BB rate hike may help contain inflation but will impact private credit

Leaders of the two top chambers said increasing the policy interest rate to contain inflation is likely to affect businesses and could impact banking liquidity available for private credit.

The reactions came after the Bangladesh Bank (BB) hiked the policy rate, or repo rate, by 25 basis points to 8 percent to make borrowing by banks costlier for the January-June period of the fiscal year (FY) 2023-24. The move is designed to curb money supply and inflation.

It was the eighth time since May 2022 that the central bank increased the repo rate.

Kamran T Rahman, president of the Metropolitan Chamber of Commerce and Industry (MCCI), said containing inflation was the most important thing right now.

"We cannot afford to have runaway inflation. Everyone will suffer if inflation continues to remain high," he said.

Rahman said increasing the interest rate would affect businesses. It will also benefit savers, he added.

Ashraf Ahmed, president of the Dhaka Chamber of Commerce and Industry (DCCI), said the policy rate hike would help control inflation to some extent by reducing money supply. But he stressed the need for appropriate supporting fiscal policy, which could have an equally important role in reducing inflation.

He said the increase in the repo rate is likely to impact money supply, and could impact banking liquidity available for private credit.

The DCCI said the public sector credit growth target has been set at 27.8 percent for the January-June period of the FY2023-24, which was realised at 18 percent against a target of 37.9 percent in the July-December period of the same fiscal year.

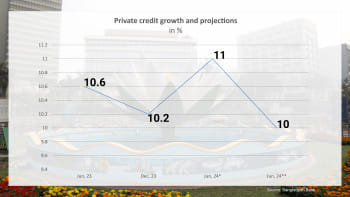

On the other hand, the private sector credit growth has been set at 10 percent in the January-June period of FY24, down from actual growth of 10.2 percent in the first half of the year, said the chamber, urging the central bank to explore more options to increase liquidity for the domestic banking system over the next six months.

"In this context, while increasing public sector borrowing is necessary, care must be taken to avoid crowding out the private sector from domestic liquidity."

Ahmed sought additional measures to increase credit flow to the private sector by an appropriate financial borrowing strategy.

Focus on enhancing availability of trade credit, use of contingents, factoring and other options may be considered as alternatives to reduce foreign exchange stress as well as increase liquidity, he said.

"We are very happy that the BB has highlighted the need to ensure sufficient liquidity to support the growth sectors," he said.

Regarding exchange rate stability, the DCCI said introduction of a crawling peg system would help the balance of payment challenges.

He said the foreign exchange market should be allowed to operate properly with limited interventions within well-structured parameters.

Ahmed also hoped that the declared monetary policy would contribute to macroeconomic stability.

"We hope the continued focus on controlling inflation and stabilising the exchange rate in the current MPS will bear fruit."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments