State banks nowhere near target to retrieve funds from top defaulters

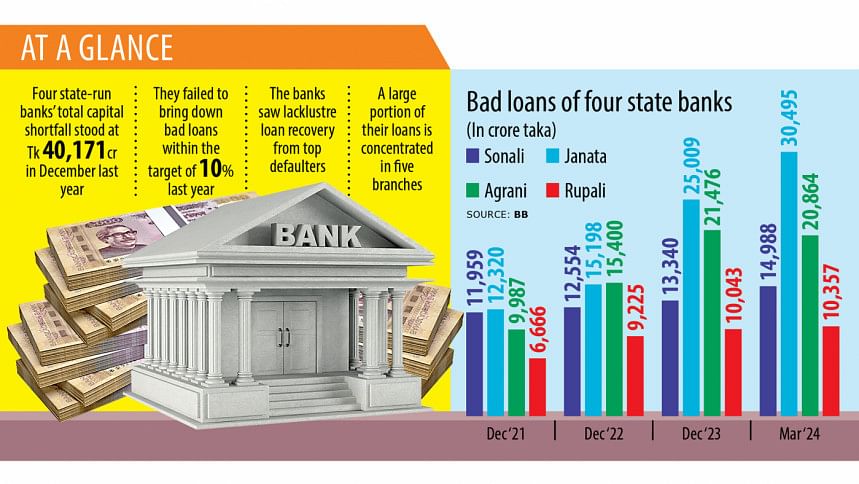

Four state-run banks in Bangladesh are finding it difficult to recoup loans from their top 20 defaulters, a failure that has worsened their financial health and squeezed their capacity further to lend.

Sonali, Janata, Agrani and Rupali repeatedly hit the loan recovery target set by the central bank as per its memorandum of understanding (MoU) with the four largest banks of the country by branches.

It came although the government is under pressure to reduce the bad loans of state-run banks to 10 percent by 2026 as per prescriptions of the International Monetary Fund as part of its $4.7 billion loan programme.

Bad loans held by the six state-owned banks, which also include Bangladesh Development Bank Ltd and BASIC Bank, totalled Tk 65,781 crore in December, making up 20.99 percent of their outstanding credits.

Last year, Sonali Bank was asked to recoup Tk 300 crore from the top defaulters, data from the Bangladesh Bank showed. The lender managed to recover only 12 percent of the amount fixed. It was, however, an improvement from the 4 percent posted in 2022.

The bank's bad loans amounted to Tk 13,340 crore in December. Of the sum, more than Tk 4,000 crore was held by the top 20 defaulters.

T & Brothers, Hallmark Group, Modern Steel Mills, Fairtrade International, Ratanpur Steel Re-Rolling Mills, and Sonali Jute Mills are the largest delinquent borrowers.

Among them, Hallmark's loan hit hard the largest lender of Bangladesh by branches.

The bank's Ruposhi Bangla Hotel branch lent Hallmark Group and five other companies Tk 3,547 crore between 2010 and 2012 on forged documents. The businesses embezzled the entire amount in collusion with some bank officials.

Officials said that despite repeated attempts, the bank has not been able to make significant gains in reclaiming funds from the major defaulters.

Speaking to The Daily Star, Md Afzal Karim, managing director of Sonali Bank, said legal proceedings are underway to recover funds from Hallmark.

"We have come a long way under the process," he said, adding that several properties of Hallmark Group will come under the bank's control this year.

Janata Bank was given a target to raise Tk 870 crore from the top defaulters last year. It was able to recover only 5 percent of the target, down from 11 percent in 2022.

In December, AnonTex Group, S Alam Group, Crescent Group, Ranka Group, Ratanpur Group, Rimex Footwear, Chowdhury Group, Thermax Group, and Sikder Group were on the list of top 20 defaulters of Janata Bank.

However, Thermax and Sikder Group's bad loans were shown as unclassified in the classified loan statement since a writ has been filed with the High Court.

AnonTex has the highest amount of bad loans at Tk 7,708 crore with Janata Bank. The garment manufacturer is largely responsible for the ailing situation of the lender.

In 2022, Janata Bank decided to waive an interest of Tk 3,359 crore of AnonTex on the condition of a one-off loan repayment. The waiver was cancelled later.

Officials of Janata Bank said AnonTex is going to get an opportunity to repay the loans by selling collateralised properties.

At Tk 25,009 crore, Janata Bank had the highest volume of default loans among lenders in Bangladesh in December. It rose to Tk 30,495 crore in March this year, central bank data showed.

This forced the bank to stop giving out large loans and focus on getting back the unpaid loans from the top borrowers.

Recently, Janata's Managing Director Md Abdul Jabbar told The Daily Star that he was worried that the bank's bad loans would surge.

Agrani Bank got back only 3 percent of the Tk 685 crore recovery target set for 2023. Owing to the lacklustre collection from the defaulters, the bank's bad loans increased to Tk 21,476 crore from Tk 15,400 crore in 2022.

Zakia Group, JoJ Bhuiya Group, Tanaka Group, and Dhaka Hide & Skin Ltd are the top defaulters of the bank.

A senior official of the bank said Agrani is going to form a separate team to recover the bad loans from the top defaulters.

Of the four state-run banks, Rupali's performance was comparatively better than the other in terms of loan recovery.

The BB gave a goal of retrieving Tk 350 crore from the big defaulters last year. The lender attained 20 percent of the target.

As of June last year, Nurjahan Group, Benetex Industries, A Net Spin Ltd, Virgo Media (Channel 9), HR Spinning Mills, Ibrahim Consortium, SA Group and M Rahman Steel were among its top defaulters.

The bank's bad loans were at Tk 10,043 crore in 2023, up from Tk 9,225 crore a year ago, BB data showed.

Yesterday, Rupali Bank Managing Director Mohammad Jahangir said the bank has maintained regular contact with the top defaulters and taken steps to fast-track the legal procedures against the defaulters.

"We got good results last year thanks to our efforts. We will keep up the momentum."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments