Banks asked to find ways to raise forex inflow

The Bangladesh Bank (BB) yesterday asked commercial banks to raise the inflow of foreign currency amid the pressure on forex reserves and impending payment obligations.

The central bank directive came during a meeting between BB Governor Abdur Rouf Talukder and the managing directors of five leading private commercial banks on Sunday.

The managing directors of BRAC Bank, City Bank, Eastern Bank, Mutual Trust Bank, and Dutch-Bangla Bank were present at the meeting.

Sources at the meeting said that the BB governor instructed the managing directors to find ways to raise forex inflows as Bangladesh's forex reserves is continuing to fall due to higher outflow than the inflow.

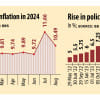

The country's forex reserves stood at $19.97 billion as of April 24, down from $23.30 billion in July 26 of last year, BB data showed.

Meanwhile, there are huge payment obligations in the upcoming days, the source said.

The BB governor asked banks to bring foreign currency through offshore banking units since the banking regulator recently relaxed the rules for them by passing the Offshore Banking Act 2024 in Parliament on March 5.

Under the new act, the government will not charge any tax on the profits that foreigners make in offshore banking units of Bangladeshi banks.

Recently, the banking regulator also revised the rules on resident foreign currency deposits (RFCD) accounts.

In December, the central bank issued a notice saying banks would be able to pay more than 7 percent interest on RFCD accounts. Besides, various benefits, including the ability to transfer money abroad and avail multiple cards, are allowed through the RFCD accounts.

The source added that cash US dollars in RFCD accounts stood at $48 million.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments