Bangladeshi banks’ profitability lowest in South Asia

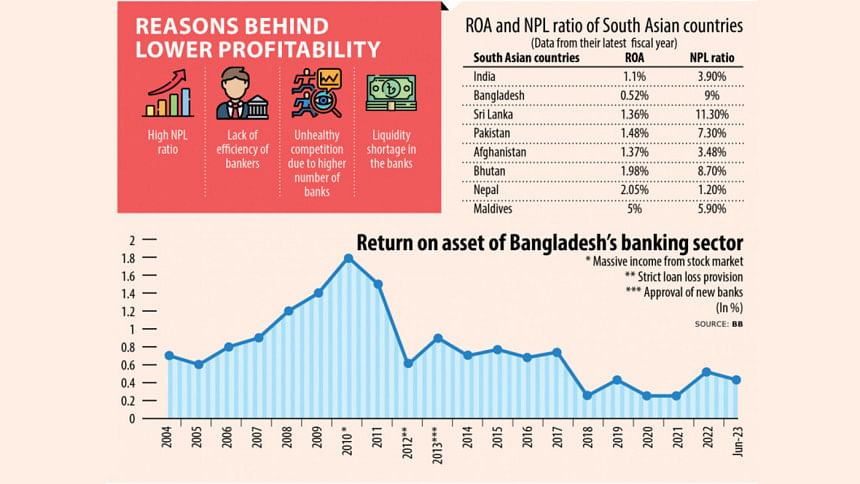

The profitability of the banking sector in Bangladesh is the lowest in South Asia due to the prevalence of higher non-performing loans, lower efficiency, and an elevated level of costs of funds.

The return on assets (ROA), also known as profitability, was 0.52 percent in Bangladesh in 2022 and it further slipped to 0.43 percent in June last year, Bangladesh Bank data showed.

In 2022, the ROA was 5 percent in the Maldives, 2.05 percent in Nepal, 1.98 percent in Bhutan, and 1.48 percent in Pakistan, according to data from central banks of the respective countries and media reports.

In Afghanistan, the ROA was 1.37 percent whereas it stood at 1.36 percent in Sri Lanka and 0.91 percent in India. India's ROA rose to 1.14 percent in 2023.

ROA measures how efficient a company's management is in generating profits from the economic resources or assets on their balance sheets.

Anis A Khan, a former chairman of the Association of Bankers Bangladesh (ABB), a platform of CEOs in the banking industry, blamed the higher default loan for the lowest ROA.

Syed Mahbubur Rahman, a former chairman of the ABB, echoed Khan.

BB data showed that NPL swelled to a whopping Tk 134,396 crore in September last year, which accounted for 9.36 percent of the total loans disbursed.

In India, the NPL ratio was 3.90 percent. It was 1.2 percent in Nepal, 3.48 percent in Afghanistan, and 5.9 percent in the Maldives.

The share was 7.3 percent in Pakistan, 8.7 percent in Bhutan and 11.3 percent in Sri Lanka. This means Bangladesh has the second-highest ratio of NPL in South Asia.

Sri Lanka's highest default loan stemmed from its recent economic turmoil as many firms incurred losses or went out of business.

"Borrowers in other countries fear downgrade of their credit status, so they regularly repay their loans," Khan said.

On the other hand, some borrowers in Bangladesh have a tendency to default on their instalment payments intentionally. Many even did not pay back despite the single-digit interest rate, payments holiday, up to four times rescheduling facility, and a lower down payment.

"The higher default loans raise the costs for banks straightforward," said Khan, currently a managing partner of AAZ Partners, a law firm.

The cost of funds for banks is low in many other countries because of a higher number of current account and savings account deposits whereas it is much higher in Bangladesh since people expect healthy returns from deposits amid a lack of a universal pension scheme until recently and limited investment opportunities.

"Fixed deposits are costlier in Bangladesh while management expenses of banks are also higher," said Khan.

The entry of the fourth-generation banks into the market has intensified competition among lenders for deposits, which ultimately drove down the ROA.

The central bank approved nine banks in 2013 bowing down to political pressure though it was opposed to the idea initially. The central bank later allowed three more banks.

Between 2007 and 2011, the ROA was more than 1 percent. It plunged to 0.6 percent in 2012 from the previous year's 1.5 percent as the central bank enacted stricter loan-loss provision rules, BB data showed.

The profitability bounced back to 0.9 percent in 2013. Since deposit collection became more competitive, the ratio has never crossed 0.8 percent in the last one decade.

Mahbubur Rahman also attributed the lower efficiency of many banks to the dismal profitability scenario.

He said the inclusion of the new banks added to the woes as they had to offer higher rates to pull deposits, eating away at profit margins.

In April 2020, the central bank introduced an interest cap for deposits at 6 percent and for loans at 9 percent, a decision that narrowed the interest rate spread, the rate charged by banks on loans to customers minus the interest rate paid by lenders for deposits. The ceiling was in place until June last year.

"This ultimately hit the bottom line of banks," said Rahman, currently the managing director of Mutual Trust Bank.

The profitability was low in 2020 and 2021 mainly because of the business slowdown brought on by the Covid-19 pandemic. However, it was even lower in 2018 due to the lower profits of Islamic banks and the overall liquidity crunch in the banking sector.

According to a BB analysis, shariah-based banks' ROA was higher than that of the other private commercial banks till 2014. In 2015, the profitability was the same for both.

The profitability of Islamic banks was 0.8 percent while it averaged 1.03 percent for private commercial banks.

"After the structural change in shariah-based banks or the change in ownership, investment decisions were not proper, so their asset quality fell," said Toufic Ahmad Choudhury, a former director-general of the Bangladesh Institute of Bank Management (BIBM).

"Due to the bad investments, NPLs and provision requirements went up. This ultimately reduced their profitability."

S Alam Group took over the ownership of Islami Bank Bangladesh Ltd in 2017. In the same year, it took control of Social Islami Bank. The Chittagong-based conglomerate assumed the ownership of Al-Arafah Islami Bank and First Security Islami Bank within a year.

A top official of a listed commercial lender said Islamic banks' asset quality declined after their ownership changed, sending NPLs higher.

Some of the bad loans have been reported officially but the disclosure doesn't portray the real scenario, he said.

On the other hand, the shariah-compliant banks are facing a trust deficit, which forced them to offer higher rates to draw deposits, leading to a drop in profitability, the official added.

Shah Md Ahsan Habib, a professor at the BIBM, said any ownership change should be based on efficiency so that the new owners can improve the situation at banks.

In Bangladesh, the efficiency level deteriorated and the asset quality of Islamic banks dipped. If asset quality falls, it reduces income, raises the cost of operations and forces banks to keep a higher provision.

"Banks have no other option but to improve their asset quality and reduce NPLs," he said, adding that the operational efficiency of banks also needs to be elevated.

The government has passed a new Bank Company Act defining willful defaulters.

"If the government can really enforce the laws and create pressure on willful defaulters legally and socially, a fruitful result will emerge and this may positively impact the ROA."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments