Bangladesh’s average import tariffs higher than in most countries

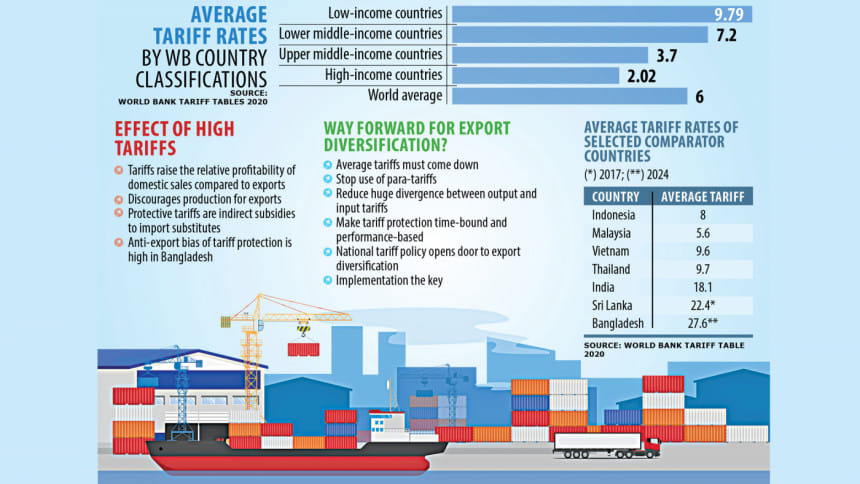

Bangladesh's average nominal tariffs are higher than in low-income, middle-income and high-income countries, as well as most of its comparators, said an economist yesterday.

Such a high tariff on imported items raises relative profitability for domestic market-oriented industries compared to exports, discourages production for overseas markets, and acts as a major barrier to export diversification, said Zaidi Sattar, chairman of the Policy Research Institute of Bangladesh (PRI).

He made the remarks while presenting a paper at a seminar on "Tariff protection and export diversification are not mutually exclusive: The Bangladesh phenomenon" organised by the Bangladesh Institute of Development Studies (BIDS) at its conference room in the capital.

The nominal tariff is 27.6 percent in Bangladesh.

It is 22.4 percent in Sri Lanka, 18.1 percent in India, 9.7 percent in Thailand, 9.6 percent in Vietnam, 5.6 percent in Malaysia, and 8 percent in Indonesia.

"Tariffs are now the principal instrument of protection, an incentive to import-substitute production," Sattar said.

The economist described higher tariffs as a critical requirement for sustaining so-called infant industries without regard to their period of establishment or the efficiency implication of long-term protection.

Sattar said almost all consumer goods produced domestically reap the benefit of extremely high and differentiated levels of nominal and effective protection.

The effective rates of protection for most import-substitute industries could range from 100 percent to 400 percent or more, he said.

Anti-export bias is also one of the bottlenecks for export diversification, according to Sattar.

He said Bangladesh exports 1,377 non-readymade garment products. Of them, 174 products are highly competitive, 408 items are moderately competitive and 795 are marginally competitive.

The country ships 346 types of non-RMG products that earn around $1 million annually, but the segments do not get the bonded warehouse facility, which allows exporters to import raw materials duty-free.

"These products can play a significant role in accelerating export diversification if they are brought under the bonded warehouse facility," he said, adding that products made by jute, leather goods and home textile industries are largely competitive in the world market.

"Non-RMG exporters can compete in the world market purely on the basis of labour cost advantage."

He said the National Tariff Policy 2023 has opened the door for export diversification.

According to the PRI chief, the focus of the policy will be on import taxes such as customs duty, regulatory duty and supplementary duty, which are not "trade neutral".

The value-added tax, the advance income tax and the advance VAT are considered trade neutral and are not under the purview of the trade policy, he said.

The economist pointed out that export diversification is not getting traction despite two decades of policy focus on "thrust sectors", "high priority sectors", and "special development sectors".

Salehuddin Ahmed, a former governor of the Bangladesh Bank, stressed cash incentives and other benefits like the bonded warehouse facility to increase export diversification.

He, however, added that the National Tariff Policy alone will not be effective in giving a boost to export diversification.

Ferdaus Ara Begum, chief executive officer of the Business Initiative Leading Development, said there are a number of sectors that have the potential to contribute more to export diversification, but they don't enjoy the bonded warehouse facility.

She called for extending the facility to them instead of giving incentives.

BIDS Director General Binayak Sen chaired the seminar.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments