Is Bangladesh paying the price of administered forex regime?

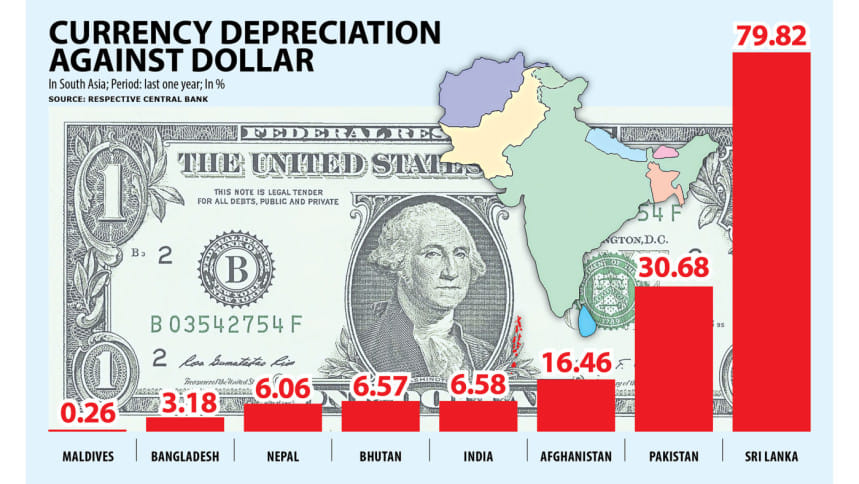

The taka faced less depreciation against the US dollar compared to other South Asian currencies in the last one year, eroding the export competitiveness of Bangladesh against its peers.

This seems that Bangladesh has been trying to tackle the ongoing global economic crisis by strengthening its currency artificially but it may leave an adverse impact on the macroeconomy, experts warned.

The currencies of South Asian countries except the Maldives experienced a devaluation between 6.06 per cent and 79.82 per cent in the past one year whereas the taka weakened by 3.18 per cent, data from the central banks in the countries showed.

All currencies in South Asia, which consists of Afghanistan, Bangladesh, Bhutan, India, the Maldives, Nepal, Pakistan, and Sri Lanka, are now under pressure like other currencies in the rest of the world due to the global supply chain disruptions and pent-up demand.

The coronavirus pandemic has spawned the crisis and it has now been exacerbated by Russia's invasion of Ukraine.

Among the countries, Sri Lanka is facing an acute foreign exchange crisis, which has already forced its prime minister to step. Pakistan's foreign exchange regime is witnessing volatility as well.

Amid the volatile situation, the Bangladesh Bank is now giving all-out efforts to keep the foreign exchange market stable by weakening the local currency to some extent, ignoring the natural course of demand and supply.

The Daily Star spoke to five noted economists who suggested the central bank abandon its historic stance on the currency and devalue it.

The central bank has depreciated the taka five times this year, but the initiatives were not enough given the surging import payments, which have already generated a record trade deficit.

The interbank exchange rate was Tk 87.50 per USD on May 21, down 3.18 per cent year-on-year. The rate was Tk 81.84 a decade ago.

Before the outbreak of the latest financial crisis, the central bank had not depreciated the taka significantly. The rate stood at Tk 84.80 per USD in May last year.

Ahsan H Mansur, executive director of the Policy Research Institute (PRI), says the peer countries of Bangladesh have been devaluing their currencies gradually over the years, whereas the BB has not followed the same path.

For example, the dong, the currency of Vietnam, one of the strongest competitors of Bangladesh in the global export market, was devalued by 11.95 per cent to VND 23,145 in the last one decade in keeping with the global market trend, data from the central bank of the southeast Asian nation showed.

As a result, the dong has not come under any significant devaluation pressure in recent times.

"Bangladesh has tried to strengthen its currency artificially, so the ongoing global volatility has created an enormous pressure on the taka," said Mansur, a former official of the International Monetary Fund.

But the banking sector is now ignoring the central bank's BC (bills for collection) selling rate – the rate at which banks sell US dollars to businesses to settle imports – due to the shortage of the greenback in the market.

Importers now have to pay Tk 95-97 to purchase a dollar to settle import bills. Preventing the taka from following the usual course of devaluation entails a number of risks.

For example, exporters may opt for under-invoicing, while remittance flow through the official channel may drop further as the rate in the formal and informal markets of US dollars has widened to a large degree.

Traders in the open market are now charging Tk 95-97 for a USD whereas the BB rate is hovering around Tk 86.5-87.45 for remitters.

The taka is set to face more pressure in the coming days as the central bank of the United States is hiking its benchmark interest rate to rein in inflation, a phenomenon that would make American greenback dearer.

On May 12, the dollar climbed to a fresh 20-year high as concerns persisted that central bank actions to drive down high inflation would crimp global economic growth, boosting the currency's safe-haven appeal, reported Reuters. More interest rate hikes are expected this year.

Mustafizur Rahman, a distinguished fellow at the Centre for Policy Dialogue, urges the central bank to inject an adequate amount of dollars from its foreign exchange reserves into the market along with depreciating the local currency.

The BB has so far supplied more than $5.3 billion to the market this fiscal year.

"We should also reduce imports to narrow the trade and current account deficit," Rahman said.

The monthly import payments are now more than $7 billion. Because of the escalated imports, the trade deficits reached a record high of $24.90 billion between July and March. The current account deficit stood at $14 billion.

The reserves fell to around $42 billion last week in contrast to $46.15 billion on December 31.

Rahman recommended the central bank restore the discipline in the foreign exchange regime since banks are not following the BB instructions related to the price of the dollar.

Selim Raihan, executive director of the South Asian Network on Economic Modeling, thinks that the central bank should have devalued the local currency step by step over the years.

"The central bank might be adopting a wait-and see approach at the moment. But the country may turn out as a loser if it takes too long to devalue the currency."

Although the depreciation of the local currency stokes inflationary pressures, the central bank has no other scope but to do so, he said.

"The government should take fiscal measures to insulate the lower income groups from higher inflation."

The existing crisis in the global market might linger as the war in Ukraine is still raging and the coronavirus pandemic is not over yet.

"A gradual depreciation is key to mitigating the crisis," said MA Razzaque, research director of the PRI.

Shah Md Ahsan Habib, a professor at the Bangladesh Institute of Bank Management, advises the central bank not to depreciate the taka to a large degree all of a sudden and rather recommends the BB monitor the market trend to assess the outcomes generated by the recent depreciation.

"If the BB depreciates the currency by Tk 4-5 suddenly, a panic will spread in the market," he said.

Md Habibur Rahman, chief economist of the central bank, says that the central bank will observe the situation in the next couple of days before deciding its next course of action.

"We will try to avoid imported inflation," he said, adding that the debt servicing will go up due to devaluation.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments