NBFIs’ bad loans surge to record Tk 26,163cr

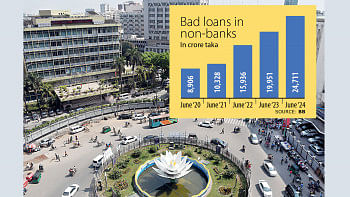

Defaulted loans at the country's non-bank financial institutions (NBFIs) reached a record 36 percent of all loans disbursed by them as of September 2024, a level that sector people described as a reflection of "massive irregularities and scams" seven to eight years ago.

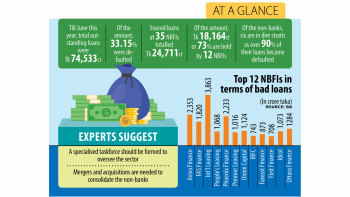

As of September 2024, the 35 NBFIs held Tk 26,163.19 crore in bad loans, which amounted to 35.52 percent of their total disbursed loans of Tk 73,662.77 crore, according to Bangladesh Bank (BB) data.

These bad loans in the sector are the "legacy of the massive irregularities and scams that took place seven to eight years ago", said industry insiders.

Referring to a BB probe report, they said former managing director of NRB Global Bank (later renamed Global Islami Bank) PK Halder swindled at least Tk 3,500 crore from four NBFIs.

Those non-bank commercial lenders are: People's Leasing, International Leasing, FAS Finance and Bangladesh Industrial Finance Company Limited (BIFC).

Consequently, these four NBFIs became ailing institutions with more than 90 percent of their loans turning bad.

Industry insiders said that the central bank bears responsibility for the current state of the NBFI sector due to inadequate supervision.

Non-performing loans (NPLs) at the NBFI sector stood at Tk 21,658 crore, or 29.75 percent of their disbursed loans, at the end of September 2023. It rose by 21 percent, or Tk 4,505.04 crore, to Tk 26,163.19 crore by September 2024, BB data shows.

"The majority of the defaulted loans are legacy loans, which were disbursed without adequate security," said Kanti Kumar Saha, chief executive officer of Alliance Finance.

He said that while bad loans have not risen sharply in recent years, some new loans have defaulted due to the current macroeconomic challenges facing businesses.

"To discuss a way out, we had met with the central bank top officials in October last year. The banking regulator assured us they will sit with the sector people soon after the groundwork," Saha added.

'TO THE EDGE OF COLLAPSE'

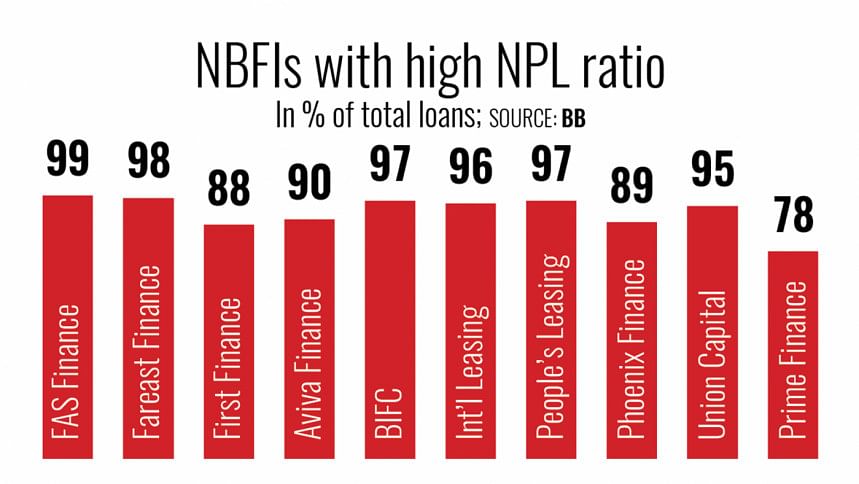

Central bank data showed that 12 finance companies out of the total 35 hold nearly 73.5 percent of the sector's bad loans.

At seven companies, bad loans crossed 90 percent of total disbursed loans.

For example, FAS Finance's bad loans stood at 99 percent of its outstanding loans, Fareast Finance at 98 percent, Aviva Finance at 90 percent, BIFC at 97 percent, International Leasing at 96 percent, People's Leasing at 97 percent and Union Capital at 95 percent, according to BB data.

Anis A Khan, former chairman of the Association of Bankers, Bangladesh (ABB), recently said that some banks and NBFIs have fallen victim to an "unholy nexus", which he described as a "serious threat" to the integrity of the overall financial system.

"Besides, several other NBFIs have been infiltrated by unscrupulous investors who have exploited their positions as chairpersons and directors for personal gain," Khan said, comparing these actions to "outright theft" that has pushed several NBFIs "to the edge of collapse".

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments