Bangladesh Bank unveils monetary policy to tame inflation

The Bangladesh Bank (BB) unveiled the monetary policy for the second half of the current fiscal year amid anticipation that it will continue to maintain a higher interest rate to bring down inflation, which has been at an elevated level for the last two years.

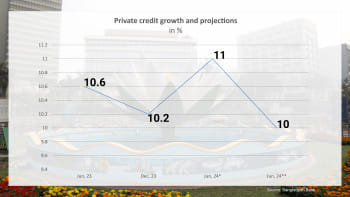

The BB maintained a contractionary policy stance in the July-December of 2023-24 in its efforts to reduce demand and contain prices.

As such, it hiked the policy rate, or repo rate, twice to 7.75 percent to increase the cost of money.

In June, the central bank hiked the policy rate to 6.5 percent, which came into effect from July.

As part of the move, the BB also introduced Six Months Moving Average Rate of Treasury bills (SMART), lifting the 9 percent lending rate cap.

Since then, the interest rate has been rising as the market sees a reduction in excess liquidity.

The policy comes at a time when the economy faces growing pressure owing to escalated inflation and the persisting foreign exchange crisis, with the Red Sea crisis adding fresh headache.

Inflation, which has been over 9 percent since March, eased to 9.41 percent in December from 9.49 percent in November.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments