Dollar-Taka exchange rate will stabilise after realignment

With extra vigilance and coordinated actions between the Bangladesh Bank, the non-resident Bangladeshis and relevant ministries, we can bring some sanity and balance to the foreign exchange market

Despite a lot of stress, the Bangladeshi taka remains one of the strong currencies in the region. No doubt, the taka is still overvalued and consequently, it is trying to realign itself with the value of the US dollar through measured depreciation.

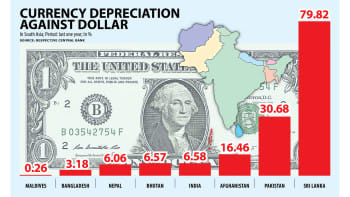

According to the Bangladesh Bank, the level of devaluation in this fiscal year up until now has been 3.2 per cent. Most currencies in the region, including the Indian rupee, depreciated much more than this.

The western currencies also devalued more than the taka. However, Southeast Asian countries, including Malaysia, Cambodia, Vietnam and Indonesia, did even less devaluation than Bangladesh.

Even though Bangladesh didn't peg its currency with the USD like Malaysia did in the late 1990s in the wake of the Asian Financial Crisis, it has been going through managed floating of its currency through appropriate market intervention to keep its exchange rate stable against the USD within a band. I think this has been a very prudent policy of the Bangladesh Bank as it was able to maintain a 'sort of peg' with the USD over about one and a half decades or so.

This gave a clear signal to foreign and local investors that the risk arising out of frequent fluctuations of the exchange rate was minimal. Both exporters and importers knew exactly what will be the costs and benefits of their businesses in the medium term.

When the government and the central bank felt that the small foreign exchange earners like the remitters were losing out due to the overvalued taka, they went for providing cash incentives (now 2.5 per cent) to keep them on board in the formal payment system. The exporters, particularly the RMGs, also got similar incentives to remain competitive.

However, of late there has been some turbulence in the foreign exchange market mainly due to the sudden opening of the businesses both at home and abroad in the post-Covid situation and, of course, further aided by the supply chain disruptions owing to the Ukraine war.

Bangladesh as a major importer of fertilizer, wheat and edible oil from Ukraine and adjoining countries, including Russia, has been suddenly facing unprecedented supply constraints of these items. In addition, the gas and oil markets have been equally destabilised by this war creating huge pressure on the import payment of the same.

Today's some kind of destabilisation of the foreign exchange market in Bangladesh owes significantly to the rising trade deficit (about $25 billion) leading to a similar rise in current accounts deficit of about $14 billion (which was in surplus for many years until this fiscal year).

Simultaneously, there has been a fall in the remittances in this fiscal year, so far a contraction of about 18 per cent, making the situation further complicated.

As a result, there has been a deficit in the overall balance of payment, creating pressure on the taka-dollar exchange rate.

The central bank continued to defend the value of the taka by selling nearly $6 billion in this fiscal year. As a result, the foreign exchange reserve has come down to about $42 billion which can still fetch about six months' imports. There is a limit to this defence against the erosion of the reserve. So, the Bangladesh Bank has wisely brought about a measured devaluation of the taka gradually.

However, the unofficial (Kerb) market of the foreign exchange accessed by the travellers going abroad for tourism or medical purposes or for sending money to their relatives in a small amount has become suddenly overtly volatile. This is, of course, a small market but attracts the most attention from the media.

The largest one is, of course, the interbank foreign exchange market, which is also facing some pressure. However, the Bangladesh Bank has been selling dollars to most banks, particularly the public banks, for opening and settling letters of credit for the import of energy, electricity production-related equipment and inputs, fertilizer and daily necessities.

It is also supporting all other banks through the import of raw materials and capital machinery for manufacturing units. It was heartening to hear from the governor of the Bangladesh Bank that the central bank will continue to intervene in the foreign exchange market and take appropriate measures to cool it. This forward guidance by the governor was needed and I hope the market got the right signal to take its position.

Given this perspective, let me suggest a few policy actions that may help stabilise the foreign exchange market. Certainly, this market is facing a mismatch in demand and supply of foreign exchange. So, we have to address both demand and supply-related issues in pragmatic ways if we really want to go to the root of the problem.

HOW TO RESTRAIN DEMAND FOR FOREIGN EXCHANGE

First, the trade gap ought to be reduced by restraining unnecessary imports. The import of luxury items, including fancy cars and electronic appliances, must be curbed more drastically.

The Bangladesh Bank has taken macro-prudential measures like raising margins for such items up to 75 per cent. Raise it further to 100 per cent if you can. The import of some items like luxury cars can be postponed until the foreign exchange market stabilises.

Second, go deeper into trade financing where a lot of irregularities are embedded along with over-invoicing. Stop the loan against trust receipts even if temporarily.

Third, further consolidate the public expenditures for prestige projects that will not yield immediate outcomes. The honourable prime minister has already asked the relevant departments to be more prudent on this. Mind it, every taka expenditure has a dollar component in it.

Fourth, the austerity measures in terms of restricting foreign travel and conducting international conferences physically should be well-targeted. Much more can be done in this area.

Fifth, ensure staggered implementation of those larger projects with higher foreign exchange commitments, including those private projects that need sovereign guarantees to reduce foreign exchange commitments.

Sixth, restrain the supply of USD under the Export Development Fund temporarily to reduce the outflow of dollars from the reserve.

HOW TO AUGMENT SUPPLY OF FOREIGN EXCHANGE

First, give cash incentives to the remittance earners by raising another one to half a percentage point of cash incentives to them.

Second, an easing of the payment system is also an incentive. Make necessary arrangements for receipts of the earnings of the nearly a million outsourcing entrepreneurs spread around the country. This can be smartly done through mobile financial services and banks with proven records of handling remittances from abroad. The Bangladesh Bank can be more innovative on this score.

Third, let the non-resident Bangladeshis invest more in more lucrative investment and/or premium bonds digitally seamlessly. The existing ceiling limit of Tk 10 million may be withdrawn for these investors.

Fourth, let the NRBs, including regular remitters, open foreign exchange deposit accounts easily and digitally with an attractive fixed deposit rate.

Fifth, let the new skilled workers be provided half the air tickets as subsidies from the government provided they open bank accounts and commit formal transactions of their earnings.

Sixth, suspend the export retention quota for about six months and allow a part of the accumulated (say 50 per cent) ERQs, (if not needed to spend immediately) for a year with some cash incentives like that is given for remittances.

Seventh, encourage the Economic Relations Division and relevant departments or ministries to speed up project negotiations with international development agencies and release the committed foreign assistance from the pipeline, which is getting fatty every year.

Eighth, encourage relevant authorities to complete special economic zones as fast as possible to attract foreign direct investment.

Ninth, have a coordinated monitoring of mega projects to remain cost-efficient, avoiding cost overruns and delays in project completion.

I have only given a few ideas on how to improve the trade balance and reduce the current account deficit by realigning the demand and supply of foreign exchange. We have seen in the past that it is possible.

With extra vigilance and coordinated actions between the Bangladesh Bank, the non-resident Bangladeshis and relevant ministries, we can bring some sanity and balance to the foreign exchange market. Along with this, the taka-dollar exchange rate will surely realign and stabilise at some point in time. As the governor said there is no need to panic. We can do it. And let's do it.

The author is an economist and a former governor of Bangladesh Bank

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments