21 banks bucked rising bad loan trend in 2024

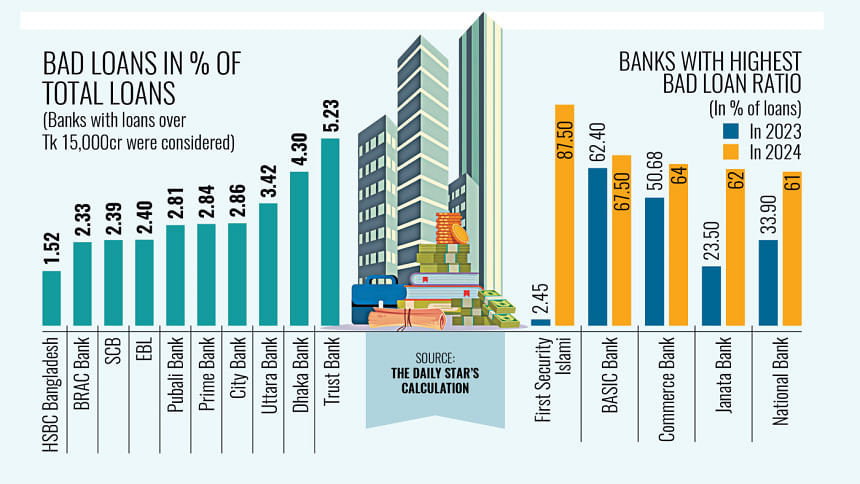

Twenty-one banks managed to keep their bad loan ratios under 5 percent of their total lending, even amid turbulence last year that rattled the sector and eventually pushed up the industry average of bad loans to 16.8 percent.

Banking experts say this outcome was due mainly to sound governance, effective risk controls, early warning systems, and a strong focus on loan recovery. Multinational banks and several local lenders have been following these practices.

Excluding newer banks, Citibank NA, State Bank of India, and Commercial Bank of Ceylon kept their bad loan ratios below 1 percent in 2024, although their lending volumes remain small.

HSBC Bangladesh and Bank Al-Falah both recorded bad loan ratios under 2 percent.

Among banks with a loan portfolio over Tk 20,000 crore, the top performers were BRAC Bank, Standard Chartered Bank, Eastern Bank, Pubali Bank, Prime Bank, and City Bank, each maintaining bad loans below 3 percent of their total disbursements.

"Good governance is the key to keeping bad loan ratios low," said Mashrur Arefin, chairman of the Association of Bankers Bangladesh (ABB), a platform of the managing directors and CEOs of banks.

He said that in a well-managed bank, the management team must work independently, and board members should not interfere with or push for loan approvals.

Arefin added that the credit risk department should also work independently from the business team to assess loans objectively.

"If the credit risk team can work freely, it reduces the risk of a loan turning sour," said Arefin, who is also the managing director and CEO of City Bank.

Woori Bank, Uttara Bank, and Dhaka Bank each reported bad loans between 3 and 5 percent of their total lending.

Trust Bank, Dutch-Bangla Bank, Jamuna Bank, Mutual Trust Bank, Habib Bank, Shahjalal Islami Bank, NCC Bank, and Bank Asia all reported ratios under 10 percent, well below the industry average of 16.8 percent in 2024.

Referring to his experience at Eastern Bank PLC (EBL), where the bad loan ratio stayed under 3 percent, EBL Managing Director and CEO Ali Reza Iftekhar said, "We always prioritise recovery by building an efficient and dedicated recovery team."

"Facing a difficult year like 2024, we tightened client screening and strengthened our recovery setup by bringing in capable people," he said.

EBL has focused equally on expanding its business and reducing bad loans, the CEO said, adding that many successful strategies have been applied to cut non-performing assets.

"When we take on new clients, we follow a professional approach. Most bad loans come from reference clients," added Iftekhar, a former ABB chairman.

Among the newer banks, Shimanto Bank, Community Bank, Modhumoti Bank, Midland Bank, Meghna Bank, Bengal Commercial Bank, and Citizens Bank reported bad debt ratios between 0 and 5 percent.

Of the 50 banks that have released financial reports for 2024, nine reported bad loan ratios between 10 and 20 percent, while 11 fell into the 20 to 40 percent range.

Mamun Rashid, former CEO of Citibank NA Bangladesh, said foreign banks maintained a structured approach to credit risk, including protocols for early warnings, portfolio monitoring, and distressed asset management.

"Foreign banks follow rigorous early alert systems and continuous loan reviews," said Rashid, who also worked with Standard Chartered Bank and ANZ Grindlays Bank.

He commented that special committees meet regularly to identify emerging risks before loans fall overdue. These reviews often lead to quick measures to limit exposure.

The former top banker said there is a stark contrast in standards as foreign banks maintain risk-based accountability systems, while many local banks suffer from lax lending practices, political pressure, and weak recovery efforts.

Last year, eight banks saw over half their loans turn bad, with political misuse and fraud playing a central role. In contrast, 21 banks kept their bad loans under 5 percent by applying strong governance practices.

Among the worst performers, BASIC Bank and Bangladesh Commerce Bank have long struggled with very high bad loan ratios. In 2024, that group grew to include First Security Islami Bank, Social Islami Bank, Janata Bank, AB Bank, IFIC Bank, and National Bank.

Union Bank has yet to publish its financial report for 2024. However, central bank data show its bad loans reached Tk 25,303 crore at the end of March 2025, nearly 90 percent of its outstanding loans.

First Security Islami Bank ended 2024 with the highest bad loan ratio in the sector, at 87.5 percent.

Mohammad Abdul Mannan, chairman of the commercial lender, said the bank's loans had been misclassified, recorded as performing assets, which inflated the bank's profits and allowed it to pay dividends.

He said the new board, formed following the July uprising last year, uncovered these irregularities.

After a change in leadership, Mannan said the bank has focused on attracting retail deposits, opening 10.5 lakh new accounts and bringing in more than Tk 3,500 crore.

Besides, around Tk 2,700 crore has already been recovered, he said.

He added that some Tk 40,000 crore had been lent to people unaware they were listed as borrowers. "That criminality within the bank, driven by a businessman from Chattogram, has now been stopped," he said.

Md Mazibur Rahman, managing director of Janata Bank, said, "Many of our assets, previously shown as regular, were classified in 2024."

Janata's bad loans jumped 171 percent in 2024, reaching Tk 62,805 crore, or 62 percent of its total lending.

Still, Rahman said the situation is starting to turn around.

"Our cash recovery in the past six months has already surpassed what we managed in the whole of 2024," he said. "We are selling off assets of defaulters and stepping up collections. It will take time, but the recovery has begun."

BASIC Bank had the second-highest ratio at 67.5 percent, followed by Bangladesh Commerce Bank at 64 percent. National Bank's bad loans stood at 61 percent by the end of the year.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments