medium enterprises, was reported as NPLs in September 2022.

In Pakistan, the microfinance sector was hit hard by the inflationary shock and losses due to the floods, with an estimated 18 lakh borrowers from areas affected by the floods in 2022.

Accordingly, the NPL ratio in the country's microfinance sector rose in the third quarter of 2022 compared to 2021.

In the case of private sector credit, the growth has accelerated in Bangladesh, Bhutan, and India, with the highest being observed in the services sector of India.

In Bangladesh, private credit grew in the fourth quarter of 2022 at a similar rate of the third quarter and faster than a year ago, as borrowers took advantage of a lending rate cap and concessionary financing by the central bank, said the WB.

The report also highlighted deposits at banks.

It said the deposit growth has declined in most countries and continues to fall behind credit growth.

In Bangladesh and Bhutan, the average deposit growth in the fourth quarter of 2022 fell below the levels in the previous quarter and in 2021.

"High inflation tends to reduce the deposit growth by lowering savings and reducing real deposit rates. A slowdown in remittance growth, which provides an important source of deposits for Bangladesh, has contributed to slow deposit growth," the report said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments